Big Tech drives stocks, Palantir beats

* Dollar, treasury yields rise as officials undecided on December cut

* S&P 500, Nasdaq send higher on Amazon-OpenAI deal

* Control of Tesla at stake in vote on Musk’s pay plan

* Palantir stock rises as defence work and AI fuels another flurry of records

FX: USD built on the Fed’s hawkish cut and positive Trump-Xi meeting as the index tested resistance at the swing high from August at 100.25. Odds of a December rate cut remain around 70%. We get to hear from an unusually divided FOMC this week with 12 (mainly dovish) officials due to speak, with Daly, Cook and Goolsbee all sharing mixed views. Ordinarily, focus would be on Friday’s US monthly employment report, but the government shutdown means that won’t be published. It looks very likely to extend beyond the 35-day record set in 2018/19 which could also start to weigh on USD sentiment.

EUR moved lower for a fourth day as it touched lows last seen at the start of August. Market consensus remains for the major to trade around 1.18 by year end. There are several ECB speakers this week, with the debate leaning more to whether eurozone inflation undershoots and the ECB requires another rate cut. Near-term support sits at 1.1504.

GBP tried to find support at the August low at 1.3141 along with a major Fib level, after dipping to levels last seen in mid-April last week. The next major support is the midpoint of this year’s rally at 1.2941. Markets are eyeing up the BoE meeting on Thursday, with just less than a one in three chance of a 25bps rate cut. The MPC will likely wait for the Budget at the end of this month, plus more data to confirm peak headline inflation is in, before contemplating more policy easing.

JPY consolidated last week’s move with the major in bullish mode. There is a minor fib (78.6%) of this year’s decline at 154.81 as next resistance. Firmer US yields following the Fed’s hawkish cut and supportive (for now) seasonals should see more upside. The calendar is light, so we expect more verbal intervention if we get beyond 155.

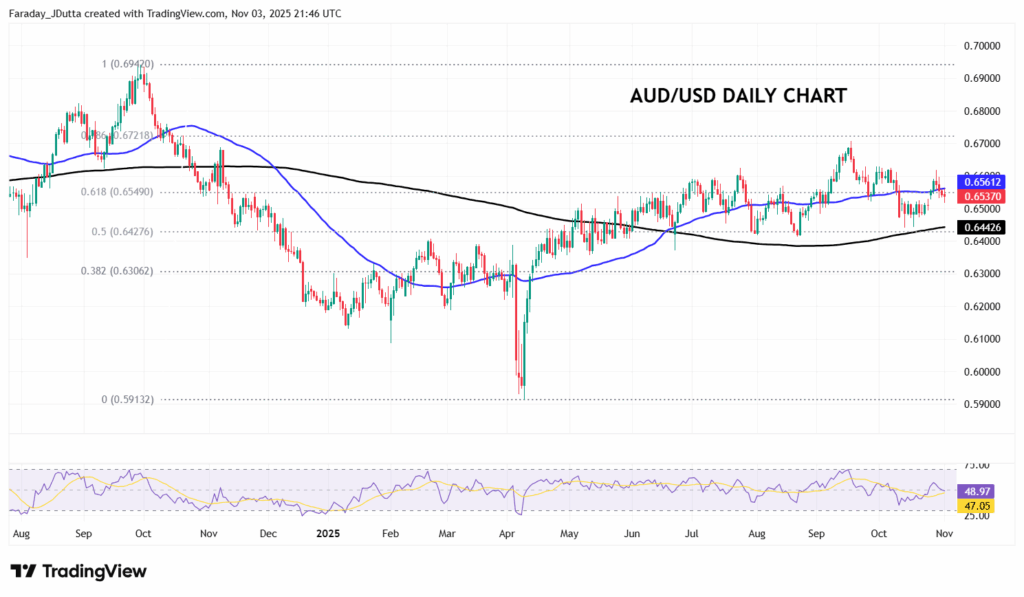

AUD fell for a fourth straight day heading into the on-hold RBA rate decision. Disappointing China PMI data didn’t help the aussie. Hotter than expected inflation data last week put paid to another RBA rate cut, with a decent chance of no move until at least February. CAD underperformed as the major neared the mid-October top at 1.4080. Sluggish growth and trade headwinds are hampering the economy and also the BoC’s job.

US stocks: The S&P 500 added 0.17%, closing at 6,851. The Nasdaq moved higher by 0.44% to settle at 25,972. The Dow Jones finished at 47,336, down 0.48% on the day. Heavy cap tech stocks, like Amazon lifted the indices after it agreed a $38bln deal with OpenAI to supply Nvidia chips. However, breadth in the market was weak with only Consumer Discretionary, Tech and Utilities posting gains while the equal-weight S&P 500 was sold. About 100 S&P 500 companies report this week. Palantir reported earnings after the closing bell and edged high in after hours. Its revenues hit another record and beat estimates while the software company boosted its full-year outlook. The latest quarter was the fourth one in a row in which the commercial business was larger than its government side. But it’s very richly valued trading at a forward p/e of 253x. For more AI colour, Qualcomm and AMD are also set to report this week, along with consumer sentiment stocks like McDonalds, Uber and Airbnb.

Asian stocks: Futures are mixed. Stocks were mostly bid with no major fresh weekend news and Japan out on holiday. The ASX 200 saw gains in tech and energy offset by miners and healthcare weakness. The Hang Seng and Shanghai Composite moved north but price action was choppy.

Gold continued to trade around the psychological $,4000 marker.

Day Ahead – RBA Meeting

The RBA is expected to hold the Cash Rate at 3.60%. Money markets agree, now pricing in a 92% chance of a pause, which is a sharp shift from earlier last week when there was still a decent shot at a 25bp rate cut. Since the last meeting, the data’s been mixed, with job figures weaker than expected as unemployment ticked up to 4.5%. The big kicker has been recent inflation data with both quarterly and monthly CPI readings hotter than expected, and annual inflation jumping to 3.2% from 2.1%, so above the top end of the RBA target band.

That has shifted the rate cut odds and has given the RBA more reason to stay on hold, with bets pushed out to February. Markets are pricing in a “wait and see” RBA with a steady hand predicted. The tone of the statement and inflation commentary will be the focus, for any hints of what’s next. More cuts will likely need unexpected and a big miss in jobs data.

Chart of the Day – AUD/USD below 50-day SMA

The upward trend on the weekly AUD/USD chart has stalled, after prices hit 11-month highs in mid-September at 0.6707. The major is now in a 0.6440 – 0.6630 range with prices trading around the 50-day SMA at 0.6539. That is also very close to a major Fib retracement level (61.8%) of the October to April move at 0.6549. Below sits the 200-day SMA at 0.6442 with the halfway point of that move at 0.6427.