Alphabet Inc. (NASDAQ: GOOGL), originally founded as Google Inc., is a global technology powerhouse headquartered in Mountain View, California, and is best known for shaping the modern internet with its innovative products and services [1].

The company’s story began in 1998, when Stanford PhD students Larry Page and Sergey Brin transformed their research project — the PageRank algorithm — into what would soon become the world’s most influential search engine.

Larry Page served as Google’s first CEO from 1998 to 2001 before passing leadership to Eric Schmidt, who guided the company for the next decade. Page later returned as CEO in 2011 and remained in that role until 2015, when Google restructured and formed Alphabet Inc. as its parent company [2].

For anyone wondering, “Is Google publicly traded?” — yes, it is. Investors can purchase GOOGL Alphabet stock (Class A voting shares) or GOOG stock (Class C non-voting shares), while Class B shares remain held internally for enhanced voting control. Alphabet continues trading on the Nasdaq under the well-known ticker GOOGL, making it one of the most followed companies in global markets.

Today, the company is led by Sundar Pichai, who has served as CEO of both Alphabet and Google since 2015, steering the business through rapid innovation, strategic growth, and continued market leadership [3].

About Alphabet Company: Business Segments

Google is Alphabet’s largest and flagship subsidiary [4]. Alphabet reports its performance across three main business segments: Google Services, Google Cloud, and Other Bets, alongside certain corporate-level costs that are reported separately. Alphabet reorganised into these reportable segments in late 2020, moving away from its former structure of simply “Google” and “Other Bets.”

Let’s explore the services under each sector:

Google Services

Google Services is Alphabet’s largest segment and is primarily driven by advertising revenue. It includes core platforms such as Google Search, YouTube, Google Maps, Android, Chrome, Google Play, and hardware products.

Google Cloud

Google Cloud comprises Alphabet’s enterprise-focused cloud infrastructure, data analytics platforms, and collaboration tools. Revenue for this segment mainly comes from:

- Google Cloud Platform (GCP) services

- Google Workspace collaboration tools

Google Workspace

Other Bets represents Alphabet’s portfolio of innovative, early-stage ventures that have the potential to become future growth engines. These include:

- Waymo (autonomous vehicles)

- DeepMind (AI research)

- Calico Life Sciences (biotech research)

- Nest (smart-home technology)

- CapitalG (investment fund)

Employment at Google/Alphabet

Data from Statista shows that Alphabet currently has a workforce of about 190,000 people worldwide [5]. As the company expands its operations to other sectors, it continues to grow its employee count.

Working at Google, the biggest subsidiary under Alphabet, is also highly sought after. What are the benefits for employees at Google?

Employment with Google is known for a strong workplace culture and attractive benefits, including paid parental leave, workplace safety initiatives, wellness facilities in many offices, and flexible or remote working options [6].

Google has also earned multiple awards, such as Best Engineering Team and Best Company Outlook, reinforcing why so many talented professionals aspire to be Google employees and why the company remains one of the most desirable tech employers in the world [7].

Alphabet Inc Companies

Over the years, Alphabet has expanded its portfolio by forming partnerships and acquiring companies that align with its long-term vision. Beyond Google, several well-known Alphabet Inc companies play an important role in strengthening its technology ecosystem.

Some of the most notable Alphabet Inc subsidiaries include:

- Alphabet acquired DeepMind in January 2016, a UK-based AI company, for more than $500 million [8].

- In December 2017, Alphabet announced its acquisition of Xively, an IoT platform provider, for $50 million [9].

- In March 2018, Google announced the acquisition of the GIF platform Tenor, which provides a platform for searching for and sharing animated GIFs [10].

- In June 2019, Alphabet announced the acquisition of Looker, another intelligence software and big data analytics platform for businesses [11].

Together, these Alphabet Inc subsidiaries highlight how the company has grown into a major technology powerhouse, with each acquisition contributing to its continued expansion and strategic growth.

Google Stock History

Google’s IPO took place on 19 August 2004, with Morgan Stanley and Credit Suisse acting as the underwriters. The IPO for Google raised USD 1.9 billion, selling 22.5 million shares at USD 85 per share [12].

The launch was hugely successful. At the time, Google already dominated the search engine market with more than 80% market share, which helped drive strong investor confidence. The impressive Google IPO share price performance made founders Larry Page and Sergey Brin instant billionaires, and thousands of Google employees also benefited through stock options as the company’s value soared. Each founder reportedly gained about USD 4 billion from their stakes in the company [13].

Today, the company that started with the IPO of Google has grown into Alphabet Inc., one of the most valuable companies in the world, with a market capitalization of around USD 3.793 trillion [14].

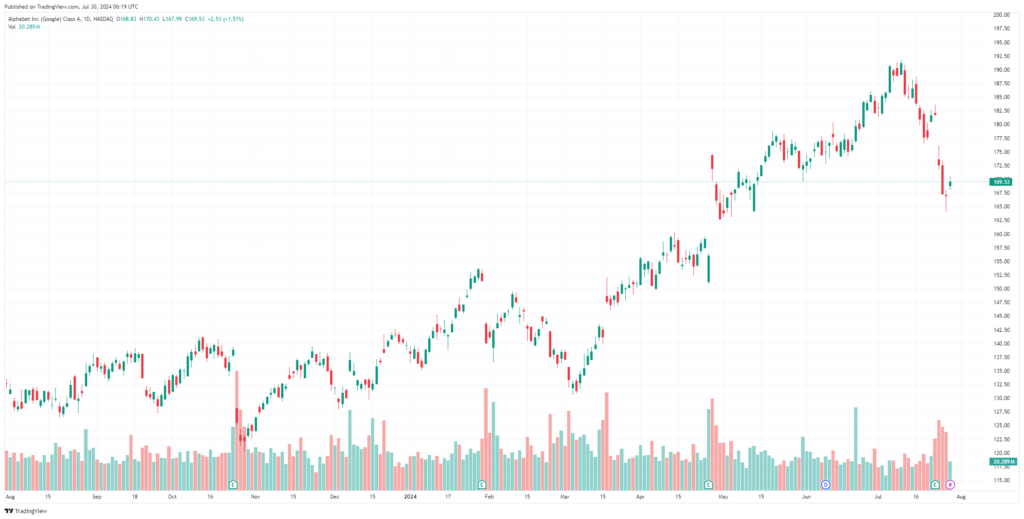

Alphabet Inc.’s Share Price

2024 [15][16][17]

Alphabet’s stock has been on a steady uptrend since March 2024, likely driven by the strong performance reported in Q1, which revealed a 15% year-over-year increase in quarterly revenue to $80.5 billion. The company also introduced its first-ever quarterly dividend and announced a substantial stock buyback program. On 29 July 2024, GOOGL was trading at $170.43, about 12% below its 53-week high of $191.75.

Following the announcement of Alphabet’s second-quarter results on 23 July 2024, which exceeded earnings estimates but fell short in other areas (such as YouTube ad revenue), the stock experienced a 5% drop in the stock’s value during the afternoon trading session the next day.

2025 [18, 19, 20]

Chart 2: Alphabet’s share price performance from March 2024 – February 2025 (https://www.tradingview.com/x/VFy4naNk/)

Alphabet’s Q4 earnings report was released on 4 February 2025, revealing an Earnings Per Share (EPS) of USD 2.15, slightly above the consensus estimate of USD 2.13.

The company is ramping up investments in AI and cloud technologies, budgeting $75 billion in capital expenditures for 2025. While these initiatives position Alphabet for long-term growth, they have sparked short-term profitability concerns.

While Alphabet’s earnings in advertising revenue and cloud segment did show robust growth, the immediate market reaction to the revenue miss and high capital expenditure plans led to a decline in the Alphabet stock price.

As of 6 February 2025, GOOGL is trading at $193.30. The stock has declined by $14.40, representing a 6.94% drop from the previous day’s close.

| Alphabet’s Stock Price History (Annual) | ||||||

| Year | Average Stock Price | Year Open | Year High | Year Low | Year Close | Annual % Change |

| 2025 | 195.8983 | 189.4300 | 206.3800 | 189.4300 | 191.3300 | 1.07% |

| 2024 | 163.4126 | 137.6699 | 196.6600 | 130.9244 | 189.3000 | 36.01% |

| 2023 | 118.3647 | 88.7974 | 141.0078 | 85.8880 | 139.1844 | 58.32% |

| 2022 | 114.3450 | 144.4667 | 147.4643 | 83.1280 | 87.9107 | -39.09% |

| 2021 | 123.7753 | 85.9941 | 149.2962 | 85.8322 | 144.3277 | 65.30% |

| 2020 | 73.6821 | 68.1863 | 90.9182 | 52.5157 | 87.3148 | 30.85% |

| 2019 | 59.3453 | 52.5431 | 67.8769 | 51.0879 | 66.7271 | 28.18% |

| 2018 | 55.8991 | 53.4663 | 64.0424 | 49.0553 | 52.0589 | -0.80% |

| 2017 | 46.8186 | 40.2543 | 54.0581 | 40.2423 | 52.4794 | 32.93% |

| 2016 | 38.0226 | 37.8346 | 41.6358 | 33.9337 | 39.4791 | 1.86% |

| 2015 | 30.8870 | 26.3817 | 39.5543 | 24.7630 | 38.7597 | 46.61% |

| 2014 | 28.3185 | 27.8131 | 30.4880 | 24.8178 | 26.4370 | -5.59% |

| 2013 | 22.0942 | 18.0716 | 28.0028 | 17.5624 | 28.0028 | 58.43% |

Table 1: History of Alphabet’s annual stock price [21]

Google Stock Split History [22]

Alphabet (Google) stock has gone through multiple stock split events, with the most significant ones occurring in 2014 and 2022. Unlike most companies, Google’s stock split also created a new class of shares, separating voting and non-voting stock. The Google stock splits are summarised in the table below.

| Date | Event |

| April 3, 2014 | Created Class C (GOOG) non-voting shares; founders retained Class B super-voting shares |

| April 27, 2015 | For every 1,000 Class C shares, holders received 2.7455 additional Class C shares. |

| July 15, 2022 | Every 1 share became 20 shares. |

Table 2: Summary of Google Stock Split History

April 2014 stock split: Class A and Class C

Before April 2014, Google only had one publicly traded share class (Class A, ticker: GOOG) with voting rights. To strengthen founder control, Google introduced a new Class C share class with no voting rights, using a stock split to make the change. Here’s what happened:

- Existing Class A shares were reassigned the ticker GOOGL and retained voting rights.

- New Class C shares took on the GOOG ticker and did not carry voting rights.

- The founders maintained Class B shares, which granted them 10 times more voting power than Class A, and aren’t listed on any public market.

- The split also effectively cut the stock price roughly in half, from about USD 1,135 to USD 568.

Someone holding 1,000 Class A (GOOG) shares before the split now hold:

- 1,000 Class A (GOOGL) shares (voting)

- 998 Class C (GOOG) shares (non-voting)

April 2015: Class C

On 27 April 2015, Google carried out another adjustment, but this time it applied only to Class C shares. For every 1,000 Class C shares, holders received 2.7455 additional Class C shares. This was more of a compensation measure than a traditional split, designed to offset the fact that Class C shares had no voting rights and often traded slightly below Class A shares.

20-for-1 stock split

Alphabet finally carried out a straightforward 20-for-1 stock split in July 2022 [23]. This split applied to all share classes — A, B, and C.

- Every 1 share became 20 shares.

- Someone holding 1,000 shares of any class before the split ended up with 20,000 shares of that same class afterwards.

- Stock price adjusted accordingly, dropping from about USD 2255.34 to USD 112.64 to reflect the split.

Dividends

To date, Alphabet has not paid any dividends to its investors. Instead, Alphabet reinvests its profits into research, development, and expansion.

Alphabet (NASDAQ: GOOGL) Stock Trading Information

Here is the key information for trading Alphabet (GOOGL) stock on NASDAQ [24]:

- Stock Symbol: GOOGL

- Location: United States

- Primary Exchange: NASDAQ

- Market Capitalisation: $3.793 trillion as of 7 January 2026

- Trading Hours: Investors can trade in the Pre-Market (4:00-9:30 a.m. ET), and After-Hours Market (4:00-8:00 p.m. ET).

- Stock Price: The Alphabet Inc. Class A (GOOGL) stock price is $313.34 as of 7 January 2025

- Volume: The average daily trading volume for Alphabet Inc. is around 41 million shares.

- Leverage: varies depending on the broker

- Dividends: Alphabet Inc. does not currently pay dividends.

- Trading Fees: vary depending on the broker.

- P/E Ratio: The P/E ratio for Alphabet Inc. is 39.1

Why Alphabet Is So Valuable: Key Strengths Behind Google’s Parent Company

“Let me Google that.”

Besides being the leading search engine, here are some other reasons why Alphabet is one of the most valuable companies in the world:

- The global presence and diverse revenue streams

Alphabet’s subsidiaries, including Google, YouTube, and Waymo, have a global presence, which ensures a diversified revenue stream.

- Strong financial performance

Despite economic uncertainty, pandemics, and market volatility, Alphabet’s earnings and revenues have been consistently strong.

- High EV adoption

Alphabet’s subsidiary, Waymo, is at the forefront of the autonomous vehicle industry, which was formerly the Google self-driving car project. Waymo is well-positioned to benefit as demand for electric and self-driving vehicles grows.

- Technological innovation

Heavy investment in research and development keeps Alphabet at the forefront of cutting-edge products, including internet services, AI, mobility, and digital platforms.

What Affects the Alphabet Stock Price?

Stock prices can often be affected by market events and news surrounding the company. Here are some factors that could affect the price of Alphabet stocks.

- Revenue and earnings

Most investors rely on Alphabet’s quarterly earnings reports to value the company, so they affect Alphabet’s stock prices.

- Change of management or employees

Changes in leadership and key employees can have an impact on Alphabet’s operations and future growth prospects, potentially changing GOOGL stock prices.

- Product updates or launches

Alphabet is known for constantly innovating. New products, platforms, or feature enhancements can boost expectations of future growth and support higher stock prices.

- Economic and political factors

Macroeconomic conditions, interest rates, tax changes, and regulatory policies can influence Alphabet’s performance.

- Company partnerships

Alphabet has partnerships with various companies, including software developers, advertisers, and manufacturers. These partnerships can affect the company’s prospects and stock prices.

- Market trends

Alphabet operates in a highly dynamic and competitive market. Rising demand for areas like AI, cloud computing, digital advertising, and autonomous technology can impact Alphabet’s stock prices.

Latest Alphabet News and Developments Investors Should Watch

China’s Antitrust Investigation into Google [25, 26]

Following U.S. tariffs on Chinese products under President Donald Trump, China responded with countermeasures, including tariffs on U.S. imports and an antitrust investigation into Google.

China’s State Administration for Market Regulation launched the probe over suspected antitrust violations, believed to focus on Google’s dominance in the Android operating system market. Although full details have not been disclosed, the investigation could increase volatility in GOOGL’s stock price.

Alphabet Q4 2024 Earnings Report [27, 28]

Alphabet reported Q4 revenue of USD 96.47 billion, reflecting a 12% year-over-year increase. Net income reached USD 26.54 billion, with EPS of USD 2.15, beating analyst expectations.

Breaking it down:

- Google Services revenue grew 10% to USD 84.1 billion, driven by strong demand for Search and YouTube ads.

- Google Cloud revenue increased 30% to USD 12.0 billion, though slightly below forecasts.

Overall, Alphabet’s double-digit revenue growth and solid performance in both Google Services and Cloud underline its continued market strength.

Increased AI Spending [29, 30]

Alphabet is significantly increasing its investment in artificial intelligence, planning to spend USD 75 billion on AI infrastructure in 2025. This marks a major jump from previous years and reinforces the company’s focus on strengthening its AI capabilities.

Most of this spending will go toward upgrading servers and data centres, ensuring Alphabet has the capacity to meet rising demand for AI services and scale effectively.

This move also reflects intensifying industry competition. With major rivals like Microsoft and Meta pouring money into AI, Alphabet is boosting its spending to maintain its leadership position in the AI race.

Emerging Competition from OpenAI [31]

Alphabet is also facing growing competition from OpenAI, which recently introduced SearchGPT, an AI-powered search tool designed to deliver quick, accurate answers with clear sources. Unlike traditional search, it focuses on more direct, conversational responses while pulling real-time information from the web.

Although still in testing, SearchGPT — backed by Microsoft — could challenge Google’s dominance in search technology. As AI competition heats up, investors should keep a close eye on these developments, as they could introduce more volatility to the market.

Start Trading GOOGL stock commission-free with Vantage

Looking to trade GOOGL shares? Vantage Markets is the place to go for $0 commission on US stocks.

Access GOOGL and over 500 other U.S. listed company stocks through Vantage and trade commission-free. You can use expert advisors or trade your own long or short strategy on GOOGL and other blue-chip stocks for $0 per trade.

References

- “Alphabet – Forbes”. https://www.forbes.com/companies/alphabet/?sh=44353e51540e . Accessed 3 May 2023.

- “Why Google Became Alphabet – Investopedia”. https://www.investopedia.com/articles/investing/081115/why-google-became-alphabet.asp . Accessed 3 May 2023.

- “Sundar Pichai – Britannica”. https://www.britannica.com/biography/Sundar-Pichai . Accessed 3 May 2023.

- “How Google (Alphabet) Makes Money: Advertising and Cloud”. https://www.investopedia.com/articles/investing/020515/business-google.asp#toc-alphabets-business-segments Accessed 7 January 2026.

- “Alphabet Inc. (GOOGL) NASDAQ: GOOGL · Real-Time Price · USD · Class A Shares”. https://stockanalysis.com/stocks/googl/employees/. Accessed 7 January 2026.

- “Benefits at Google – Google Careers”. https://careers.google.com/benefits/ . Accessed 3 May 2023.

- “Google – Comparably”. https://www.comparably.com/companies/google/awards . Accessed 3 May 2023.

- “Google Acquires Artificial Intelligence Startup DeepMind For More Than $500M – TechCrunch”. https://techcrunch.com/2014/01/26/google-deepmind/ . Accessed 3 May 2023.

- “Google spends $50 million to buy a division of LogMeIn that lets companies manage smart devices – CNBC”. https://www.cnbc.com/2018/02/15/google-buys-xively-for-50-million.html . Accessed 3 May 2023.

- “Google buys GIF platform Tenor – The Verge”. https://www.theverge.com/2018/3/27/17169682/google-gif-platform-tenor-android-ios . Accessed 3 May 2023.

- “Google cloud boss Thomas Kurian makes his first big move — buys Looker for $2.6 billion – CNBC”. https://www.cnbc.com/2019/06/06/google-buys-cloud-company-looker-for-2point6-billion.html . Accessed 3 May 2023.

- “If You Had Invested Right After Google’s IPO – Investopedia”. https://www.investopedia.com/articles/active-trading/081315/if-you-would-have-invested-right-after-googles-ipo.asp . Accessed 3 May 2023.

- “Google Guys Worth Billions More Thanks To Stock’s Earnings Surge – Forbes”. https://www.forbes.com/sites/steveschaefer/2015/07/17/google-stock-surge-brin-page-billions/?sh=4ded164e109c . Accessed 3 May 2023.

- “Market capitalization of Alphabet (Google) (GOOG) – Companies Market Cap”. https://companiesmarketcap.com/alphabet-google/marketcap/ . Accessed 3 May 2023.

- “Why Alphabet (Google) Is Still A Great AI Stock For 2024 and Beyond – Yahoo!Finance”. https://finance.yahoo.com/news/why-alphabet-google-still-great-223000199.html . Accessed 30 July 2024.

- “Alphabet stock tumbles on mixed earnings results, but Goldman sees 25% upside ahead on AI strength – Business Insider”. https://markets.businessinsider.com/news/stocks/alphabet-stock-price-outlook-earnings-youtube-ad-ai-growth-google-2024-7 . Accessed 30 July 2024.

- “M&A News: Alphabet’s (GOOGL) $23 Billion Wiz Deal Falls Apart – Nasdaq”. https://www.nasdaq.com/articles/ma-news-alphabets-googl-23-billion-wiz-deal-falls-apart . Accessed 30 July 2024.

- “Alphabet stock tumbles after cloud revenue miss, spending growth – Yahoo!Finance”. https://finance.yahoo.com/news/alphabet-stock-tumbles-after-cloud-revenue-miss-spending-growth-210708696.html . Accessed 5 February 2025.

- “Alphabet praises DeepSeek, but it’s massively ramping up its AI spending – msn.” https://www.msn.com/en-us/news/technology/alphabet-praises-deepseek-but-it-s-massively-ramping-up-its-ai-spending/ar-AA1yqeYb . Accessed 5 February 2025.

- “Alphabet Inc Class A – Google Finanace.” https://www.google.com/finance/quote/GOOGL:NASDAQ . Accessed 5 February 2025.

- “Alphabet – 21 Year Stock Price History | GOOGL – Macrotrends.” https://www.macrotrends.net/stocks/charts/GOOGL/alphabet/stock-price-history . Accessed 5 February 2025.

- “All You Need to Know About Google Stock Splits”. https://brokerchooser.com/education/stocks/how-to-buy-google-shares/google-stock-splits . Accessed 7 January 2026.

- “Google’s stock just got a lot cheaper – CNN Business”. https://edition.cnn.com/2022/07/18/investing/google-alphabet-stock-split/index.html . Accessed 3 May 2023.

- “GOOG Historical Data – Nasdaq”. https://www.nasdaq.com/market-activity/stocks/goog/historical . Accessed 3 May 2023.

- “China counters with tariffs on US products. It will also investigate Google – msn.” https://www.msn.com/en-us/money/markets/china-counters-with-tariffs-on-us-products-it-will-also-investigate-google/ar-AA1ymQoS . Accessed 5 February 2025.

- “China launches an antitrust probe into Google. Here’s what it means – AP.” https://apnews.com/article/google-china-antitrust-investigation-tariffs-ab02b906733666cb0d348d2b416b7fa5 . Accessed 5 February 2025.

- “Google Parent Alphabet’s Stock Slides as Cloud Revenue Disappoints – Investopedia.” https://www.investopedia.com/google-earnings-q4-fy-2024-update-8785878 . Accessed 5 February 2025.

- “Alphabet reports Q4 2024 revenue of $96.47 billion – 9TP5Google.” https://9to5google.com/2025/02/04/alphabet-q4-2024-earnings/ . Accessed 5 February 2025.

- “Alphabet expects to invest about $75 billion in capital expenditures in 2025 – CNBC.” https://www.nbclosangeles.com/news/business/money-report/alphabet-expects-to-invest-about-75-billion-in-capex-in-2025/3623589/ . Accessed 5 February 2025.

- “Google Parent Alphabet Plans to Spend $75B This Year, as Big Tech Goes All in on AI – Investopedia.” https://www.investopedia.com/google-parent-alphabet-plans-to-spend-usd75b-this-year-as-big-tech-goes-all-in-on-ai-8786108 . Accessed 5 February 2025.

- “OpenAI’s new SearchGPT prototype is a declaration of war against Google – Business Insider”. https://www.businessinsider.com/openai-searchgpt-search-engine-prototype-declares-war-with-google-2024-5?utm_source=pocket_saves . Accessed 30 July 2024.