If the last two years were the Artificial Intelligence (AI) land-grab, Nvidia Corporation’s (NASDAQ: NVDA) latest earnings were the ranger’s whistle reminding everyone there’s a speed limit.

The company smashed records again, with $46.7 billion in quarterly revenue alongside fat margins, yet the stock wobbled as investors digested an outlook that, while strong, hinted at growth normalising from “absurd” to merely “incredible” [1].

That tension is exactly why this print matters: Nvidia isn’t just another company reporting numbers; it’s the barometer for the entire AI infrastructure build-out and is now the closest thing markets have to an AI GDP proxy.

If hyperscalers, AI-native startups, and sovereign projects are still writing big checks for compute, it shows up in Nvidia’s backlog, guidance, and commentary. If they hesitate, it shows up there first, too.

On the earnings call, management framed AI as a once-in-a-century infrastructure wave, pointing to hyperscaler capex that has doubled to roughly $600 billion annually and a potential $3 to $4 trillion AI infrastructure build-out by decade’s end [2].

That’s the top-down context for every bottom-up debate on growth durability, margins, and valuation. That’s the big picture. Let’s take a look at how it showed up in Nvidia’s latest results, and what they reveal about the three big questions investors can’t ignore: demand, infrastructure, and geopolitics.

Key Points

- Nvidia delivered another record quarter with $46.7 billion in revenue, strong margins, and robust demand led by its Blackwell platform.

- Investors adjusted expectations as growth, while still extraordinary, showed signs of normalising and China shipments remained uncertain.

- Nvidia’s results continue to serve as a global barometer for AI demand, infrastructure build-out, and sector-wide market sentiment.

Record Quarter Anchored by Blackwell But Tamed by Realism

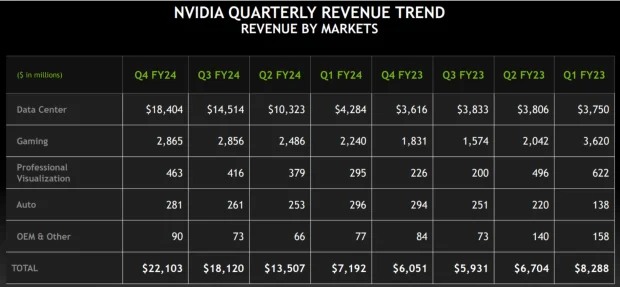

Nvidia delivered revenue of $46.7 billion, up 56% year-on-year and 6% sequentially, and guided for Q3 FY2026 sales of $54 billion, which is roughly in line with where Wall Street expectations had settled by the print. Profitability stayed extremely robust, with a non-GAAP gross margin of around 72.7% (GAAP ~72.4%).

The Data Centre segment remained the workhorse, while Networking reached $7.3 billion. Gaming came in at $4.3 billion and Automotive at $586 million. To cap it off, management announced a new $60 billion share buyback authorisation on top of existing capacity.

What Did Investors Not Like?

Despite beating on revenue & earnings per share (EPS) targets and guiding for Q3 FY2026 sequential revenue growth of $7 billion, shares slipped about 4% in after-hours trading on Wednesday (27 August) [3].

Market concerns focused on two things: a data-centre unit performance slightly below some bulls’ loftier expectations, and the absence of H20 AI chip shipments to China in both Q2 FY2026 and forward guidance.

In short, growth is spectacular but investors are adjusting their lens from “hyper-compounding” to “high-compounding.” If Nvidia is the AI GDP proxy, the rate-of-change blinked this quarter. And that’s exactly what this earnings call signaled: still extraordinary, just not hyperbolic.

3 Big Themes: Demand, Infrastructure & Geopolitics

1. AI Demand: Still Accelerating, Just Smarter

AI spending is still growing fast, but the focus is shifting from “build the biggest model at any price” to “run lots of AI cheaply.” Nvidia’s new Blackwell systems are built for that.

Think of them as AI cars with much better mileage: they deliver more answers for the same electricity and hardware, thanks to smarter chips, faster connections inside the cabinet, and software that squeezes more work out of every watt.

Independent tests also show Blackwell’s performance lead is real, not just marketing. The recent DeepSeek phenomenon showed how much investor sentiment can swing when AI gets dramatically cheaper: its reasoning model rattled markets on fears that efficient AI would mean fewer chips sold.

But history suggests the opposite: when the “price per answer” falls, usage usually explodes as companies find more ways to deploy AI. Platforms that lower the cost per AI answer may see increased adoption, though outcomes can vary. Ultimately, that’s what keeps demand compounding even if budgets don’t.

2. Supply-Side Realities: Power, Cabinets & Speed Limits

It’s no longer about fabs; it’s about feeding AI factories: laptops are easy, but training clusters need megawatts and low-latency fabrics everywhere.

We’re no longer asking “can the factories make enough chips?” The harder part now is building enough AI cabinets and plugging them into big power lines.

Nvidia is shipping a lot of full cabinets each week and ramping output, but data centres still run into limits like “how many megawatts can the site support?” and “is the network fast enough between cabinets?”

3. China & Geopolitics: Big Market, Choppy Waters

Nvidia’s China opportunity is massive. CEO Jensen Huang pegs it at around $50 billion in 2025, growing at around 50% annually. But this quarter, no H20 chips were shipped to China. Instead [4]:

- Around $180 million in previously-reserved inventory was sold outside China.

- Nvidia expects $2 to $5 billion in H20 revenue in Q3, if US export licenses continue, but excluded it from guidance.

- Some licenses have been granted, and Nvidia has agreed to pay 15% of H20 revenue to the US government–a potential headwind to margin.

- China has urged firms not to buy Nvidia H20 chips, and domestic alternatives are advancing.

That uncertainty, rather than a demand collapse, is what spooked markets post-earnings. But analysts emphasise this remains optional upside, not a structural drag, and it sits as a future catalyst once visibility improves.

Why This Quarter Matters Even More Than It Seems

Nvidia’s quarterly results act as a barometer for the AI economy, shaping sentiment across markets and industries. This quarter stands out for what it reveals about demand strength, valuations, and the sector’s next phase of growth.

1. Nvidia as the AI Economy’s Pulse Check

Every three months, Nvidia doesn’t just report earnings. It effectively takes the temperature of the global AI build-out.

With hyperscalers and enterprises spending hundreds of billions of dollars on infrastructure, Nvidia’s backlog and guidance are the earliest and clearest signals of whether that spending is accelerating, plateauing, or facing roadblocks.

This quarter indicates strong demand, although growth has moderated compared with previous periods.

2. Valuation Meets Reality

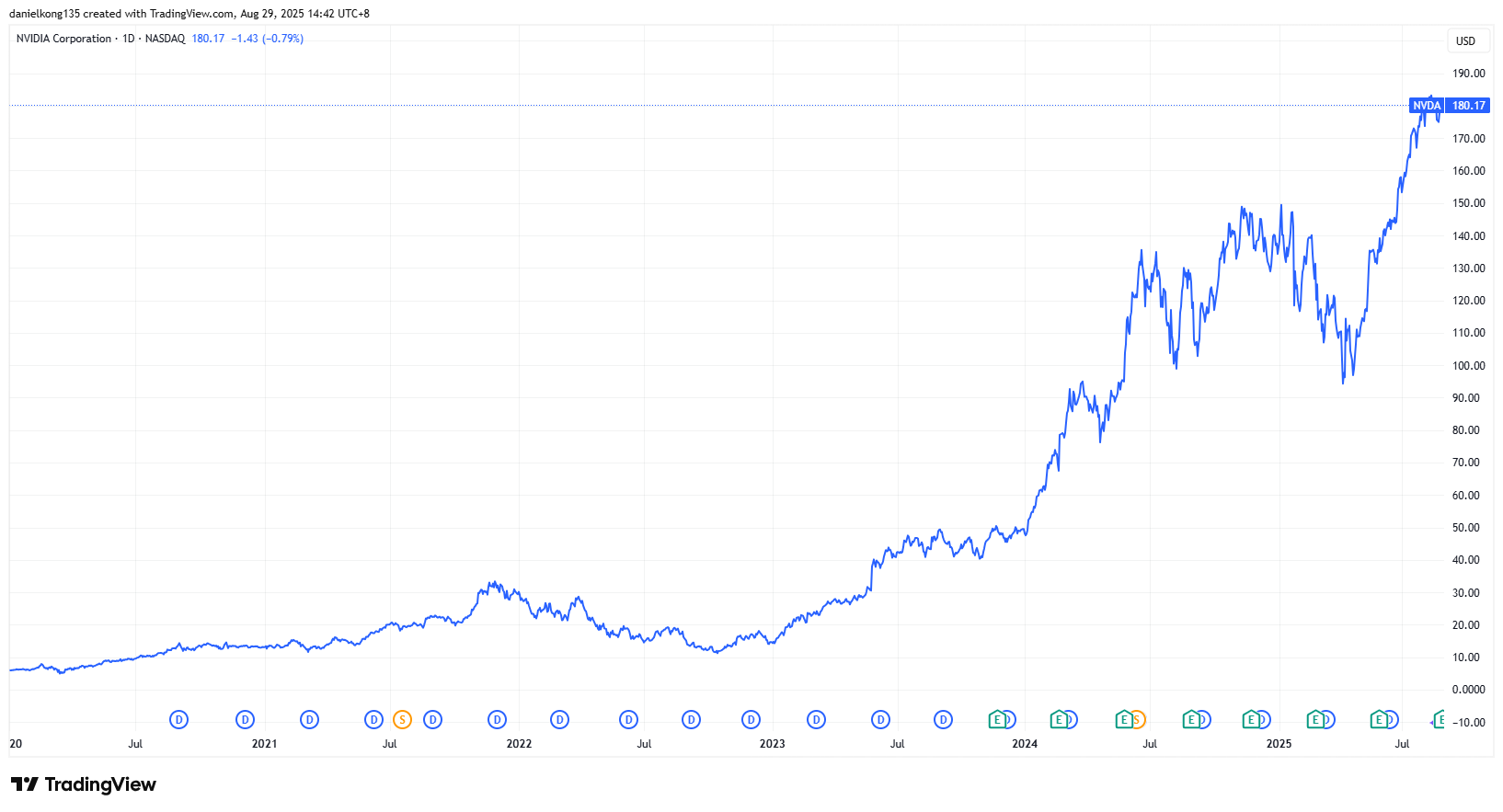

At a market value north of $4 trillion, Nvidia is already in rarefied air. Over the past five years, its stock has increased significantly over the past five years, reflecting market interest in AI infrastructure.

With its recent closing price of $180.12 on 28 August, shares trade at a trailing price-to-earnings (PE) ratio of about 60 and a forward multiple near 43, lofty by any standard.

Those kinds of valuations mean that Wall Street isn’t just looking for strong results; it’s looking for flawless ones. And that’s why the stock slipped even after another record quarter.

When expectations are sky-high, sometimes even “incredible” doesn’t feel good enough. Volatility is a notable characteristic of Nvidia’s stock given its market position.

3. Sector Leadership That Moves the Market

Nvidia’s report isn’t just about one company. Its results set the tone for chipmakers like AMD and Broadcom, for memory suppliers like Micron, for hyperscalers like Microsoft and Amazon, and even for software startups building on AI.

When Nvidia talks about demand breadth or cost-per-token improvements, it ripples across the ecosystem. This quarter’s message was that AI spending is alive and well, but maturing, and it will shape how the entire sector trades.

4. Geopolitics Still Loom Large

China remains the wild card. No H20 shipments were included in this quarter’s numbers, and none are in guidance, yet management noted $2–$5 billion of potential upside if licenses clear. Add in the unusual wrinkle of paying 15% of H20 revenue to the US government, and you’ve got a geopolitical subplot that investors simply can’t ignore.

The key takeaway? China isn’t a demand problem, it’s a visibility problem—and that can swing sentiment sharply quarter to quarter.

5. Capital Flows Follow the Bellwether

Nvidia’s guidance doesn’t just steer Wall Street models. It influences how much capital flows into AI more broadly.

Venture funds, corporate CFOs, and even sovereign projects watch Nvidia’s results to decide whether to greenlight new projects or trim ambitions. A steady growth outlook, even with some moderation, reassures investors that the AI super-cycle is far from over.

Catalysts & What To Watch Next

Short-term triggers

- MLPerf Inference results (September): MLPerf is the industry’s gold-standard benchmark for AI chips. Think of it as the “SATs” for processors. It measures how well chips handle real-world AI tasks like image recognition and natural language processing. Strong Blackwell results would confirm that Nvidia’s performance lead is real, not just marketing.

- GTC Conference (October 28): Nvidia’s annual GPU Technology Conference is its version of Apple’s iPhone launch event. CEO Jensen Huang uses it to unveil new chips, software updates, and roadmaps. Past GTCs have introduced game-changing products like the H100. This year, investors should watch for announcements around software, robotics, and edge AI.

- Q3 FY2026 earnings (mid-November): This will be the real scorecard for how quickly Blackwell Ultra systems are ramping, whether Spectrum-X networking is being adopted, and if China contributes any revenue after being absent this quarter.

Data Points to Track Each Quarter

- Breadth of demand: Is AI spending still dominated by hyperscalers, or is it spreading to enterprises, sovereign projects, and robotics? Broader adoption means stronger staying power.

- Unit economics: Are customers getting more AI output for every watt of power and every dollar spent? Independent benchmarks will help confirm whether Nvidia is delivering those efficiency gains.

- China resolution: Any regulatory clarity or new product variants that make it into China could unlock billions in upside revenue. For now, it’s best to treat this as a bonus rather than the base case.

Broader Market Implications: Nvidia as Sector Thermometer

- Cloud & AI Infrastructure

Nvidia’s results may influence activity and investment decisions in the cloud computing sector. If Amazon, Microsoft, and Google keep spending big on data centres, that’s good news for the companies supplying the plumbing. Think high-speed networking (like Arista), power upgrades, AI-friendly storage, and even the real estate players building campuses designed for AI.

- Semiconductor Peers

Here’s the ripple effect: when Nvidia moves, the rest of the chip world feels it. If Nvidia’s outlook cools, stocks like AMD, Intel, or TSMC-linked packaging companies often wobble too. But the bigger picture is still positive. AI infrastructure is growing fast, and plenty of chipmakers stand to benefit from the rising tide.

- Software & Model Builders

As Nvidia makes AI cheaper to run, software companies get a tailwind. Lower compute costs may encourage broader usage of AI tools and potentially support new business models. In other words, cheaper “AI tokens” mean more people spending them.

- Edge, Robotics & “Physical AI”

AI isn’t just living in the cloud. Nvidia is pushing it into the physical world with things like Jetson Thor chips for robots, Omniverse for digital twins, and AI systems for factories. That shift could create a new growth wave at the “edge,” where machines and devices start running AI on-site instead of relying solely on big data centers.

Positioning Ideas

- Long AI infra? Market participants often watch AI infrastructure trends, including chip production, power, and network efficiency, to assess sector developments.

- Cautious on normalisation? Investors may adjust expectations as growth normalises and volatility affects market prices.

- Looking for catalysts? Upcoming events such as MLPerf, GTC, and future earnings reports may provide information relevant to the AI sector.

Still Green Lights But With Smarter Pedals

Yes, this quarter was Nvidia’s slowest growth in years, but “slowest” still meant 56% year-on-year revenue growth, record margins, and massive global demand. Its Blackwell platform is reshaping AI compute economics.

The supply-chain bottlenecks now lie in power, cabinets, and networking, not silicon, and Nvidia is firmly in the lead there. The China market remains a massive but currently gated opportunity.

Ultimately, what investors saw post-earnings wasn’t a red flag: it was a yellow caution light: yes, we are still accelerating but in a responsible manner.

The AI era has moved past “Can it work?” to “How affordably can we run it everywhere?” Nvidia’s answer to it is Blackwell today and Rubin tomorrow, and it continues to play a central role in AI infrastructure markets.

Reference

- “NVIDIA Announces Financial Results for Second Quarter Fiscal 2026 – Nvidia”. https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-second-quarter-fiscal-2026 . Accessed 29 August 2025.

- “Nvidia CEO Jenson Huang: Amazon, Oracle, Alphabet, and Microsoft Alone Plan to Spend ‘$600 Billion Per Year’ on the ‘AI Revolution’ – Yahoo!Finance”. https://finance.yahoo.com/news/nvidia-ceo-jenson-huang-amazon-190311771.html . Accessed 29 August 2025.

- “Earnings live: Nvidia stock edges lower as investors digest results, Gap and Dell sink, Affirm pops – Yahoo!Finance”. https://finance.yahoo.com/news/live/earnings-live-nvidia-stock-edges-lower-as-investors-digest-results-gap-and-dell-sink-affirm-pops-210539722.html . Accessed 29 August 2025.

- “Nvidia says it’s missing out on China sales as it awaits guidelines on US 15% pay-to-play plan – CNN”. https://edition.cnn.com/2025/08/27/tech/nvidia-earnings-china-trump . Accessed 29 August 2025.