Weekly Outlook | Volatile Markets With Positive Momentum

Equity markets continue to shuffle as investors shift their focus away from tech companies towards other sectors. With pharmaceuticals rising and some chemical companies gaining, in particular the commodity sector shows further gains. This is also being reflected in the AUD, which keeps holding some strength against the Dollar. In comparison the EUR and GBP already weaken against the Greenback. With several news events this week, traders should keep their focus on those data points. Furthermore, the potential implementation of news tariffs by the US administration might shake up markets this week. Negative headlines will likely cause new volatility this week in general.

Important events this week:

– US- Core PCE price index- The Core PCE price index is important for traders, as it will give further insights into the potential development of interest rates in the Unites States. The US Federal Reserve Bank will watch this price index closely to determine whether rates need to be adjusted. The price index has been fairly stable in recent months, showing an increase in pries of about 0.2% on a monthly basis. Yet, a deviation of the number might cause fresh volatility and hence move the Dollar.

EURUSD, weekly chart

The EURUSD currency pair is losing market momentum. The exchange rate has moved lower and the weekly chart above might suggest that prices could fall further. A higher reading of the index might support such view, as the Fed might not be in a hurry to cut rates further, which would then support the Greenback. Currently, the pair remains capped below the technical resistance level of 1.1700. While prices fall, a break below the technical support level of 1.1500 might indicate a bigger slide in the price. The data will be released on Thursday, 22nd January at 14:30 CET.

– JP- interest rate decision- The interest rate decision in Japan is a news event, which usually does not shake up markets a lot. Yet, the JPY is currently trading at interesting levels, potentially indicating a further strength of the Yen against other currencies. Slight hawkish statements from the Bank of Japan might hence underline such view.

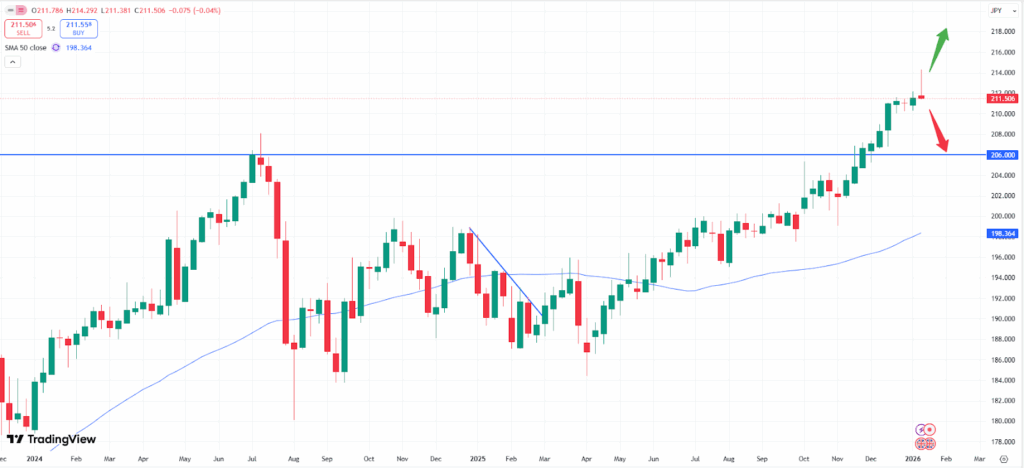

GBPJPY, weekly chart

Based on the weekly chart above the GBPJPY currency pair did not move higher. The USDJPY and EURJPY currency pairs also offer the same insights. The technical pinbar candlestick pattern might now offer fresh downside momentum in this market. Though, this would be against the general trend, corrections like this might still occur and push the market lower for some time. The slide in prices might then intensify if the market trades below the 210.00 zone. As a target the 206.00 could be found, where the market back July 2024 acted as a resistance level, now potentially turning into a support zone. The rate decision will be held on Friday, 23rd January.