Two-way trade in stocks, USD lower on soft jobs data

* Stocks mixed as defensives outperform overvalued tech

* Dollar slides on signs of US labour market weakness

* GBP underperforms on soft labour market data and rising BoE rate cut bets

* US shutdown nears end as Senate passes deal, House readies vote

FX: USD dropped sharply after soft weekly ADP employment data showed that employers shed jobs (-11,250) in the four-week period through October 25. The 200-day SMA sits at 100.20. This weak labour market data comes as the government shutdown is about to come to an end, which means we may get a torrent of economic data in the coming days and weeks. Goldman Sachs reckons deferred government resignations could see a 50k drop in the headline October NFP print. There’s around a two in three chance of 25bps Fed rate cut next month.

EUR picked up as it traded around near-term resistance at 1.1591. The 50-day SMA is at 1.1663. The German business ZEW survey data disappointed as ‘structural problems continue to exist’. There was mixed ECB commentary with data dependence and inflation risks now broadly balanced the key takeaways, so nothing new.

GBP lagged its peers after weaker than expected jobs data. Key wage growth matched forecasts but the unemployment rate ticked higher with employment contracting. Cable dropped to the low of the day at 1.3116 before climbing higher through the day, mainly on dollar weakness. BoE rate cut odds turned marginally more dovish, with above a 70% chance of a December 25bps move. The MPC’s Greene noted the report was ‘not great’ and cautioned around a cloudy jobs picture.

JPY initially softenedas the major bumped into resistance around 154.44/48, before the dollar grew weaker through the session. The yen has been under pressure after new PM Takaichi called for the BoJ to go slow on policy normalisation.

US stocks: The S&P 500 gained 0.21%, closing at 6,847. The Nasdaq moved lower by 0.31% to settle at 25,533. The Dow Jones finished at 47,928, up 1.18% on the day. Only technology was in the red with Healthcare, Energy, Consumer Staples, Real Estate and Materials all up by more than 1%. Mag 7 stocks are choppy at the moment as they most fell after a solid rally on Monday, though Apple, Microsoft and Alphabet stayed positive. Nvidia suffered the most after Japan’s Softbank said it sold its entire stake in October, though this was to fund other AI investments. Coreweave shares plunged 16.3% despite revenue more than doubling at the AI data-centre operator. Paramount Skydance jumped over 9.7% as investors cheered the new CEO’s pitch on remaking the storied media house for the streaming era, with further cost cuts and plans to invest $1.5bn next year.

Asian stocks: Futures are mixed. Stocks were muted as there was little positive follow-through from Wall Street’s gains after the optimism around the US government shutdown nearing an end. The ASX 200 saw early gains by gold miners and stocks offset by bigger weakness in tech and financials. Earnings growth by Cba was modest. The Nikkei 225 initially rallied on yen weakness before it gave up gains and turned red. The Hang Seng and Shanghai Composite were lower amid tech selling and a disappointing start to China’s Singles Day shopping sales.

Gold had a mixed day as it kicked off with more buying to a high at $4,148, a two-and half week high. But sellers emerged to see it trade modestly higher on the day.

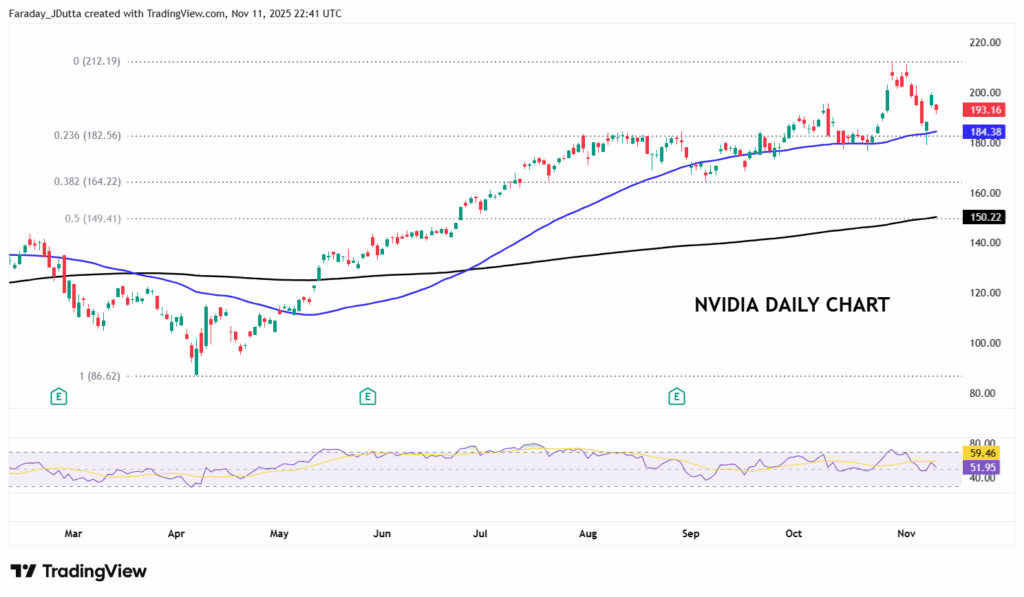

Chart of the Day – Choppy price action in NVDA

We covered the tech-laden Nasdaq yesterday, and where Nvidia goes, so do the broader indices. This is because a $5 trillion market cap gives you a roughly 7.6% and 13.9% weighting in the S&P 500 and Nasdaq respectively. As concerns ramp up about AI valuations and AI capex, last week saw the world’s biggest stock by market cap suffer its worst week since mid-April, falling over 7%. Prices touched the 50-day SMA on Friday but bounced back strongly and on Monday. That is well watched momentmu indicator is currently at $184.80. That level sits just above a minor Fib level (23.6%) of the April rally to record high at the end of last month at $182.56, reinforcing it as a strong support zone. The record top is at $212.19 with their earnings report due next Wednesday after the US market close. Guidance is currently pointing to $54bn in revenue and strong data growth given by Blackwell architecture. Needless to say, this is a big risk event for NVDA, AI and the wider market.