When the US Federal Reserve (Fed) trimmed rates by 25 basis points in September, the move itself was no surprise [1]. What caught markets’ attention were the Fed’s projections hinting at possible further cuts in 2025, though Chair Jerome Powell was quick to stress that nothing is guaranteed.

By calling it a “risk-management cut,” Powell underscored that policy remains data-dependent. That leaves markets wondering: is this the cautious start of an easing path, or just a one-off adjustment that could stall if inflation stays sticky?

Here, we’ll explore what more rate cuts could mean for markets – from the Fed’s balancing act between inflation and employment and how past cycles offer clues, through to the potential global ripple effects and what markets should watch most closely as we enter the last quarter of 2025.

Key Points

- The Fed’s September cut signals a cautious easing path, with markets expecting up to two more reductions in 2025.

- Policymakers face a balancing act between supporting a softening labour market and keeping inflation in check.

- Even gradual rate cuts can reshape bond yields, equity valuations, and global capital flows, making credibility crucial.

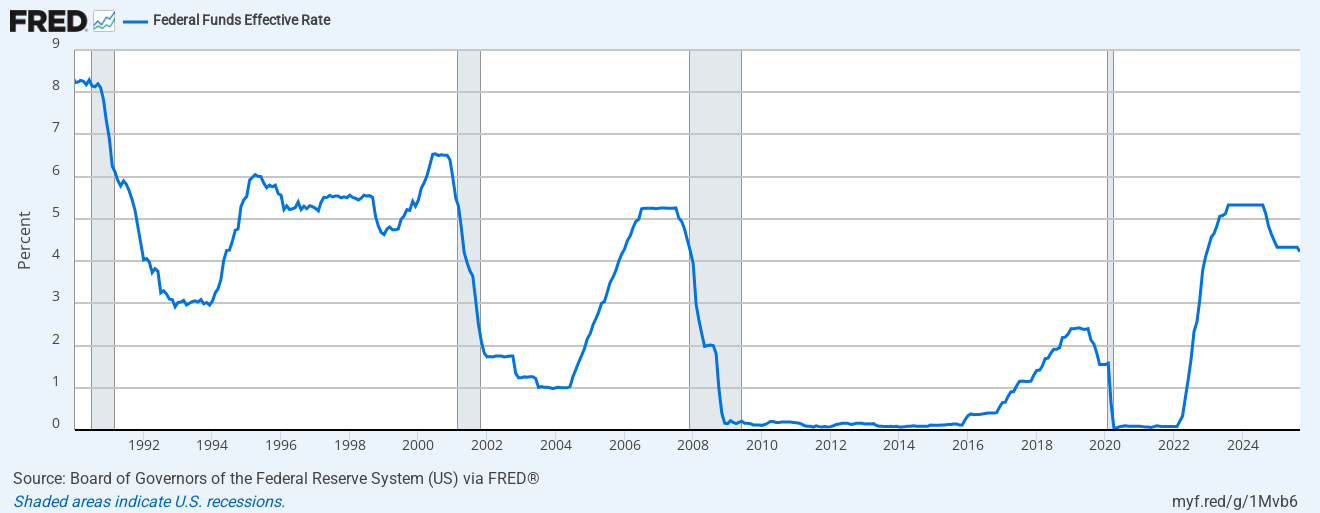

From One Cut to a Cycle

The difference between a one-time trim and a full easing cycle couldn’t be bigger. A single cut can be written off as an adjustment to shifting conditions. But a “rate-cutting cycle”? That changes the calculus across bond markets, equity valuations, and global capital flows.

History offers plenty of examples. In 1995, a well-timed “mid-cycle adjustment” helped stretch the expansion for years. In 2019, Powell’s so-called “insurance cuts” steadied markets amid trade-war jitters.

But in the 1970s, easing too quickly left the Fed scrambling to contain inflation, a misstep that scarred its credibility for well over a decade.

So where are we now? Powell has been clear that the Fed is not on a “preset course.” Even so, markets are leaning toward the idea that September’s move wasn’t the end of the story, but the opening scene of a potential easing path.

To understand why more cuts could follow, we need to look closely at what’s driving the Fed’s shift.

Why the Fed Is Cutting and Where It Might Go From Here?

The September cut wasn’t about declaring victory over inflation. It was about managing risks in an economy that looks increasingly uneven.

The labour market is showing cracks as the unemployment rate has crept up to 4.3%, job growth has slowed to just 22,000 in August, and earlier payroll data was revised sharply lower [2]. Yet inflation, at 2.9% headline and 3.1% core, remains above the Fed’s official 2% target – with tariffs still feeding price pressures [3].

That leaves the Fed in a bind. Powell admitted the labour market is no longer the pillar of strength it once was, but he also stressed policy remains data-dependent. His “risk-management cut” captures the dilemma: ease enough to cushion jobs, but not so much that inflation reignites.

The path ahead is uncertain. Every inflation print and payroll release could tilt the balance between more easing or another pause. To help markets understand that path, the Fed leans on its dot plot; the quarterly collective view from the Fed’s Board of Governors of where rates might go next.

The Dot Plot: Reading the Tea Leaves

The September dot plot chart gave markets their clearest hint of the Fed’s current thinking. Policymakers now expect the policy rate to end 2025 around 3.81%, down from the June projection of 4.06%.

That implies two more quarter-point cuts this year, but no aggressive rate-cutting cycle. Beyond that:

- End-2026: 3.30% (just one more cut projected)

- End-2027: 3.15%

- Long run: ~3.12%

The message is clear: this isn’t a slash-and-burn approach. It’s a gradual glidepath designed to ease financing stress without fueling fresh inflation. Think of it as “insurance easing” — cautious, deliberate, and always subject to the next data release or, in other words, wholly “data-dependent”.

Why it matters?

For markets, even a shallow easing path has bite if it:

- Removes the ceiling on front-end rates

- Eases deposit-rate pressure in banks

- Supports long-duration assets, provided long yields don’t stay sticky, and

- Nudges policy from “restrictive” toward “less restrictive,” lowering debt-service costs before labour damage compounds

The Fed’s Balancing Act With Politics and Credibility

Powell’s current playbook is one of controlled deceleration: cut just enough to support a softening labour market, but leaving wriggle room to pause if inflation rears its ugly head again.

His warning about “two-sided risks and no risk-free path” captures the dilemma. The mistake he’s determined to avoid is a repeat of 2022, (i.e., being late to inflation back then and then late again to labour softness now).

Yet the Fed’s challenge goes beyond economics. It must also guard its credibility and independence. September’s 11–1 decision revealed dissent, with Stephen Miran calling for a deeper 50bp cut, raising questions about just how unified the committee really is [4].

That matters because markets don’t just trade on the Fed’s policy moves. They also trade on the perception that those moves are made free from political influence. With tariffs pushing inflation higher, mid-term elections on the horizon, and legal challenges swirling, Powell must show that rate decisions are driven by data and not politics.

A cautious easing path reflects this balancing act. By pairing gradual cuts with continued balance-sheet runoff, the Fed signals that it won’t abandon discipline. The underlying message: soften the front end of rates without letting markets believe the inflation fight is over.

For markets, credibility is the real currency. Forward guidance works only if markets trust the Fed to act independently and consistently. The 1970s remains the cautionary tale, when political pressure blurred policy, credibility crumbled, and inflation expectations ran loose.

Back then, it took a new Fed Chair (Paul Volcker) to raise the Fed Funds rate to close to 20% to eventually crush inflation. Powell knows that confidence in the central bank is far more precious than the temporary high gained from a quarter-point cut.

Markets Get Ahead of the Fed

There’s always a gap between what the Fed says and what markets expect. Powell called September’s move a “risk-management cut” and emphasised its data-dependence.

Markets, however, are already leaning into a possible easing path.

- Equities surged, with the S&P 500 Index and Nasdaq Index touching record highs after the dot plot pointed to more cuts ahead. But the rally proved cautious. Intraday pullbacks highlighted ongoing market uncertainty about whether a full easing cycle is in play. This aligns with Powell’s messaging: rates remain high, inflation risks persist, and tariff pass-through could complicate the path to lower policy rates.

- Treasury yields rose in both the short and long ends. Short yields dropped slightly on easing hopes, then rebounded as inflation concerns and Powell’s cautious tone kicked in. Longer yields seem to reflect inflation risk and shifting real rate expectations.

- Futures markets are now pricing in high odds of two more cuts by year-end. But much of that optimism may already be baked into prices. Some market participants caution that expectations could be running ahead of reality, especially if inflation proves sticky and forces the Fed to slow its pace.

The upshot? Markets are front-running the Fed’s potential easing path. In 2019, markets initially reacted positively, though external shocks later dominated.

But if the path diverges, whether through an inflation flare-up, a surprise in the labour market, or an external shock, disappointment and volatility could follow quickly.

The Double-Edged Sword of Easier Money

Rate cuts are never a one-way street. On one side, easier money often loosens credit conditions. Companies can refinance more cheaply, households may access lower borrowing costs, and market participants sometimes take on more risk.

A softer dollar can also give US exporters a tailwind while supporting commodity prices, from oil to industrial metals. But the other edge of the sword is sharper. If inflation proves sticky, whether from tariffs, energy shocks, or supply chain frictions, the Fed could find itself in a stop-and-go cycle, cutting only to reverse course.

That kind of policy whiplash undermines confidence. Just as damaging is the credibility risk: after years of insisting on “higher for longer” to beat inflation, a sudden pivot back to easing risks sending a signal to the market that policymakers blinked too soon.

Global Ripples of a Softer Fed

The Fed doesn’t just set policy for the US; given the importance of the US dollar it sets the rhythm for global capital flows.

- Capital flows: A softer Fed often triggers inflows into Asia and emerging markets, where yields look more attractive once US rates edge down

- Other central banks: Dollar-linked economies, such as Gulf states, have already followed suit by trimming their own rates. Others may be forced to act if their currencies strengthen too much

- Commodities and trade: A weaker dollar typically supports commodity demand, benefitting exporters from Latin America to Southeast Asia

But here, perception matters as much as policy. If global markets frame US rate cuts as “insurance” against a soft patch, optimism can grow. If they interpret them as a response to deeper trouble, risk aversion can quickly set in.

Lessons From Past Cycles

As the saying goes, “History doesn’t repeat, but it does rhyme”. Here’s a quick look at some past rate-cutting incidents.

- 1995: A modest mid-cycle adjustment extended the expansion, stocks rallied, and inflation stayed tame – in other words it was often described as the textbook ‘soft landing’ central bankers aim for.

- 2001: Aggressive cuts after the dot-com bust cushioned the blow but recession hit anyway

- 2019: Insurance cuts calmed nerves and lifted markets amid an unfolding trade war between the US and China, only to be overwhelmed by the pandemic

The takeaway? Cuts can extend expansions, soften downturns, or backfire if mistimed. The outcome depends on the context, inflation trends, labour market health, and external shocks.

Beyond 2025: The Road Splits

Looking past this year, three broad scenarios dominate the debate:

- Soft landing: Modest cuts stabilise growth, inflation cools gradually, and the expansion extends into 2026.

- Stagflation risk: Growth slows, unemployment rises, and inflation proves sticky, leaving the Fed trapped between mandates.

- Re-tightening: If easing overshoots and inflation re-accelerates, the Fed could be forced to hike again in 2026, which is a painful but plausible outcome.

Markets tend to respond positively when policy paths appear stable, but history suggests bumps, detours, and even U-turns are more likely.

What Markets Should Really Watch

For market observers, the key isn’t the next FOMC meeting. It’s to understand how cycles ripple through fundamentals:

- Which sectors do analysts often consider as benefiting most from cheaper funding costs?

- Which types of companies have historically shown steady earnings even when growth slows?

- Who typically gains from a softer dollar and stronger global trade flows?

These are the types of questions market participants often consider. Interest rates shape the playing field, but resilience, balance sheets, and earnings durability decide who end up winning.

Where to From Here for Rates?

The September cut was important, but it was the signal of more to come that truly changed the conversation. The Fed is trying to walk a fine line: cut enough to protect jobs, but not so much that inflation makes a comeback.

If history is any guide, the outcome depends less on the Fed’s intent and more on the data that comes next.

Every inflation print, every payroll number, and every wage report will shape the path ahead for rates. For markets, that means less focus on the most recent 25bp cut, and more on the economic story unfolding into 2026.

Disclaimer: The information is provided for educational purposes only and doesn’t take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Reference

- “Fed lowers interest rates, signals more cuts ahead; Miran dissents – Reuters”. https://www.reuters.com/business/fed-lowers-interest-rates-signals-more-cuts-ahead-miran-dissents-2025-09-17/ . Accessed 22 Sept 2025.

- “Job growth stalls: US economy added just 22,000 jobs in August and unemployment rose to highest level since 2021 – CNN Business”. https://edition.cnn.com/2025/09/05/economy/us-jobs-report-august-final . Accessed 22 Sept 2025.

- “Consumer prices rose at annual rate of 2.9% in August, as weekly jobless claims jump – CNBC”. https://www.cnbc.com/2025/09/11/consumer-prices-rose-at-annual-rate-of-2point9percent-in-august-as-weekly-jobless-claims-jump.html . Accessed 22 Sept 2025.

- “Fed’s Miran defends call for steep rate cuts, says Trump didn’t direct his vote – Reuters”. https://www.reuters.com/business/feds-kashkari-sees-two-more-rate-cuts-this-year-likely-appropriate-given-labor-2025-09-19/ . Accessed 22 Sept 2025.