New highs keep coming in stocks ahead of earnings deluge

* Wall Street scales fresh records on US-China trade optimism

* Gold falls below $4,000as safe haven demand cools

* Dollar trades steady ahead of Wednesday’s FOMC rate decision

* Bessent names Fed Chair finalists as Trump eyes end of year pick

FX: USD was quiet again as it consolidated ahead of a big week of major risk events. Positive news on the US-China framework agreement for Trump-Xi talks on Thursday only impacted high-beta currencies. Front and centre for the greenback is Wednesday’s Fed rate decision with 25bps rate cuts at this and the final meeting of 2025 in December baked in by money markets. We’ve had two inside weeks on the Dollar Index which means we may have a period of range expansion in due course. It’s 50:50 if the government shutdown extended beyond November 16.

EUR ticked higher for a fourth straight day but remains below the 100-day SMA is at 1.1660 and the 50-day SMA at 1.1686. German IFO business sentiment offered a slight surprise on the forward looking expectations sub-index. Euro yield spreads have continued to narrow, offering the single currency fundamental support. Markets are expecting no changes at Thursday’s ECB meeting as policy is in a ‘good place’.

GBP found a very modest bid to halt six straight days of selling. Last week’s cooler inflation and the prior soft wage data have perked up rate cut expectations at the BoE meeting next week. Focus is also on the November 26 Budget which looms large, with leaks on proposed measures increasing weekly. The daily RSI remains below 50 with SMAs still pointing south.

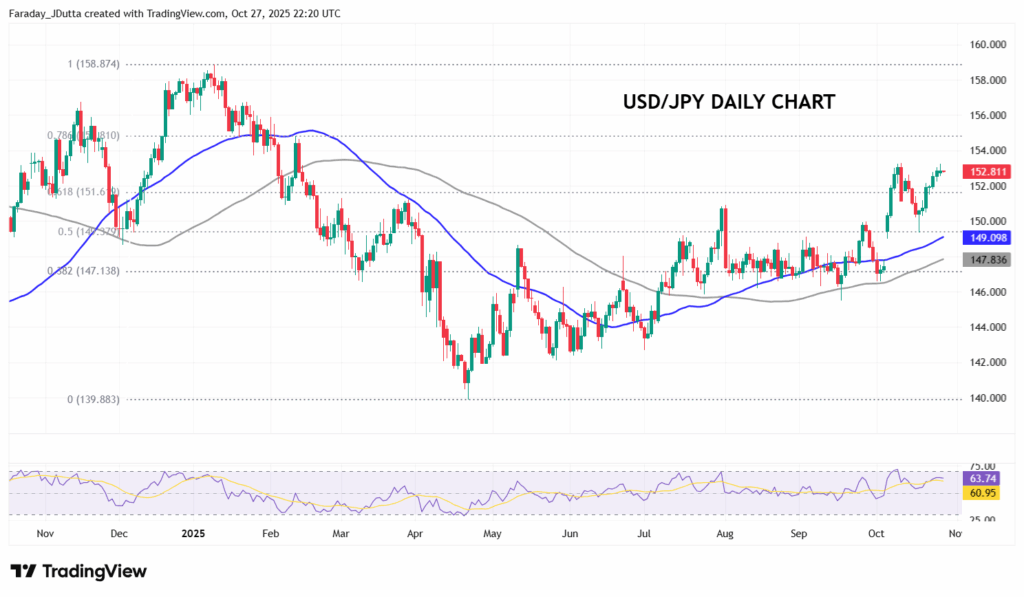

JPY was the underperformer again as it heads into a big week. The BoJ is set to hold rates at 0.5% after the Takaichi PM win put paid to any near-term policy normalisation. Markets do not now price in a full 25bps rate hike until March 2026 with around 10bps of tightening in the December meeting. Bullish momentum in the major is threatening to break the early October highs in the low 153 zone. Bulls eye 155 and beyond, where we are into intervention territory, ahead of the Trump-Takaichi meeting set for today.

AUD outperformed strongly on US-Sino optimism and ahead of Q3 inflation data due on Wednesday. The major is trading on its 50-day SMA at 0.6550. CAD tried to brush off new 10% tariffs but struggled and underperformed its peers. Eyes are on another BoC rate cut, though it could be the last in the rate cut cycle.

US stocks: The S&P 500 added 1.23% to close at 6,875, a new record close and the 35th one of 2025. The Nasdaq moved higher by 1.83% to settle at 25,822, another record close. The Dow Jones finished at 47,545, up 0.71% on the day and also a record finish. Sectors were predominantly green with Communications Services leading the gains, followed by Technology and Consumer Discretionary, while Consumer Staples and Materials were the only sectors in the red. The stock-specific highlight was Qualcomm, which surged over 11% after announcing the launch of Qualcomm AI200 and AI250 chips for data centres, with commercial availability starting next year. Nvidia also rose over 2.8% and gave the benchmark S&P 500 its biggest boost. Tesla rallied over 4.3% on the optimism around the US-China talks. Shares of US-listed rare earth miners sunk after their recent rally and the prospects for a US-Sino agreement eased fears of disruptions.

Asian stocks: Futures are green. Stocks were generally higher on the China-Us trade positivity, especially the potential one-year delay to a new rare earth exports licensing regime. The ASX 200 was helped by tech and financials strength with defensives lagging. The Nikkei 225 surged through the 50,000 barrier to record highs ahead of the Trump-Takaichi meeting, with deals on bio, quantum and nuclear fusion expected to get signed off. The Hang Seng and Shanghai Comp were positive on the improving US-China noises and consensus ahead of the Xi-Trump meeting on Thursday.

Gold fell sharply, dropping over 3.1%, which means a decline of over 8% from the recent record highs. The intraday top from mid-October was $4,381. A major Fib level (38.2) from the September low to record high sits at $4,033. The midpoint of that move is $3,925. More profit taking after the US-China trade news also hit silver.

Chart of the Day – USD/JPY bullish into risk events

Yen traders have a busy week with the Trump-Takaichi meeting first up today, with the BoJ meeting to follow on Thursday. The White House would like USD/JPY lower to correct the US trade deficit with Japan, while PM Takaichi’s presumed policies are yen negative, with pressure on the Bank of Japan not to raise rates. It seems a broad dollar decline is needed to arrest the strong bullish momentum in the major. We shouldn’t get intervention until the 155-160 area as the Japanese last sold USD/JPY near 160 in July 2024. With prices above a major Fib level of this year’s drop at 151.61, bulls aim for the next retrace level at 154.81.