Oil fades gains as geopolitical concerns could ease

* Supreme Court issues no ruling on Trump’s tariffs, due next week

* Gold and silver post more record highs(!). silver +30% y-t-d(!)

* Buying Greenland could cost as much as $700bn

* More mixed banking results as Citigroup profit slips, Wells Frago misses

FX: USD was little changed as it consolidated just below recent highs but above the 50-day and 200-day SMAs at 99.80 and 98.79 respectively. November retail sales topped estimates, while the US PPI was mixed across October and November. Fedspeak was mixed with one voter voicing economic uncertainty and another believing modest rate cuts are likely appropriate later this year if forecasts are met. Geopolitical risk eased mildly late in the day after President trump said he had been told killing in Iran is stopping.

EUR traded in a narrow range around 50-day SMA at 1.164, printing an inside day. Fundamental data releases have been limited and comments from the ECB have reintroduced a slightly more neutral bias. Greenland talks have not had a major impact on the single currency as they are expected to see a friendly compromise.

GBP moved on the quieter broader risk sentiment as it steadied above 1.34. The 200-day SMA sits at 1.3392.

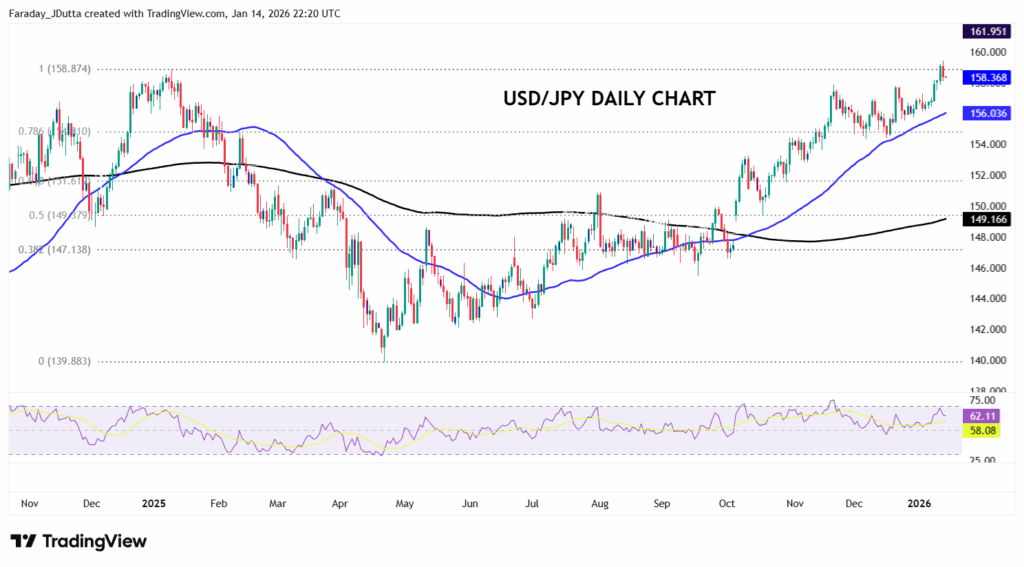

JPY outperformed as the major printed a fresh cycle high before falling back below the prior top at 158.87. See below for more details.

US stocks: The S&P 500 lost 0.53%, closing at 6,927. The Nasdaq moved lower by 1.07% to finish at 25,466. The Dow settled lower by 0.09% to close at 49,150. Energy again led the winners though crude came off its highs after touching the 200-day SMA in Brent at $62.35. Consumer Discretionary (-1.75%) and Tech (-1.45%) led the laggards. Megacap tech stocks all fell, leading indices lower, with the Nasdaq underperforming, while the Russell and Equal Weight S&P closed green. Big bank earnings generally disappointed again after JP Morgan’s results on Tuesday. Citigroup said the credit card cap would have a detrimental impact on the economy and restrict access to credit. The CEO warned of more job cuts and the stock fell 3.3%. Wells Fargo missed on the top and bottom line as the stock dropped 4.6% while Bank of America slid 3.8% as EPS and revenue beat.

Asian stocks: Futures are mixed. APAC stocks were mostly in the green again. The ASX 200 moved higher initially before Financials lagged and dragged on the main index due to JP Morgan’s disappointing earnings. The Nikkei 225 surged for a third straight day to more record highs on the ‘Takaichi’ trade after the call for a snap election. The Hang Seng and Shanghai Comp were both bid again on broad positive risk sentiment.

Gold made another new high intraday at $4,641 before closing mildly off the peak. Several ongoing drivers are responsible for this new year surge, including safe haven buying amid US-Iran tensions, Fed independence uncertainty and fiscal worries. Underlying central bank buying is also helping bullion and silver, which broke $90.

Day Ahead – UK GDP

Output in the UK is expected to rebound after October’s fall, but bigger picture, there’s been a slowdown in UK growth through the second half of 2025. A lot of that is likely due to November budget-related uncertainty hitting already fragile consumer confidence and putting off big investment and spending decisions. However, it also fits a broader trend where every year since 2022, the GDP data has been much stronger in the first half of the year than the second, hinting at seasonal adjustment problems in the data.

BoE rate expectations are relatively steady following their recent pullback with money markets still pricing at least one quarter point cut by June and nearly 50bps by year-end.

Chart of the Day – USD/JPY pulls back from one-year highs

The yen outperformed its peers yesterday after being down and lagging over the last month. We mentioned earlier in the week about the renewed ‘Takaichi’ trade and snap elections have now been called, potentially meaning more fiscal stimulus and a delay in another Boj rate hike. But implementation of these policies might still be tricky if a potential majority is nullified, with reports of a new party forming. There was the inevitable jawboning from MoF officials saying ‘nothing is excluded’ in relation with FX moves. For reference, in July 2024, Japan let the pair rise above 160 and only intervened when it nearly touched 162. That intervention saw an initial decline of 1.8% but unilateral intervention is rarely successful. A fresh cycle high printed at 159.45 yesterday before the mild correction, just above the 158.87 high from January last year.