In fast-moving financial markets, the price at which a trade is executed may differ from its original expected price—this difference is called slippage.

Slippage usually occurs during periods of high volatility or low liquidity, particularly when using market orders. It is more likely if the trade size exceeds the available volume at the requested price. As market prices can shift rapidly, slippage can occur in the brief time it takes for an order to be processed and filled.

While slippage is an unavoidable part of trading, understanding its causes—and the measures brokers use to help reduce it—can potentially help traders protect profit margins and make more informed decisions.

What Is Slippage in Trading?

Slippage in trading refers to the difference between the price a trader expects when placing an order and the actual price at which the order is executed. In simple terms, it occurs when market conditions prevent an order from being filled at the exact requested level.

The phenomenon is most common during periods of high volatility—such as major economic announcements, earnings releases, or unexpected geopolitical events—when prices can move rapidly in a short span of time.

Slippage can also occur in thinly traded markets where liquidity is limited and there may not be enough buyers or sellers to fill an order at the desired price. For example, small-cap stocks and exotic currency pairs.

Another scenario where slippage can arise is when large orders exceed the available volume at the quoted price. In such cases, part of the order may be filled at the requested price, while the remainder is executed at progressively worse prices as the system searches for additional liquidity.

In the next section, discover if slippage is a good or bad thing for most traders.

Is Slippage Good or Bad? The 2 Types of Slippage: Negative and Positive

Slippage can affect traders in two ways: Negative slippage and positive slippage—both of which directly influence trading costs and outcomes.

What Is Negative Slippage?

Negative slippage occurs when a trade is executed at a less favourable price than the one requested. For example, a buy order at 1.1000 might be filled at 1.1010 instead.

This difference increases trading costs and reduces potential profit. To illustrate, imagine placing a gold order at $2,400, only to be filled at $2,405. That $5 difference represents an additional expense per unit, which compounds over multiple trades and can significantly impact profitability.

What Is Positive Slippage?

Positive slippage occurs when an order is filled at a more favourable price than expected. For instance, a buy order placed at 1.1000 might instead be filled at 1.0990, giving the trader a better entry point.

This type of slippage improves cost efficiency and may slightly boost returns. For example, placing a sell order at 1.1000 that gets filled at 1.1005 provides a stronger exit than anticipated, adding incremental gains to the trade.

What Causes Slippage in Financial Markets? 3 Factors Traders Need to Know

Slippage can occur for several reasons, most of which are linked to the speed of price movements and the level of liquidity available in the market. By understanding these causes, traders can make more informed decisions about order types, risk management, and execution strategies.

1. High Market Volatility

Slippage is most common during sharp price swings, when markets move too quickly for orders to be filled at the requested price. This often happens during major economic data releases, central bank announcements, or unexpected global events.

Examples include the release of US Non-Farm Payrolls (NFP), Federal Reserve interest rate decisions, or sudden geopolitical developments that trigger rapid shifts in supply and demand.

In such cases, markets may ‘gap’ past price levels, leading to execution at a different rate than expected.

2. Low Market Liquidity

Slippage also occurs when there aren’t enough buyers or sellers available at the desired price level. In such cases, orders are filled at the next available level in the order book, often at a less favourable price.

Liquidity tends to be thinner:

- During off-peak trading hours, such as the Asian session for EUR/USD.

- In thinly traded markets, such as exotic currency pairs, small-cap stocks, or low-volume commodities.

Recognising when liquidity is thin helps traders anticipate potential slippage and adjust order sizes or timing to achieve better execution.

Read More: 16 Currency Pairs to Trade in Forex

3. Execution Delays (Broker and Technology Factors)

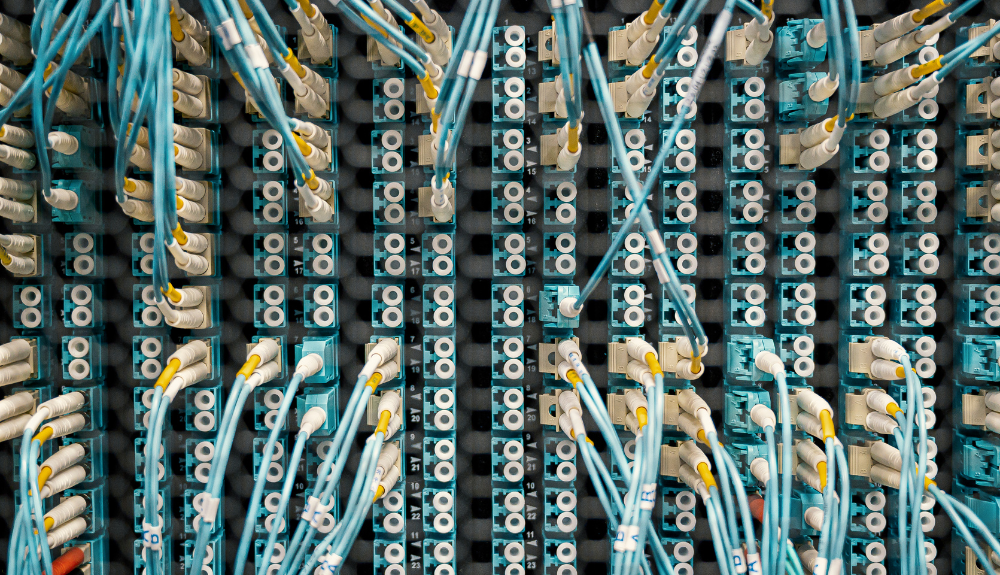

Even small delays in communication between a trading platform and its liquidity providers can cause slippage, as prices may shift in milliseconds.

Factors that reduce execution risk include:

- Low-latency order routing offered by brokers like Vantage

- Advanced trading infrastructure, such as servers located close to major exchanges

Fast, reliable order execution narrows the window for price changes, helping traders minimise slippage in volatile or fast-moving markets.

Read More: A Guide to Trading in Volatile Markets

How Do Contracts for Difference (CFD) Brokers Minimise Slippage?

While slippage cannot be eliminated, reputable CFD brokers employ several methods to help reduce its impact and improve trade execution.

1. Superior Order Execution Speed

Reliable CFD brokers often invest in state-of-the-art trading infrastructure designed to support ultra-fast order execution and minimise latency. That typically means using high-performance servers, low-latency networks, and direct connections to liquidity providers.

At Vantage, this is taken to the next level. Our live trading servers are located in major financial hubs like London and New York. We also partner with Equinix to leverage fibre-optic network connectivity, providing low-latency execution designed to improve trade efficiency.

Vantage also uses the oneZero™ MT4 Bridge, a next-gen price aggregator that connects clients to our dark liquidity pool while handling high volumes of market orders with minimal delay.

Plus, whenever positive or negative slippage occurs, Vantage passes it directly to clients, reinforcing fairness and transparency in execution.

2. Access to Deep Liquidity Pools

By connecting to a broad network of Tier 1 banks and non-bank liquidity providers, brokers can aggregate liquidity and source the best available prices, even when handling large trades. This depth of market access allows orders to be filled more efficiently and at competitive rates.

3. Advanced Risk Management Tools

Some brokers also provide risk management features such as Guaranteed Stop Loss Orders (GSLOs) and slippage-control settings. These tools give traders added certainty during periods of high volatility, helping them manage risk and possibly maintain greater control over trade outcomes.

At Vantage, slippage is managed with precision and transparency. From ultra-low latency execution to access to deep liquidity pools, we are committed to reducing the negative impact of slippage while ensuring clients benefit from positive price improvements when available.

Related Course: Master the Basics of Risk Management

How to Avoid Slippage in Trading: 3 Commonly Used Strategies

Although slippage cannot be completely avoided in trading, there are practical strategies available to reduce its impact and improve execution quality. If you’re looking for ideas on how to reduce slippage in trading, keep scrolling to learn the three commonly used techniques.

1. Utilise Limit Orders

A limit order ensures that a trade is executed only at the specified price or better. This protects against unfavourable fills caused by sudden price moves. However, the trade-off is that the order may not execute at all, if the market never reaches the specified price level.

2. Be Cautious with Stop Orders

Stop orders, including stop-loss orders, automatically convert into market orders once the trigger price is reached. In fast-moving markets, this can expose traders to slippage because the execution price may differ from the stop level.

To reduce risk, traders should place stops thoughtfully—factoring in volatility, market depth, and asset liquidity.

Read More: Money Management Strategies and Techniques in Trading

3. Avoid Trading Around High-Impact News Events

Major economic releases and policy announcements often trigger sharp volatility and rapid price changes in the markets. Reviewing an economic calendar and avoiding order placement during such periods may help reduce the likelihood of slippage.

Read More: Get the Latest Market News & Analysis

It’s Possible to Manage Slippage in Trading

Slippage is an unavoidable aspect of trading, reflecting the realities of fast-moving prices and varying liquidity conditions.

While it can sometimes work against traders, it can also deliver desirable outcomes when markets move in their favour. The real difference comes from how effectively traders prepare for and manage it.

By combining smart strategies—such as choosing the right order types, timing trades carefully, and applying sound risk management—with the support of a broker that prioritises execution quality, traders can potentially reduce the impact of slippage over time.

Vantage provides access to deep liquidity, low latency execution, and advanced trading tools designed to help you trade more efficiently in volatile conditions.

Ready to put it into practice? Consider opening a Vantage Live Account today to experience professional-grade execution—or start with our Demo Account to build confidence in real market environments before going live.

FAQ

Does Slippage Affect All Trading Markets?

Yes. Slippage can occur in various markets such as forex, contracts for difference (CFDs), commodities, indices, and equities.

In essence, any markets with fast-moving prices or thin liquidity are susceptible.

Does a Broker with Fast Execution Speed Eliminate Slippage Completely?

No broker can eliminate slippage entirely, as it is an inherent part of trading in dynamic markets.

However, brokers with faster execution speeds and low-latency infrastructure can significantly reduce the frequency and magnitude of slippage by ensuring orders are processed more quickly and efficiently—especially during periods of high volatility.

How Can I Know the Impact of Slippage in My Trading Performance?

Regularly reviewing your trade confirmations or execution reports can help you assess the impact of slippage. By comparing your requested (order) prices with the actual executed prices over time, you can determine whether slippage is consistently affecting your entries and exits—and adjust your strategy or order types accordingly.