When Washington grinds to a halt, the ripple effects rarely stay within the country. Given the global heft of the US and the US Dollar’s status as the world’s reserve currency, a US federal government shutdown has ramifications.

A federal shutdown occurs when Congress fails to pass legislation to fund government operations, leading to a lapse in appropriations. In essence, the world’s largest economy partially switches off.

The result is that hundreds of thousands of federal employees are forced to stay home without pay while key services, from passport processing to national park operations, are paused indefinitely.

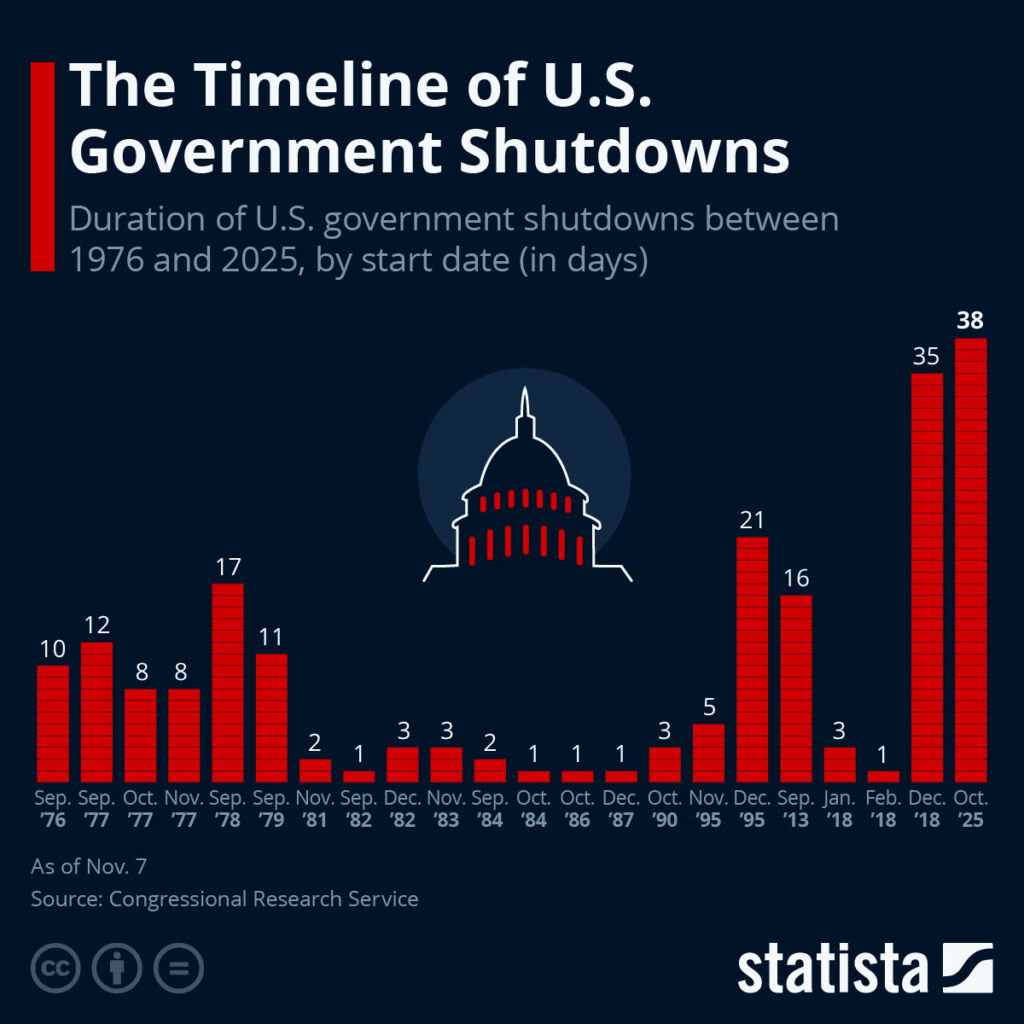

The 2025 government shutdown, which began in early October, lasted five weeks and became one of the longest in US history. Markets have grown increasingly uneasy, recalling the 35-day impasse of 2018–2019 that cost an estimated US$11 billion in lost output [1].

Analysts note that this shutdown reflects differing political views over spending limits, healthcare subsidies, and foreign aid, amid a more polarised legislative environment.

After weeks of negotiations, Congress eventually reached a compromise and passed the agreement needed to restore funding. With the bill now approved and federal operations resuming, the 2025 shutdown has officially come to an end.

Here’s a brief overview of what drove the shutdown and why its effects have been closely watched by global market participants.

Key Points

- A US government shutdown occurs when funding bills fail to pass, leading to halted services and furloughed federal workers.

- Prolonged shutdowns weigh on economic activity, delay key data releases, and heighten uncertainty for households, businesses, and markets.

- The 2025 standoff reflects deep political divisions, with its resolution dependent on congressional compromise and the timing of a final agreement.

How Government Shutdowns Arise

The budget process in the US is both constitutional and political. Each fiscal year begins on 1 October, but the process leading up to that date requires Congress to pass 12 separate appropriations bills funding various government departments.

If lawmakers cannot agree on one or more of these bills, they may resort to a temporary measure known as a continuing resolution (CR) to keep agencies open at prior-year funding levels.

When neither a full-year appropriation nor a CR passes, the Antideficiency Act comes into force, prohibiting federal agencies from spending money in the absence of congressional authorisation. That legal constraint has been weaponised and has now transformed budget stalemates into full-blown shutdowns.

Before then, agencies often continued operating on the assumption that Congress would soon approve funding (mainly because the assumption was that lawmakers would be responsible). Since that reinterpretation, they have been obliged to halt all “non-essential” work once appropriations lapse.

The triggers vary, but the underlying theme is usually partisan gridlock. One side may demand spending cuts while another may seek to attach policy riders (i.e. pork barrel spending on pet projects) to appropriations bills.

Occasionally, disputes spill over from broader ideological battles: foreign aid packages, defence spending ceilings, or even the debt-ceiling debate.

Historically, the US has experienced several major shutdowns that left economic scars. In 1995–96, clashes between President Bill Clinton and House Speaker Newt Gingrich over Medicare and education spending closed the government for 21 days.

The 2013 shutdown under President Barack Obama, triggered by attempts to defund the Affordable Care Act, lasted 16 days. The longest, in 2018–19, under President Donald Trump, stretched to 35 days over border-wall funding.

Each episode carried a political cost and an economic price tag, from delayed paycheques to weakened investor sentiment. These shutdowns are not constitutional crises but, rather, fiscal ones borne out of partisan politics.

The 2025 Shutdown in Context

The current shutdown, which began on 1 October 2025, stems from a deadlock between the Republican-controlled House and the Democratic-led Senate over competing visions of fiscal discipline.

At its heart are disputes over renewed subsidies under the Affordable Care Act, reductions in foreign aid to Ukraine, and cuts to domestic discretionary programmes.

As negotiations drag on, roughly 750,000 federal employees have been furloughed, while another 1.3 million are working without pay to maintain essential functions like air-traffic control and border security.

The Office of Management and Budget (OMB) has warned that if the impasse continues into late November, the cost could exceed US$8 billion to US$10 billion in lost output. Goldman Sachs estimates that each week of shutdown trims 0.05 percentage points from quarterly GDP growth.

The overall impact from this? A potential 0.3 to 0.4 percentage-point drag if the standoff endures until the end of 2025.

The 2025 episode ultimately became the longest in modern history, lasting 43 days and ending on 12 November 2025, surpassing the shutdowns of 2018 and 1995.

Beyond duration, its distinguishing feature is timing: it arrives when fiscal stress is already elevated, with the US budget deficit running above 6% of GDP and Treasury issuance at record highs.

What Happens During a Shutdown

A shutdown divides the federal government into two camps: essential and non-essential operations. Essential personnel, like those whose work protects life or property, continue working without pay until funding resumes.

Meanwhile, non-essential services are suspended, meaning the routine machinery of governance slows to a crawl. For citizens, the consequences are tangible. Passport and visa applications halt, national parks and museums close, and new clinical trials at the National Institutes of Health stall.

Small businesses awaiting loans from the Small Business Administration (SBA) find their applications frozen. Even the release of key economic data that markets rely on, from inflation and jobs reports to retail-sales figures, are delayed.

At a time of volatile inflation and uncertainty about everything from tariffs to the jobs market, depriving investors and policymakers of critical information that has created a glaring blind spot.

Federal contractors also suffer, as suspended projects interrupt revenue streams. Airlines and tourism operators bleed business when travellers cancel trips to shuttered parks and monuments. In Washington D.C., restaurants and services catering to government workers see foot traffic plunge.

On the larger scale, the macroeconomic toll builds gradually but steadily. The Congressional Budget Office (CBO) estimated that the 2018–19 shutdown shaved US$11 billion from US GDP, with about one-third of that permanently lost [2]. Once consumer spending is lost at a point in time, it can’t come back or be recouped.

During that shutdown, consumer sentiment fell sharply, and federal employees missed two pay cycles. Although back pay is eventually issued, the uncertainty weighs on spending patterns.

A comparable dynamic is playing out now. Early indicators show dips in credit-card transactions around major federal workplaces, while surveys of small-business optimism have declined for two consecutive months.

The University of Michigan’s closely-watched consumer-confidence index dropped to a five-month low in mid-October, citing “concerns about government dysfunction” as a top reason.

As for financial markets, they typically react with caution rather than panic. Equity indices may wobble but rarely collapse outright; investors generally assume a political resolution is inevitable (as seems to be the case now) and is more a question of “when”, not “if”.

However, Treasury markets can experience temporary dislocations if auction schedules or data releases are more permanently disrupted. In 2013 and again in 2018–19, yields on short-dated bills spiked briefly as traders priced in operational uncertainty.

Risks and What If It Lasts?

Before the shutdown ended on 12 November, analysts warned that a prolonged lapse in funding could place increasing strain on the economy and the political system that supports it. Each missed pay cycle added stress for federal employees, who make up one of the largest workforces in the US.

Beyond individual households, there were concerns that institutional pressures would build. Agencies faced growing backlogs in applications, compliance reviews, and permits, all of which would require significant overtime and resources to clear once operations resumed.

The Government Accountability Office previously found that earlier shutdowns added between US$1 billion and US$4 billion in restart expenses — a meaningful cost even if not catastrophic.

Had the 2025 standoff extended into December, analysts noted the risk of broader economic pressure. Private contractors linked to defence and infrastructure could have scaled back work, potentially slowing job growth. Consumer sentiment might have weakened further, affecting retail activity during the important holiday period.

Ratings agencies also reiterated that sustained fiscal brinkmanship could erode confidence in US governance, echoing the concerns that contributed to Fitch’s downgrade of the US credit rating to AA+ in 2023.

Market visibility was another worry. The suspension of statistical releases from agencies such as the Bureau of Labor Statistics and the Census Bureau left traders and policymakers without key economic signals. Inflation, jobs, and GDP data guide decisions across the Federal Reserve and the corporate sector, and any delay tends to widen bid–ask spreads and reduce liquidity.

In a more extreme scenario, analysts highlighted the risk that a prolonged shutdown could overlap with debt-ceiling debates. Even the possibility of administrative delays in interest payments would have unsettled global investors, given how unprecedented such an event would be.

There was also an international dimension. Fiscal gridlock in the US often influences global market sentiment, supporting short-term safe-haven flows into the US dollar and Treasury bonds while raising longer-term questions about policy consistency. By early November, the US Dollar Index (DXY) had already strengthened by close to 2% since 1 October.

What Can Change/What Next?

Historically, every shutdown ends the same way and that’s with simple political compromise. The path there, however, can vary.

Most closures resolve through a continuing resolution, temporarily funding agencies while negotiations continue. Others end with a full appropriations package once one side concedes or public backlash forces action.

Lawmakers were spurred into action over the past weekend with reports coming out that the latest agreement (passed by the Senate) had been hammered out in round-the-clok negotiations over the past weekend (8-9 November).

Opinion polls show that nearly two-thirds of Americans blame Congress collectively rather than one party alone and that could have contributed to the urgency to come to an agreement. That shared disapproval can catalyse movement, particularly with election season looming.

If this agreement does get passed and the government reopens, the economic rebound is usually swift but incomplete. Federal workers receive back pay, boosting short-term consumption.

Yet the broader uncertainty lingers. Businesses delay investment decisions, and investors stay wary of future disruptions. The net effect is a modest but persistent dent in growth and confidence.

For market watchers, several signposts merit attention in coming weeks:

- White House communications: Tone matters and conciliatory remarks can shift expectations quickly. Future developments may depend on how the administration responds to the agreement.

- Economic data releases: Any postponement or cancellation confirms operational disruption. With the economy going through an AI investment boom, alongside a rapidly slowing jobs market, any comprehensive data points (in the absence of official ones) will be closely monitored.

Investor Takeaways From a Shutdown

A US government shutdown is, at its core, a political failure with economic consequences. What begins as a dispute over line-items in the federal budget quickly scales into a nationwide pause, disrupting lives and denting confidence.

The current deadlock demonstrates how fragile the intersection between governance and growth can be when partisan priorities overshadow the actual functioning of everyday government.

Historically, two key observations stand out. First, short-term market volatility during shutdowns tends to be contained, but longer-term credibility concerns can emerge. Second, the absence of reliable data during these periods heightens uncertainty across asset classes, from equities to currencies.

With a stopgap funding deal now in place, attention has shifted to how policymakers will approach the next budget deadline and ongoing fiscal negotiations. Whether via a continuing resolution or a broader fiscal deal, the endgame will shape not just the coming quarter’s growth numbers but global investors’ trust in America’s political institutions.

In a world already jittery about inflation, rates, and geopolitical risk, that trust may prove the economy’s most valuable (and ironically fragile) asset.

References

- “Report estimates shutdown cost economy $11 billion, $3 billion of which won’t be recovered – ABC News”. https://abcnews.go.com/Politics/report-estimates-shutdown-cost-economy-11-billion-billion/story?id=60677289 . Accessed 13 Nov 2025.

- “From Gridlock to Market Moves: Comparing the 2018–19 and 2025 U.S. Shutdowns – Orient Futures”. https://www.orientfutures.com.sg/market-insights-from-gridlock-to-market-moves-comparing-the-2018-19-and-2025-us-shutdowns/ . Accessed 13 Nov 2025.