- Trading

Trading

-

CFD Trading

What is CFD Trading How to Trade CFD Why Trade CFD CFD Trading Strategies

- All Trading Products

-

Markets

All Instruments Forex CFDs Indices CFD Commodities CFD Stocks CFD ETFs CFD Bonds CFD Cryptocurrency CFDs

- Trading Accounts

- Trading Fees

- Trading Leverage

- Trading Server

- Deposit & Withdrawal

- Premium Services

-

CFD Trading

- Platforms

- Academy

- Analysis

- About

-

AllTradingPlatformsAcademyAnalysisAbout

-

Search query too short. Please enter a full word or phrase.

-

Keywords

- Trading Accounts

- TradingView

- Trading Fees

Popular Search

- Trading Accounts

- MT4

- MT5

- Professional Trading Accounts

- Academy

Forex trading, also known as foreign exchange trading, is one of the most popular financial markets globally. At Vantage, we offer Forex trading via CFDs (Contracts for Difference), allowing you to speculate on currency price movements without owning the underlying assets. This page will highlight the key benefits, compare it to markets like stocks, and introduce free tools and resources to help you get started. Whether you’re a beginner or an experienced trader, this guide will provide valuable insights into why forex trading via CFDs might be a suitable choice for you.

TOP BENEFITS OF FOREX CFD TRADING

Forex CFD trading offers numerous advantages that make it an attractive option for traders worldwide. From high liquidity to flexible trading hours, here are some of the key benefits:

High liquidity

The forex market is the most liquid financial market globally, with a daily trading volume exceeding $7.51 trillion [1]. This high liquidity allows traders to enter and exit positions quickly, even with large trade sizes, without significantly impacting prices. This is beneficial when trading CFDs, as it means tighter spreads and potentially better execution prices. This feature also means that the forex market is less prone to manipulation compared to smaller markets.

Convenience & Accessibility: Forex (FX) markets open 24/5

The forex market runs 24 hours a day, five days a week, allowing traders to join at any time. This flexibility makes it easy to trade, no matter your time zone or schedule. However, liquidity may vary during off-hours or around major economic events.

The market is divided into four major trading sessions: Sydney, Tokyo, London and New York [2]. Here’s a breakdown of the four major forex trading sessions, including their opening and closing times in UTC:

| Trading Session | Opening Time (UTC) | Closing Time (UTC) | Pairs to Trade |

|---|---|---|---|

| Sydney | 22:00 | 07:00 | AUD/USD, AUD/JPY |

| Tokyo | 00:00 | 09:00 | USD/JPY, EUR/JPY |

| London | 08:00 | 17:00 | GBP/USD, EUR/USD |

| New York | 13:00 | 22:00 | USD/CAD, USD/CHF |

The market remains active 24/5, with the highest liquidity occurring during session overlaps, particularly between London and New York (13:00 – 17:00 UTC). This continuous operation means that traders can react to global economic events and news in real-time, providing more opportunities to potentially profit from market movements.

Use of Leverage

Forex CFD trading allows the use of leverage, which enables traders to control larger positions with a smaller amount of capital. leverage can significantly amplify both profits and losses. For example, using 30:1 leverage, a 1% movement in the currency pair results in a 30% gain or loss on your invested capital. It's essential to manage risk and use leverage carefully, as it can magnify losses. Ensure you understand its impact on your trades.

Low trade costs and no commissions

Forex CFD brokers typically charge low spreads (the difference between the bid and ask price) and may charge commissions. This can make forex CFD trading a cost-effective option compared to other markets. However, you may also encounter other fees, such as overnight financing fees (also known as swap fees), which are charged for holding positions overnight. Vantage aims to offer competitive spreads and transparent pricing. Always check the full fee schedule before trading.

Opportunity to profit from rising and falling prices

The Forex market allows traders to potentially profit from both rising and falling prices, offering flexibility in various market conditions. In forex trading, you can potentially profit from both rising (going long) and falling (going short) markets. This flexibility allows traders to potentially capitalise on market movements in any direction. For example, if you believe the Euro will strengthen against the US Dollar, you can go long on the EUR/USD pair. Conversely, if you expect the Euro to weaken, you can go short. This dual opportunity is a significant advantage over the markets where you can only profit from rising price.

When trading Forex through CFDs, you can open long or short positions, allowing you to potentially profit in both market conditions. While you can potentially profit from both rising and falling markets, it's important to note that trading Forex involves substantial risks, including the potential for significant financial loss.

Trade various currency pairs

The forex market offers a wide range of currency pairs, including major, minor and exotic pairs.

- Major pairs like EUR/USD, GBP/USD and USD/JPY are the most traded and offer the highest liquidity.

- Minor pairs, also known as cross-currency pairs, do not include the US Dollar and are less liquid.

- Exotic pairs involve one major currency and one from a developing economy, such as ESD/SEK (US Dollar/Swedish Krona).

Trade a wide range of forex currency pairs including major pairs, minor pairs and exotic pairs with Vantage via Forex CFDs.

FOREX VS STOCKS: WHAT ARE THE DIFFERENCES?

Forex CFD and stock CFD trading are two popular investment options, but they differ significantly in several aspects. Here's a comparison:

Market opening hours

The forex market operates 24 hours a day, five days a week, unlike stock markets, which have fixed trading hours that vary by exchange. Each stock market follows set opening and closing times based on its local time zone. For instance:

| Market | Trading Hours (Local Time) | Trading Hours (EST) |

|---|---|---|

| Forex Market | 24 hours (rotating sessions) | 5:00 PM (Sunday) – 5:00 PM (Friday) |

| New York Stock Exchange (NYSE) | 9:30 AM – 4:00 PM (EST) | 9:30 AM – 4:00 PM (EST) |

| London Stock Exchange (LSE) | 8:00 AM – 4:30 PM (GMT) | 3:00 AM – 11:30 AM (EST) |

| Tokyo Stock Exchange (TSE) | 9:00 AM – 3:00 PM (JST) | 7:00 PM – 1:00 AM (EST) |

| Sydney Stock Exchange (ASX) | 10:00 AM – 4:00 PM (AEST) | 7:00 PM – 1:00 AM (EST) |

While stock traders must operate within these set hours, forex traders benefit from uninterrupted trading opportunities due to the market’s global rotation.

Liquidity

With a daily turnover of $7.51 trillion*Forex is the most liquid market in the world [3]. This high liquidity ensures tighter spreads and more actionable prices. Major currency pairs like EUR/USD and GBP/USD trade around the clock, providing continuous liquidity.

In contrast, stock liquidity varies by company and market conditions—large-cap stocks like Apple are highly liquid, while smaller stocks may have wider spreads and price gaps. Unlike forex, stock trading is also restricted to exchange hours, limiting flexibility.

| Market | Daily Trading Volume (USD) |

|---|---|

| Forex Market | $7.5 trillion |

| New York Stock Exchange (NYSE) | $40 billion |

| Nasdaq | $200 billion |

| London Stock Exchange (LSE) | $8 billion |

| Tokyo Stock Exchange (TSE) | $5 billion |

Table 1: Forex and stock market daily trading volume [4] [5] [6].

Volatility

Forex markets tend to be more volatile than stock markets, offering more opportunities for potential returns but also requiring careful risk management. Currency prices can swing rapidly—such as the USD strengthening after a Fed rate hike or the EUR dropping due to Eurozone instability—creating both opportunities and risks.

While stocks can also experience volatility, especially around earnings reports, major economic data, or geopolitical events, they generally move more steadily compared to forex. Stock prices are influenced by company fundamentals, market sentiment, and broader economic trends, whereas forex pairs react more immediately to macroeconomic factors like interest rate changes and geopolitical tensions.

In 2024, the Federal Reserve initiated its first rate cut after a prolonged tightening cycle, reducing the federal funds rate by 50 basis points in September, followed by two additional 25 basis point cuts in November and December, bringing the rate to a range of 4.25%–4.50% [7]. This monetary easing led to a depreciation of the USD, as investors anticipated looser monetary policy.

Conversely, stock markets experienced gains, with the S&P 500 rising approximately more than 23% in2024, reflecting increased investor optimism due to lower borrowing costs [8]. *Past performance is not indicative of future results.

ACCESS TO FREE RESOURCES TO HELP YOU TRADE

Vantage offers a range of free resources to help traders improve their market know-how and understanding. These include a variety of webinars, trading tools and market analysis. Various trading platforms and social trading functions are also available.

Beginners can opt to open a demo account and practice trading with virtual funds, or can open a live account to start trading. You will have access to real-time charting services and different types of trading accounts, all to suit your start-up capital and needs.

EXPLORE MORE ABOUT FOREX TRADING

-

What is Forex

Learn the basics of Forex trading, including how it works and why it’s a popular market for traders worldwide.

-

How to trade Forex

Discover step-by-step guidance on how to start trading Forex via CFDs, from opening an account to executing your first trade.

-

Forex Trading Strategies

Explore Forex trading strategies via CFDs to help you navigate potential market opportunities while managing risks.

Trade AU Share CFDs On All Trading Platforms

MetaTrader4

- 30 built-in technical indicators

- 31 analytical charting tools

- 9 time-frames

- 4 types of trading orders

MetaTrader5

- 38 built-in technical indicators

- 44 analytical charting tools

- 21 time-frames

- 6 types of trading orders

TradingView

- 15+ chart types

- 100+ in-built indicators

- 50+ drawing tools

- 12 alert conditions

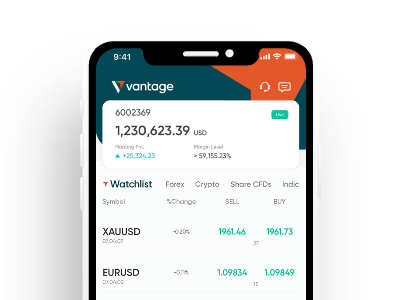

Vantage Mobile App

- 55 deposit methods globally

- 220+ daily product analysis

- 16 TradingView indicators

- 80,000+ copy traders

Choose a Trading Account Based on Your Experience Level

-

1

Beginner Traders

-

2

Experienced Traders

-

3

Professional Traders

High Volume Traders

- For traders looking for low and competitve commission, with only $1 per standard FX lot per side.

-

1

Register

Quick and easy account opening process.

-

2

Fund

Fund your trading account with an extensive choice of deposit methods.

-

3

Trade

Trade with spreads starting as low as 0.0 and gain access to over 1,000+ CFD products.

Frequently Asked Questions (FAQ)

-

1

Does Forex trade on weekends?

No, the forex market is closed on weekends. It operates 24 hours a day from Monday to Friday, following different global trading sessions. -

2

How do Forex CFD brokers generate revenue?

Forex CFD brokers typically earn revenue through spreads, commissions and overnight financing fees. The exact amount varies depending on the broker’s pricing model, market conditions, and trading volume. -

3

Why choose Forex CFDs over other markets?

Forex CFDs offer high liquidity, 24/5 market access, low trading costs and the ability to potentially profit from both rising and falling markets. While trading costs can be competitive, it's important to understand the full fee structure involved. With its large daily trading volume and decentralised nature, the forex market can offer more flexibility compared to smaller or less liquid markets, but it is still subject to market risks and volatility. -

4

What is the best time to trade Forex CFDs?

The best time to trade Forex CFDs is during overlapping market hours, such as the London-New York overlap, when liquidity and volatility are highest. This period generally sees higher liquidity and volatility, which may present more trading opportunities and competitive spreads. -

5

What are the 4 major sessions for Forex trading sessions?

The four major Forex trading sessions are the Sydney, Tokyo, London and New York sessions.

[1] “Forex Daily Trading Volume – BestBrokers.com.”

https://www.bestbrokers.com/forex-trading/forex-daily-trading-volume/. Accessed 6 March 2025.

[2] “The Forex 3-Session System – Investopedia.”

https://www.investopedia.com/articles/forex/08/3-market-system.asp. Accessed 6 March 2025.

[3] “Daily Market Statistics – Nasdaq.”

https://www.nasdaq.com/market-activity/daily-market-statistics. Accessed 6 March 2025.

[4] “Daily U.S Equity Matched Volumes (millions) - NYSE.”

https://www.nyse.com/markets/us-equity-volumes. Accessed 6 March 2025.

[5] “Daily Market Summary – NasdaqTrader.com.”

https://www.nasdaqtrader.com/Trader.aspx?id=DailyMarketSummary. Accessed 6 March 2025.

[6] “Market Data - Daily Average Trading Volume/Value - Japan Exchange Group Corporate Site.”

https://www.jpx.co.jp/english/corporate/investor-relations/financials/value-and-volume/index.html. Accessed 6 March 2025.

[7] “Federal Funds Rate History 1990 to 2025 – Forbes"

https://www.forbes.com/advisor/investing/fed-funds-rate-history/. Accessed 6 March 2025

[8] “It Was a Very Good Year – Charles Schwab”

https://www.schwab.com/learn/story/it-was-very-good-year. Accessed 6 March 2025

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Ensure you understand how CFDs work and whether you can afford to take the high risk of losing your money. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.