Gold soars ahead of key US labour data

* Dollar slipped amid US government shutdown risk

* Wall Street rises as investors brush off hawkish talk and shutdown woes

* Gold unstoppable rally surges through $3,800 to fresh all-time highs

* JOLTs labour market data kick off NFP Friday

FX: USD started a busy data-packed week in downbeat fashion as it traded just below its 50-day SMA at 98.02. This came after a decent prior week on the back of stronger GDP activity data. Thursday’s weekly jobless claims also dipped again and fell back to more average levels after the brief recent spike higher. Weak data will build the case for more aggressive rate cuts, potentially sealing the deal for two 25bps Fed rate cuts in October and December. Money markets currently price around a 68% of that happening. The US government shutdown is grabbing headlines but typically doesn’t have any long-term economic impact.

EUR found support last week at its 50-day SMA, now at 1.1679 and the midpoint of the August to September rally at 1.1655. Yield spreads remain supportive of the euro, as attention turns to French and German CPI numbers tomorrow, and then the full eurozone release on Wednesday. Hotter figures could rein in any chance of one more ECB rate cut this year and boost the euro.

GBP ticked up for a second straight day as it neared the 50-day SMA at 1.3464. Attention has turned to Chancellor Reeves and this week’s Labour Party conference as the UK’s stagnant growth and sticky inflation outlook calls for tough decisions ahead regarding its parlous public finances. She pushed back on calls for a wealth tax, though tax rises are coming, and reinforced a broader commitment to the government’s self-imposed fiscal rule.

JPY outperformed after the major peaked just below 150 on Friday. A BoJ official and noted dove suggested upside risks needed ‘a new policy perspective’. Markets took this as a mild endorsement of rate hikes, raising expectations into the end of October BoJ meeting. This week’s Tankan data and speeches by Ueda and others will be worth watching. The 200-day SMA sits at 148.41.

AUD led the gainers with focus on today’s RBA meeting. See below for more details. CAD strengthened modestly after making fresh four-month highs in the major just below the May peaks around 1.40, where the 200-day SMA also lies. Seasonals going into the end of the year are weak for the loonie.

US stocks: The S&P 500 gained 0.26% to close at 6,661. The Nasdaq moved higher by 0.44% to settle at 24,611. The Dow Jones finished at 46,316, up 0.15% while small caps underperformed with the Russell 2000 up 0.04% at 2,435. Only two sectors were in the red – Energy (-1.91%) and Communication Services (-0.45%). Consumer Discretionary and Tech led the gainers, with Materials and Financials close by. Energy gave back some of last week’s gains with crude falling on reports OPEC+ will likely raise oil output by at least 137k bpd at its October 5 meeting. Last week, saw value cyclicals – including materials, energy, and banks – particularly strong. Inflation-sensitive sectors, especially consumer names, remained under pressure, so too defensives like staples and healthcare, the latter on the back of more tariffs.

Asian stocks: Futures are positive. Stocks traded mostly firmer after Friday’s decent performance Stateside. The ASX 200 pushed north led by gold miner strength and a bounce in healthcare. The Nikkei 225 underperformed on yen strength, with eyes on Wednesday’s Tankan survey and LDP vote later in the week. The Hang Seng and Shanghai Comp initially diverged as Hong Kong rose on tech gains. The mainland oscillated in the red and green heading into th weeklong holiday period. We note the S&P 500’s forward P/E briefly touched levels only seen during the dot-com bubble and the 2020 pandemic surge.

Gold broke out again to the upside after its bullish consolidation we highlighted last week. The relentless rally has seen 10 ‘green days’ out of the past 14 sessions. The US government shutdown has been cited as a reason for bugs pushing prices higher. But ETF inflows have been strong recently, with positive numbers over the past four straight weeks. That has seen total holdings reach levels near the pandemic record highs.

Day Ahead – RBA Meeting, JOLTs data

The RBA is widely expected to keep the Cash Rate unchanged at 3.60% at its meeting, with the next 25bps cut not fully priced in by mkts until March 2026. The meeting will not include updated forecasts. The upside surprise in August’s monthly CPI reduced the case for near-term easing, although the trimmed mean eased one-tenth to 2.6%. The RBA is unlikely to overreact to one month of stronger data given the broader inflation outlook remains consistent with the target while the labour market is gradually loosening. Policymakers are unlikely to rush into rate cuts and will adopt a wait-and-see approach ahead of the Q3 CPI release on October 29. Governor Bullock has previously emphasised this data as a key input to future rate decisions.

JOLTS data centres around job vacancy figures and labour market churn. This kicks of a data-heavy week of multiple employment figures including ADP on Wednesday, weekly initial jobless claims on Thursday and NFP to wrap up the week. (There is the possibility of the government shutdown thwarting some of these releases.) Consensus expect JOLTS to show job openings held firm around 7.18mn in August while some attention will be on the uptick in layoffs. A low quit rate would continue to signal wage moderation. Recent figures have confirmed the job market is loosening.

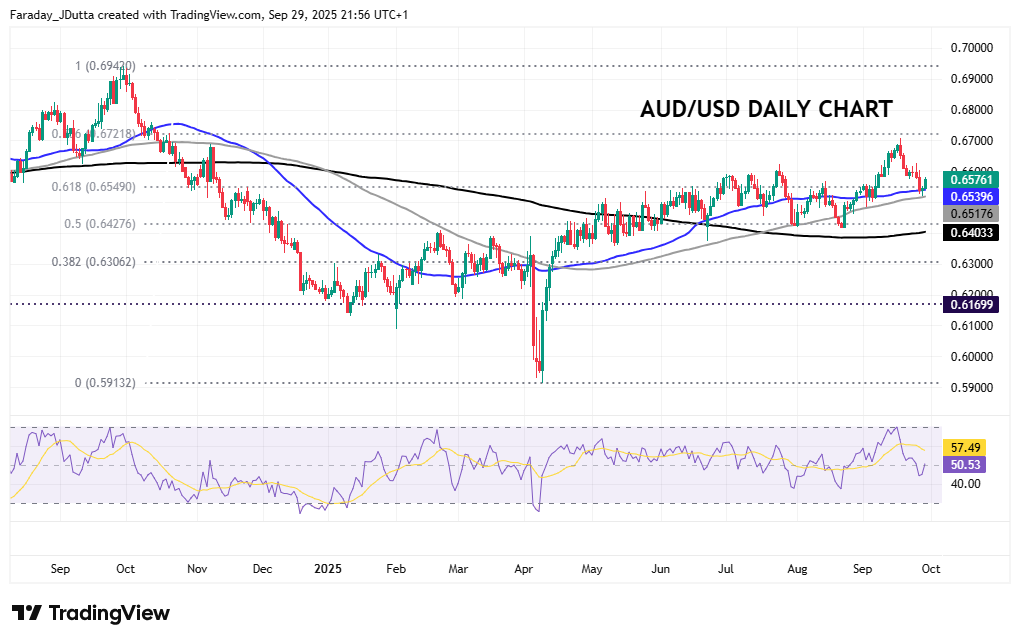

Chart of the Day – AUD/USD bounces off 50-day SMA

The aussie has been the best performing major currency against the dollar this month. Rate cuts bets have cooled since the stronger than expected inflation data. That saw odds of a November 25bps reduction slashed from a near 90% chance to currently roughly a coin toss now. The major’s retrace from the multi-month top above 0.67 ten days ago looks to have found support at the 50-day SMA at 0.6539. A Fib level (61.8%) of the September 2024 to April 2025 decline sit at 0.6549 reinforcing this support zone. A more hawkish RBA should see prices push higher, though markets will also have one eye on US jobs data out this week.