Markets choppy, tech sell-off continues

* Divided Fed worried about tariffs, inflation and labour

* President Trump may try to fire Fed’s Cook after accusation

* Pound Sterling slides versus euro, dollar despite hot UK inflation

* Nasdaq falls again for a second day as tech struggles persists

FX: USD stayed rangebound printing a doji candle with the big Friday Jackson Hole risk event on the horizon. Fed Chair Powell’s keynote speech will determine near-term price action until we get the PCE data at the end of the month, followed by NFP on the first Friday of September, and the CPI report on 11 September. The FOMC meeting takes place a week later. The FOMC minutes revealed that most officials agreed it was too soon to lower rates, but there was a divergence of opinion. Prices continue to trade around the 50-day SMA at 98.06.

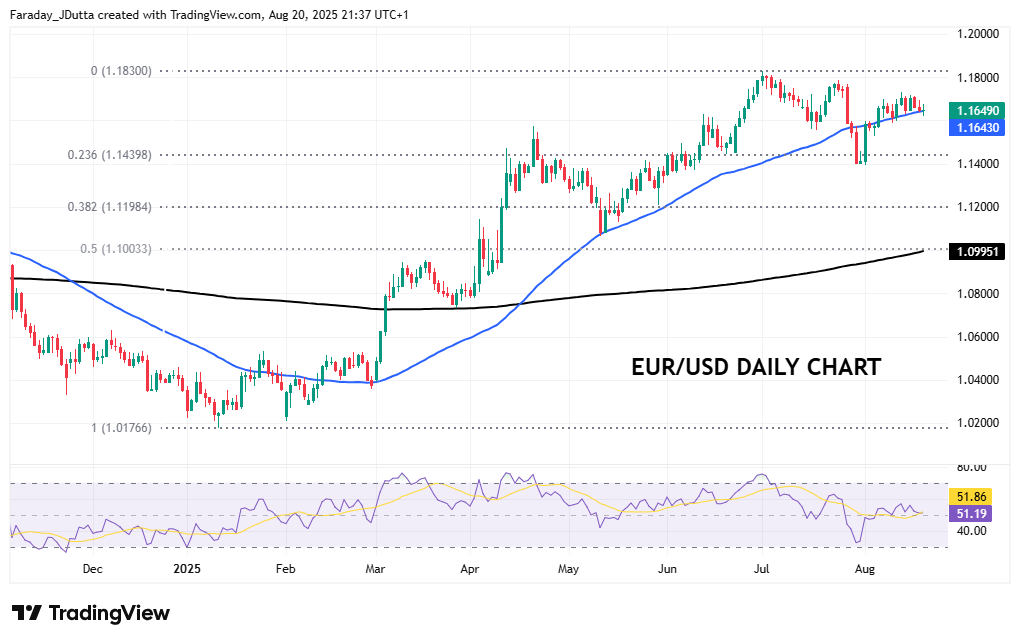

EUR also traded around its 50-day SMA at 1.1643 as markets await PMI data and Powell’s speech. ECB Lagarde mainly talked about trade policy and how the ECB will include the US-EU trade deal in its September staff projections.

GBP sold off for a third day on the damp risk mood. Cable moved down through the 50-day SMA at 1.3456 and settled on its lows. Stronger than expected CPI data was looked through even as services inflation ticked up to 5%. That said, some of this was down to airfare rises which the BoE may ignore, as they are more concerned about food inflation which has been steadier. Rate expectations were largely unchanged so UK-US yields spreads actually still remain supportive of sterling.

JPY outperformed though gave back gains late in the session after the FOMC minutes, as haven currencies were generally mildly bid. The continued narrowing in US-Japan rate differential is giving the yen fundamental support. JGB yields continue to climb, with the 10-year at fresh multi-year highs, and levels last seen in October 2008.

AUD got hit again on mild risk off sentiment as well as being dragged lower by NZD. The kiwi got smashed on a dovish rate cut by the RBNZ who projected a new lower terminal rate at 2.5%. This came after a strong debate among the MPC which saw two officials vote for a bigger 50bps rate reduction. Prices closed just below the 200-day SMA we highlighted yesterday, at 0.5833. CAD outperformed its commodity dollar peers but the major still moved up to three-month highs and levels last seen in late May. The US NFP high is at 1.3879 which is when a bearish outside day printed.

US stocks: The S&P 500 printed down 0.24% at 6,395. That’s the fourth straight days of losses and the biggest four-day percentage drop since the first day in August. The Nasdaq settled off, by 0.58% at 23,249. The Dow Jones finished up at 44,938 adding 0.04%. Prices in the Nasdaq closed well off their lows, having dipped below 23,000. Defensive rotation was the name of the game with more distinct value sectors outperforming, so helping the Dow. We’ve seen textbook profit-taking once again after the strong tech rally over the last few months, which initially fell into another negative feedback loop. The mini correction saw Palantir drop sharply before eventually finishing marginally lower. Nvidia also made it back to near flat on the day after also falling below $170. Their results next Wednesday after the US closing bell will be a key test for all markets. Target closed down over 6% after the retailer kept its annual forecasts that were revised lower in May due to weak demand, whilst also announcing a new CEO.

Asian stocks: Futures are mixed. Regional markets were split again with tech-heavy indices dragged lower, whilst also contending with earnings and the RBNZ’s dovish rate cut. The ASX 200 eked out small gains on strength in financials and defensives. The Nikkei 225 sold off and fell below 43,000 on mixed data and profit taking. The Hang Seng and Shanghai Composite were mixed as Xiaomi and XPeng results were digested.

Gold reversed it move lower on Tuesday as prices climbed back to the 50-day SMA at $3,348. Treasury yields moved lower for a second day ahead of you know who appearing in Wyoming.

Day Ahead – PMIs

Business surveys, aka PMIs, can show economic trends months before they appear in official data. These leading indicators may offer more clues about whether US tariffs are driving the world’s largest towards stagflation, or alternatively if growth momentum is continuing.

EZ Manufacturing PMIis the most widely followed survey and is forecast at 49.5, whilst Services is expected at 50.7, and Composite at 50.6. These are all slightly lower than the prior July readings. That composite index matched an 11-month high in July, despite a marginal downward revision in the final release. However, the rate of growth remained modest and could see some softening in growth momentum, judging by the declines in other surveys like the Sentix and ZEW.

Chart of the Day –EUR/USD finds support

The world’s most popular currency pair has rebounded from the lows seen in very late July and early Auugst. Prices found support around 1.14, the mid-June lows and the first minor Fib retracement level of this year’s rally at 1.1439. The bounce has seen the major move back above the 50-day SMA at 1.1643, which had acted as decent support on a few occasions this year. Recent consolidation has caused bullish momentum to slow with the daily RSI near the neutral 50 level. Initial resistance stis at 1.1730 ahead of the multi-year top at 1.1830.

All eyes will be on tomorrow’s Powell speech at Jackson Hole, with today’s PMIs also of interest too. How pushback will there be against market expectations for rate cuts starting in September? It seems consensus is predicting a very data dependent stance so mild dovish chatter may push EUR/USD higher. The flipside and a strong Fed independence, (why aren’t we in fact hiking?) speech would hurt the major.