Santa surge stalls, bullion bounces back

* Wall Street remain muted on holiday volumes and FOMC Minutes

* USD modestly higher amid a disappointing year for dollar bulls

* Gold and silver prices stabilise after wild holiday price action

FX: USD found a bid as the FOMC minutes showed a split on 2026 policy, reflecting uncertainty and a wait-and-see stance. Most officials were inclined to cut rates further if inflation continues to ease. Trading was inevitably quiet with the dollar on track for its worst performance in eight years.

EUR slipped with one day of holiday trading still to go. The single currency is up over 13.4% on the year, with the year-to-date top from mid-September at 1.1918. The low came in mid-January at 1.0176.

GBP dipped as prices fell to 1.3449 before finding some buyers. Sterling closed up around 7.6% against the dollar in 2025, with one day to go.

JPY softened as the major stayed above 156. The minor Fib level of this year’s high to low move sits at 154.81 with the 50-day SMA now at 155.05. The recent highs sit just below 158. The recent hawkish BoJ minutes endorsed continued tightening in 2026.

US stocks: The S&P 500 lost 0.14%, closing at 6,896. The Nasdaq moved lower by 0.25% to finish at 25,462. The Dow settled lower by 0.2% at 48,367. The benchmark S&P 500 closed lower for a third straight day with the broad-based index down just 0.52% from its 52-week high at 6,932. But the Santa rally isn’t happening so far. Tech was mixed Tesla lower by 1.2% and Nvidia off 0.36%. Investors continued to assess the outlook of AI returns amid massive infrastructure capex.

Asian stocks: Futures are mixed. APAC stocks were mixed with eyes on geopolitics and China-Taiwan. The ASX 200 slipped in quiet year‑end trade, weighed down by gold and mining. The Nikkei 225 faded with some profit‑taking in Tech and SoftBank after a strong year leaving the index still near the 50k handle. The Hang Seng outperformed as bargain hunting in beaten‑up China plays offset lingering nerves over Taiwan headlines, while the Shanghai Composite was little changed.

Gold found some buyers after its tumble on Monday, dragged down by silver’s plunge. Prices got back to the previous top around $4,380, after posting a fresh all-time top at $4,550. Silver also rebounded in very strong seasonal trading up over 6%. China export restrictions plus more stringent CME margin rules will likely see more wild price action in thin liquidity.

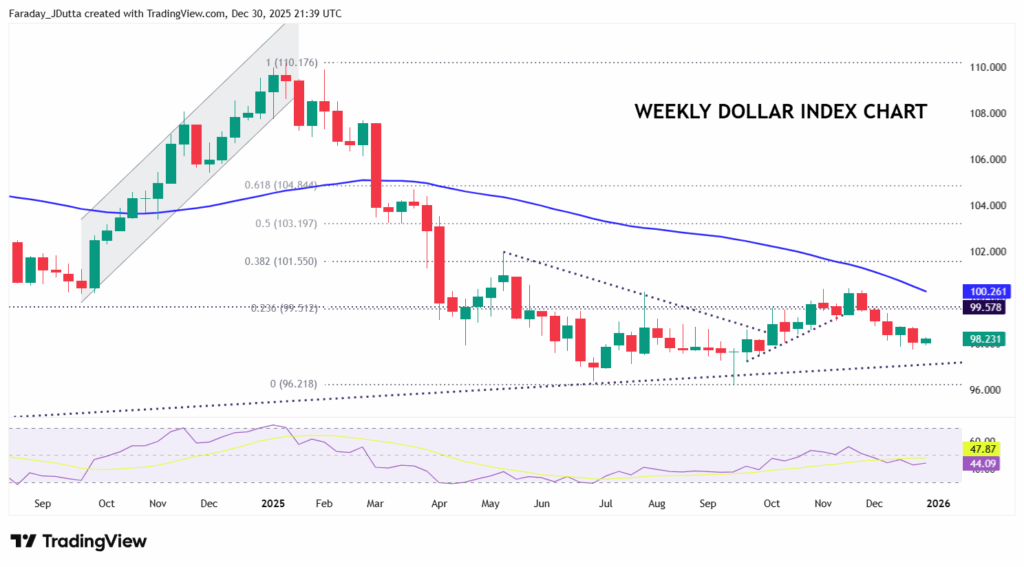

Chart of the Day – USD in bearish consolidation mode after tough year

The greenback is headed for its steepest annual fall since 2017, as the dollar Index has dropped nearly 10% this year, which commenced after President Trump’s inauguration in January. His trade war sparked fears for the world’s biggest economy, and cast doubts over the dollar’s traditional status as a safe haven for investors. The Fed’s resumption of rate cuts in September and consecutive moves has also kept the buck under pressure, with at least two more rate reductions priced in for 2026. This comes in contrast to other major central banks like the ECB, whose easing cycle has very lilely come to an end, according to money market expectations for next year. Going forward, consensus appears to be for more dollar weakness with a new more dovish Fed Chair installed in May. Can the AI investment boom in the US keep their economy humming along, and underpin support for USD? Watch the long-term support trendline from 2011 lows, which comes in just above 97.