Precious metal plunge amid quiet markets

* Wall Street lower as tech sees selling continue

* USD little changed as yen outperformed on BoJ minutes

* Gold and silver plunge, copper down too on profit taking

FX: USD posted a doji candle in quiet trade. The recent low sits at 97.74. Geopolitics were a focus with talks between President Trump and Zelensky and hopes of a peace deal. As usual at this time of year, volumes are light and liquidity is thin.

EUR printed a doji as the world’s most popular major traded marginally lower for a third straight day. Last week’s spike high sits at 1.1804. News was very light with volumes low amid the holiday season.

GBP traded modestly in the green as cable consolidated in bullish fashion just below the October 1st top at 1.3527. Momentum for more upside looks good.

JPY outperformed in quiet trade with prices just above 156. A minor Fib level of this year’s high to low move sits at 154.81 with the 50-day SMA at 154.94. The minutes of the recent BoJ meeting showed that some officials signalled Japan’s real interest rate remains very low, pointing to further rate hikes.

US stocks: The S&P 500 lost 0.35%, closing at 6,905. The Nasdaq moved lower by 0.46% to finish at 25,525. The Dow settled lower by 0.51% at 48,461. Tech led the laggards with Nvidia losing 1.2% and Tesla down over 3.2%. Palantir and Oracle also underperformed as elevated valuations and heavy capex by software and data centre firms continued to struggle. Energy stocks outperformed as crude moved higher by 1.2%, after the US blockade of Venezuelan tankers.

Asian stocks: Futures are mixed. APAC stocks were mixed amid thin year-end trade. The ASX 200 saw financials and healthcare underperform while miners helped limit the downside, leaving the index still not far off its recent highs. The Nikkei 225 slipped as a stronger yen weighed, while a sharper-than-expected drop in China’s industrial profits knocked Hong Kong lower amid China-Taiwan tensions.

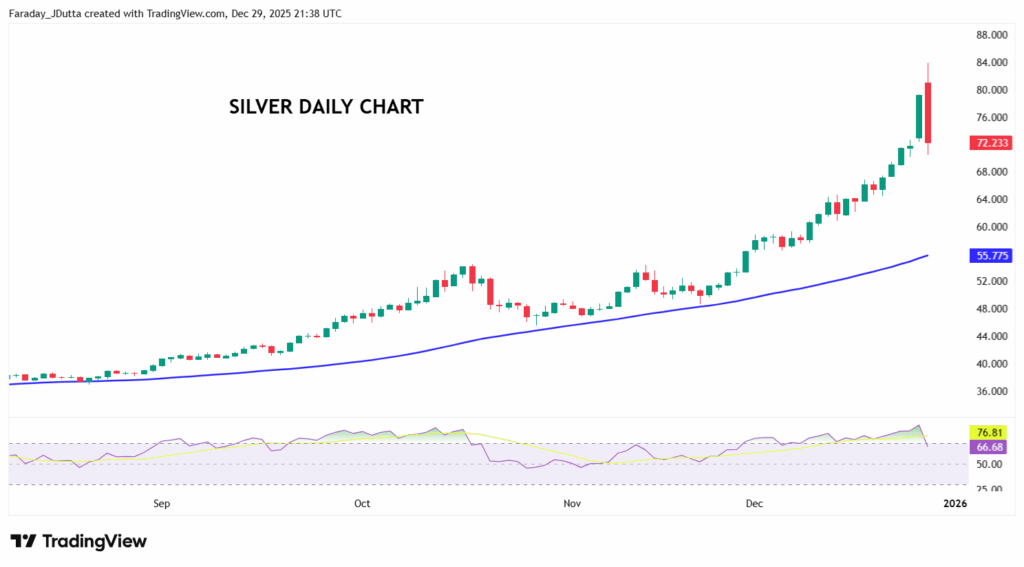

Gold posted a fresh all-time top at $4,550 before succumbing to strong selling and profit taking. That took bullion down below the previous October peak at $4,380. Other metals also took a hit after some major upside moves in silver and copper. The former fell 10% at one point having gained 10% on Friday on China news.

Day Ahead – FOMC Minutes

The Fed cut rates by 25bps in December as expected, but the vote wasn’t unanimous (9–3), showing clear internal debate. An unusually divided committee saw some officials prefer no cut, while one pushed for a larger 50bps move. The dot plot also hinted that several non-voters would have held rates steady.

The minutes should highlight these mixed views, though Powell said there was broad support overall. A key focus will be updated guidance pointing to a slower pace of future cuts. Powell remains more worried about jobs than inflation and stressed caution going forward when reading economic data. There’s just over two more 25bps rate cuts priced in by money markets for 2026, matching the central projection of 50bps.

Chart of the Day – Silver’s parabolic move over…

Precious metals have been a tear with broader demand supported by central buying and more recently by momentum chasing hedge funds and retail investors. For example, platinum recently reached a record high over $2,300 per ounce due to tight supply and strong demand, marking the tenth straight session of gains and a 150% increase this year, the largest since at least 1987. Silver too has enjoyed similarly stellar gains in 2025 – a hybrid trade which acts as both a precious metal and industrial input. It can also leverage on gold rallies but with higher volatility. Solar and electronics demand supports the long-term bull case. But recent parabolic price action and a bearish engulfing candle yesterday warn of a pullback and correction.