Wall Street mixed as tech lags, futures up on positive Broadcom

* Dow, S&P 500 mark record closes, Oracle drags on Nasdaq

* Dollar sags as Fed outlook undermines, CHF lifted by SNB

* EUR/USD hits 9-week high on soft US jobs data

* Silver and copper hit more record highs, Gold breaks to the upside

FX: USD headed lower for a second straight day and further below the 100-day SMA at 98.63. The dollar is headed for a third consecutive down week which was last seen in mid-August. It turned out some of the FOMC voting was more hawkish – with two regional Fed presidents opposing the cut and four others seeing a 4% target rate for end-2025. But market focused on QE and Powell’s lack of an explicit push back on future rate cuts, which contrasted with his October stance. Two more rate cuts are still predicted by swaps, and this compares negatively with other central banks where hikes are evident later next year. Jobless claims added pressure with the biggest increase in over four years.

EUR outperformed all its peers apart from JPY and CHF, as it pushed above 1.1750 and up to levels last seen in early October. There is increasing chatter that the ECB and Lagarde could potentially be mildly hawkish in their assessment and latest projections next week at its final meeting of 2025. Yield spreads between Germany and the US suggest more upside in the euro which is currently undervalued.

GBP continued its post-Fed bullish breakout from a continuation pattern. Next Thursday’s meeting sees markets still pricing a 92% chance of a 25bps cut, though the terminal rate has lifted in recent days. Risks lie with the bank’s guidance and tone with some talk of a ‘hawkish cut’ and a push back versus more policy easing in the new year.

JPY outperformed its peers apart from the safe haven CHF. The major fell for a second day though US-Japan yield spreads widened modestly. Markets continue to price in the near certainty of a 25bp BoJ rate hike next week. Industrial production is released today ahead of the Tankan sentiment numbers.

AUD underperformed after jobs data disappointed while the CHF led gains after the SNB policy meeting resulted in no change in rates. The SNB remains willing to be active in the FX market as necessary and slightly revised its 2026 and 2027 inflation projections lower.

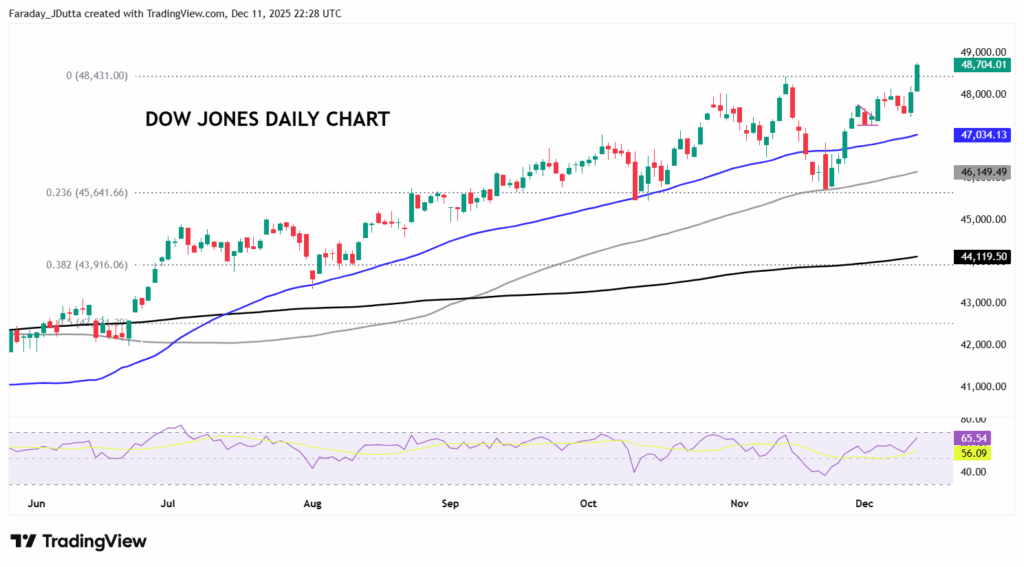

US stocks: The S&P 500 added 0.21%, closing at a record high at 6,901. The Nasdaq moved lower by 0.35% to finish at 25,687. The Dow settled higher by 1.34% at 48,704, a new all-time high. Materials, Financials, Industrials and Health outperformed while Communication Services, Tech and Energy were the only three sectors in the red. The post-Fed rally faded with futures showing indices down over 1%, but those losses eased through the session. Oracle earnings elicited concerns on its data centre build-out and debt after it raised its capex outlook. The stock finished down 10.8% with other AI names negative, Nvidia off 1.6% and Alphabet down 2.27%. Broadcom, the so-called additional member of the ‘Magnificent 8’ with a market cap close to $2 trn, reported after the closing bell. The tech giant forecast upbeat quarterly revenues on AI chip demand. The stock is up over 3% after hours. Visa jumped over 6% on broker upgrades.

Asian stocks: Futures are mixed. APAC stocks were mostly muted ahead of the Fed policy decision while the region also digested the latest Chinese inflation data. The ASX 200 was flat as weakness in tech, industrials, energy, health care and financials was offset by gains in miners, materials and resources. The Nikkei 225 initially rallied above 51,000 on recent currency weakness but then reversed course as yields briefly edged higher on BoJ rate hike risks. The Hang Seng and Shanghai Comp retreated following mixed inflation data. Trade-related issue also lingered, including reports that China is set to limit access to Nvidia’s H200 chips despite export approval from US President Trump, and that chips exported to China will undergo a special security review.

Gold made fresh near 7-week highs, advancing to levels last seen in the violent sell-off in late October. We could be on for a textbook upside breakout of the bullish ascending triangle pattern we highlighted yesterday. The target is of course the record high at $4,380. Silver continued its incredible rally with fresh record highs.

Day Ahead – UK GDP

The October monthly print is expected at 0.1% after the negative previous reading. Q3 growth missed expectations as manufacturing output fell sharply, primarily due to the cyberattack at Jaguar. With that Land Rover plant resuming normal operations after its temporary shutdown, PMIs point to manufacturing bouncing back.

Chart of the Day – Dow breaks to record highs

The Fed decision was slightly overshadowed by the Oracle hit after hours on Thursday. That meant US stock index futures were in the red immediately after the closing bell when ORCL released their earnings. Worries over an AI bubble re-emerged but that points to more broadening out of stocks driving the indices, as the US economy still remains relatively solid, underpinned by monetary policy that is in a ‘good place’. By broadening out, we mean stock rotation and this was clearly seen yesterday and on Wednesday with a clear preference for cyclicals. Value cyclicals especially, like materials, industrials and consumer discretionary were favoured over cyclical growth stocks like the Mag 7. Healthcare too, which has outperformed in recent months could also do so again. This has all helped the Dow to fresh all-time highs, and less so the tech-heavy Nasdaq.