The Investors’ Handbook to 2026: How to Survive a Macro Year

2026 has already offered a glimpse of what a full tank of surprises can look like. Geopolitical risk has moved firmly into the driver’s seat, tariff tensions have returned in full force, and the independence of central banks — once largely taken for granted — is increasingly being tested.

In this environment, markets are no longer moving purely on earnings beats or growth narratives. They are responding to power, policy and protection. Against that backdrop, recent market shifts — from a softer dollar to heightened enthusiasm for precious metals — are not noise. They reflect capital adjusting to a more survival-focused investment regime.

1. Don’t fight the flow, respect the macro tide

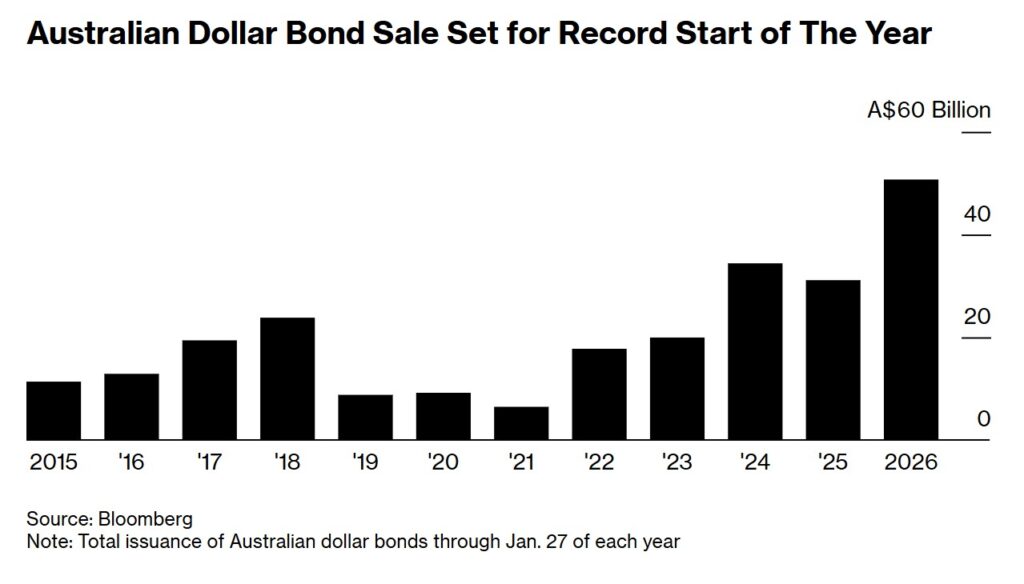

Capital flows rarely lie. Australian dollar bond issuance has surged to record levels early in the year, up more than 60% from a year ago. That partly reflects expectations the RBA may keep policy tighter for longer, but it also signals a broader shift as global investors diversify away from US-dollar exposure toward Australia’s low default risk and relative stability.

When macro risk takes centre stage, capital stops fighting trends and starts following them. Metals, energy, defence and other real assets are not outperforming because they are fashionable, but because they sit closer to sovereignty, security and supply constraints — qualities that matter most as visibility fades.

2. Stretch the horizon — short-term noise, long-term signals

Volatility has a way of shrinking our time horizon. It pulls investors toward reaction rather than positioning — and at its extremes, it can even trigger panic. Yet over long and unstable decades, the investors who tend to do better are those who step back and widen the lens. Long-term positioning does not mean being passive. It means recognising which themes can absorb policy shocks, regional tensions and even regime shifts. For example, structural-driven inflation, de-globalisation and rising debt burdens are not one-year stories. They are forces that play out over multiple cycles.

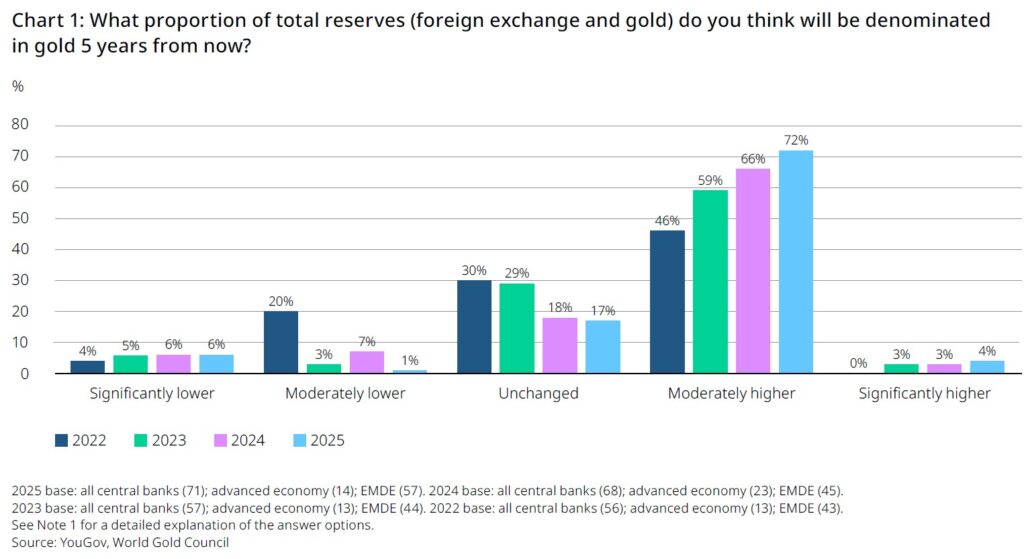

Long-horizon central banks are a good place to look. Over the past decade, they have been consistent net buyers of gold and continue to signal a desire to lift gold’s share in reserves relative to the US dollar — even as prices sit near record highs. Recent central bank surveys show that more than 70% of central banks expect demand for gold reserves to rise further over the next five years.

Central Bank Survey 2025

3. Build a safety nest before chasing upside

Before asking what can outperform, the more relevant question in 2026 is “what can protect”. Building a safety nest is not about fencing capital in; it is about buying time while reducing the pressure to make decisions at the worst possible moments. History shows that investors who make it through periods of dislocation are often the ones who make fewer costly mistakes and are able to wait until conditions eventually stabilise.

That translates into maintaining exposure to assets that tend to hold their value when confidence breaks — cash with yield, gold as monetary insurance, and assets anchored in real demand rather than financial leverage.

4. When the Australian dollar flies to the sky

Those same macro forces do not stop at borders. They increasingly show up through currencies — and for Australian investors, the Australian dollar is where global narratives meet local portfolios.

This week, the AUD climbed to its highest level since early 2023. When it rallies sharply, offshore assets become cheaper in local terms, while exporters and globally exposed companies can face margin pressure. For Australian investors, currency strength is a signal to rebalance, not celebrate — a moment to review global exposure, consider selective hedging, and avoid over-concentration in domestic beta.

Closing thought

2026 is not a year for bold calls. When visibility is limited, time and patience become the most valuable assets investors have. The goal is not to predict every turn, but to stay in the game long enough to navigate it. In a macro regime shaped by power shifts and policy risk, resilience is what ultimately compounds.