Tariffs, Fed Uncertainty, and Euro Strength: What’s Next for EUR pairs?

The Eurozone continues to surprise on the upside. June’s unemployment rate fell to 6.2%, beating expectations and signalling further resilience in the labour market. July’s CPI was flat MoM, holding steady after two months of modest increases, and rose 2% YoY, exactly in line with the ECB’s target. The lack of further monthly gains suggests inflation pressures may be stabilising, even as underlying demand remains firm. Meanwhile, Q2 GDP came broadly in line with estimates, collectively painting a picture of underlying stability in the bloc’s economy.

Against this backdrop, the European Central Bank called an end to its easing cycle in July after eight consecutive cuts over the past year, leaving rates at their lowest since late 2022. While markets are still pricing in the possibility of one additional cut by the end of the year, the ECB now appears more comfortable shifting into a wait-and-see mode, allowing incoming data to guide the next steps.

Trade risks remain a lingering headwind, particularly with the imposition of 15% US tariffs on a range of European exports. Yet equity markets appear unfazed. The Euro Stoxx 50 surged above 5480 before retreating slightly, marking its highest level since April. Markets are shrugging off the higher-than-expected US PPI, which dampened hopes for a larger Fed rate cut in September. The price action suggests traders are increasingly willing to look past near-term trade frictions, anticipating instead the relative strength and policy credibility of the Eurozone.

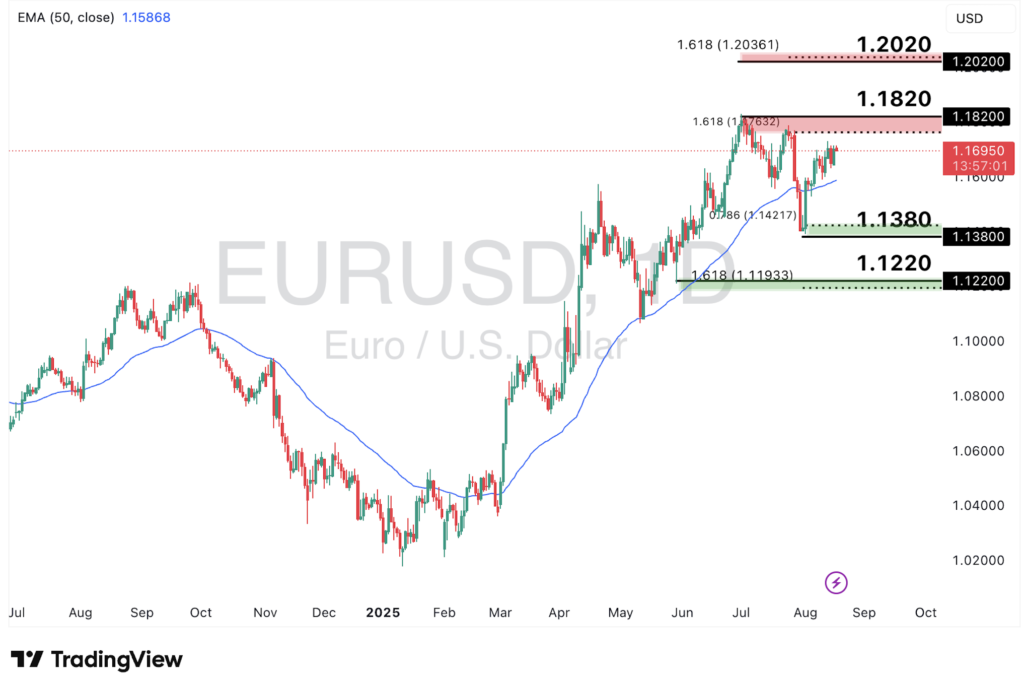

EURUSD – Holding Gains, Eyes on Powell

The euro extended its gains as the dollar slipped to its weakest level since late July, while Brent and WTI stabilised with supply concerns easing. This relative calm has lent support to the single currency in the near term. Looking ahead, the focus shifts to the Jackson Hole Symposium, where remarks from Fed Chair Jerome Powell could set the tone for the euro’s next move by shaping expectations around the Fed’s policy path.

EURUSD maintains bullish momentum above the 50-EMA, having rebounded off the 1.1380 level, a key level aligned with the 78.6% Fibonacci extension. The pair is now advancing towards resistance at 1.1820, which coincides with the swing high and the 161.8% Fibonacci extension. A breakout above this level would likely open the path to 1.2020, also reinforced by the 161.8% retracement.

On the downside, a break back below 1.1380 could shift momentum bearish, exposing the 1.1220 support, the prior swing low and aligned with the 161.8% retracement.

EURJPY – Bulls Eye Fresh Highs Above 175.50

EURJPY continues to trade firmly above the Ichimoku Cloud, reinforcing the bullish momentum. The pair is now testing resistance at 175.50, aligned with the 127.2% Fibonacci retracement. A clean break higher would likely open the way toward 179.50, where the 78.6% Fibonacci extension sits as the next key upside target.

On the downside, initial support lies at 169.20, which is also in line with the 127.2% retracement. A break below this level would expose the 166.80 zone, the prior pullback support, which coincides with the 50% retracement.

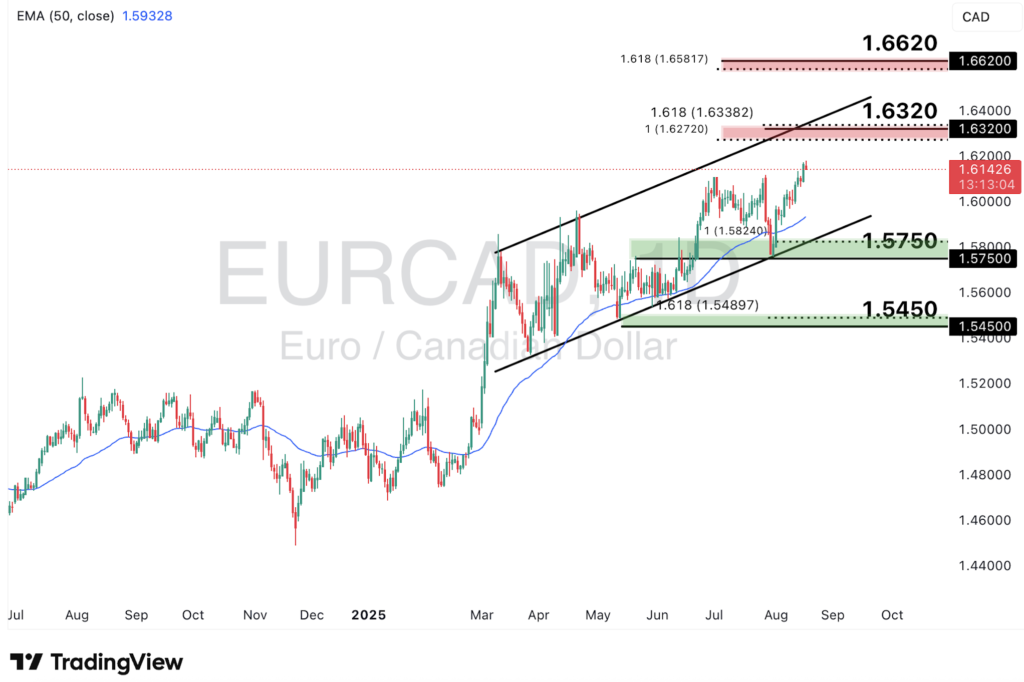

EURCAD – Channelling Higher With Room to Run

EURCAD remains supported within an ascending channel and above the 50-EMA, keeping bullish momentum intact. The pair is poised to test resistance at 1.6320, where the channel top aligns with both the 100% Fibonacci extension and the 161.8% retracement. A breakout above this zone could accelerate gains toward 1.6620, another key resistance reinforced by the 161.8% retracement.

On the downside, a pullback toward the lower boundary of the channel would put focus on the 1.5750 support, also aligned with the 100% Fibonacci extension. A decisive break below the channel could extend losses toward 1.5450, the previous swing support that coincides with the 161.8% retracement.

Overall momentum remains tilted to the upside for the euro. While trade tensions and tariff risks linger, broader sentiment favours the single currency as excess liquidity seeks alternatives to the US. Upcoming data releases, including manufacturing and services PMIs from the Eurozone, will determine whether the Euro’s resilience can translate into sustained outperformance, especially if US data continues to complicate the Fed’s policy path. Strong prints may reinforce the case for euro strength into year-end.