Tech hit again on hawkish Fedspeak and China tech updates

* Wall Street dives with steep losses in AI and tech megacaps

* Dollar drops as government reopens after record shutdown

* US October employment report will not include jobless rate

* Markets see a 50:50 bet on FOMC 25bps December rate cut

FX: USD fell the most in a week as the index broke down through trend line support from September. With economic data releases potentially flowing form next week, investors are increasingly nervous about softer figures. September NFP data could emerge in the next few days and currently, November NFP is due on December 5th, just ahead of the FOMC decision on the 10th. The BLS will update its release schedule once it is fully back at work with some October reports skipped entirely. A growing number of Fed officials are also pushing back against a December rate cut citing worries about inflation and relative stability in the labour market. That decision is now seen by markets as a coin flip.

open interest on bullish Treasury options has increased significantly in the last few days, suggesting the prevailing call is soft US data prompting dovish Fed repricing. And there is still only 15bps of rate cuts priced in for the December Fed meeting so more room to go.

EUR pushed higher close to the 50-day SMA at 1.1659 with broad based dollar weakness dominating. There was little fresh talk from ECB officials with interest rate differentials continuing to help the euro.

GBP was a mid-performer with pound helped by broader sentiment. Q3 GDP data was disappointing along with deeply negative industrial production. That all adds to the depressing picture being painted by many about the November Budget. The 200-day SMA sits at 1.3279.

JPY printed an inside day as prices in the major closed below 155 for a second day. The yen has assumed increasing importance as a haven currency again. There is still some focus on new PM Takaichi’s efforts at influencing the BoJ policy outlook. Japan’s MoF continues to send warning signs that yen price action is entering FX intervention territory, but even if intervening is the plan, there is an argument for the MoF to wait until US data releases resume.

US stocks: The S&P 500 lost 1.64%, closing at 6,739. The Nasdaq moved lower by 2.05% to settle at 254,993. The Dow Jones finished at 47,457, down 1.65% on the day. All but two sectors were negative with only Energy in the green and Consumer Staples unchanged. Consumer Discretionary and Technology lagged, both down by more than 2.3%. Big tech names led the losses, seemingly driven by concerns over the US position in the AI race against China after a slew of positive commentary from China tech companies overnight. The reining in of Fed rate cut bets continued too, putting a downer on bulls looking for easier policy. December market expectations have gone from a near certainty one month ago to 50% now. Nivida, Palantir, Oracle and Broadcom led the tech losses while Disney plunged 7.8% on revenue misses but an earnings beat.

Asian stocks: Futures are mixed. Stocks were mixed too with markets digesting the US government shutdown. The ASX 200 was muted amid tech and real estate underperformance but better jobs data. The Nikkei 225 was choppy around earnings. The Hang Seng and Shanghai Composite were mixed with weakness in tech offset by pharma strength.

Gold made fresh three-week highs before paring gains and closing lower. Higher Treasury yields and less Fed rate cuts hurt bugs.

Day Ahead – China data

China will release the monthly batch of data for retail sales, industrial production and indicators for the housing market. Consensus expect to see a continued picture of a two-speed economy with robust manufacturing, partly driven by strong exports, while retail sales and housing data will likely continue to show weak domestic demand.

Retail sales are seen easing to 2.6% y/y as the impact of the trade-in policy gradually fades. Soft confidence is set to keep investment subdued, though industrial production is expected to continue to outperform.

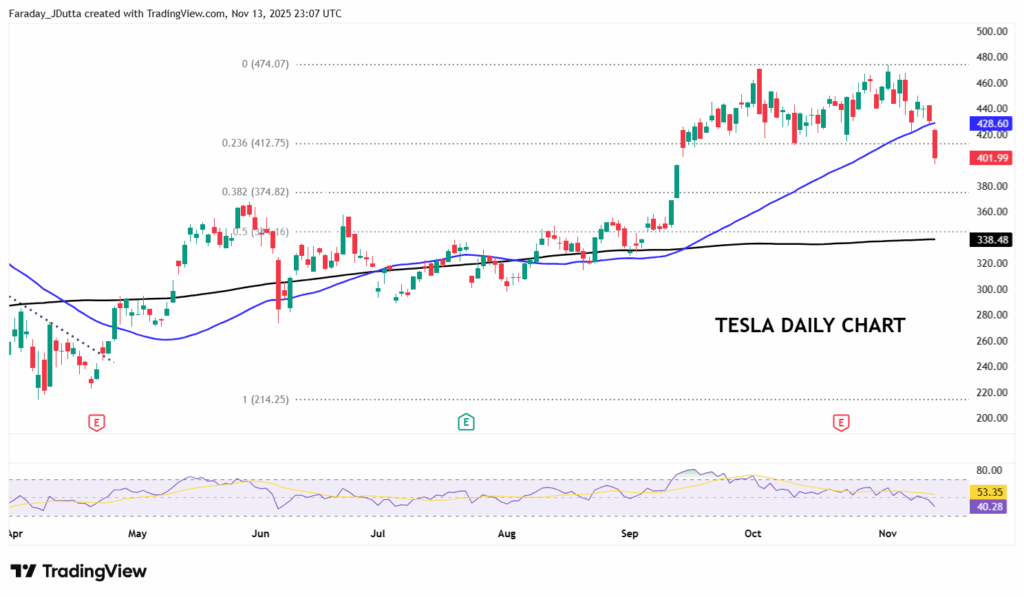

Chart of the Day – Tesla breaks down

Tesla suffered its biggest one-day percentage drop since July 24, the session after the company reported Q2 earnings and CEO Elon Musk mentioned to investors nine times that future quarters would be ‘rough’. The stock is now down nearly 10% in the last three sessions, and -0.5% on the year making it the only Mag 7 in the red. There’s been various negative news stories in recent days including the leaders of the Cybertruck, Model 3 and Model Y programs all leaving. A recall of a battery unit after complaints very recently dampened the mood, with more broadly disappointing China sales numbers in focus. Major bull Cathie Wood also trimmed her ARK holding. Prices have broken down through the 50-day SMA at $428.60. The last time they did this decisively was in late January when the stock fell below $225. The next major Fib level (38.2%) of the April to November high is at $374.82.