DoJ Fed probe unnerves investors, but stocks still make new highs

* Dollar lower on mild “Sell America”, stocks finish higher

* Gold and silver smash record highs, copper eases on supply concerns

* Former Fed Chairs, Treasury Secretaries condemn Powell probe

* Alphabet hits $4trn market cap on Gemini deal with Apple

FX: USD sold off sharply overnight on the open and again after the European open before holding relatively steady through to the US session close. News of Fed subpoenas spooked markets, while other important and uncertain news like the legality of tariffs, Iran geopolitical events and the announcement of the next Fed Chair all linger. Hassett is again the narrow favourite in betting markets, but he faces the challenge that markets perceive him to be too dovish which could be bad for the 10-year US Treasury yield. In the near-term the move against current incumbent Powell has seen him respond in a quite extraordinary manner. This is obviously a developing story which could see more ‘Sell America’ if it develops.

EUR held steady as it saw support at the 50-day SMA at 1.1643. There’s been very limited ECB dissent recently, and markets will remain reluctant to change their ECB pricing of no moves for the foreseeable future. If we lose last week’s low from Friday at 1.1618, the 200-day SMA sits below at 1.1568.

GBP found support from the 200-day SMA at 1.3386 and the midpoint of the July to November move at 1.3397. The move is all sentiment driven with no data UK releases or BoE speeches. The recent top is 1.3567 with GDP the highlight data point released on Thursday.

JPY markedly underperformed even with haven buying and dollar selling. Speculation that Prime Minister Takaichi will dissolve the parliament and call snap elections continued to rise over the weekend. That is meant to secure a bigger majority, but the uncertainty has worried investors. Prices are close to fresh cycle highs above 158 with several ‘lines in the sand’ near and more than just verbal intervention.

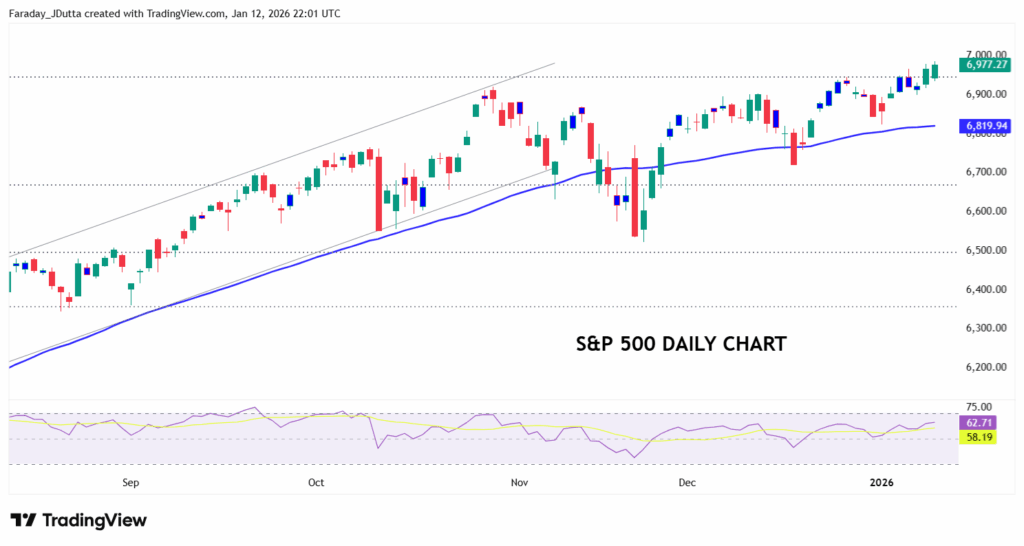

US stocks: The S&P 500 added 0.16%, closing at 6,977. The Nasdaq moved higher by 0.08% to finish at 25,788. The Dow settled higher by 0.17% to close at 49,590. It was a new record close of the S&P 500, the third of 2026. But stock futures were in the red as Trump’s apparent legal move against Fed Chair Powell saw investors run to safe havens. The plan to cap credit card rates saw financial stocks like Visa and American Express tumble, with big banks in the crossfire ahead of their earnings. But Google grabbed the headlines as it became the fourth company to surpass the $4 trillion market cap mark. Alphabet has entered into a multi-year deal with Apple where the next generation of the iPhone maker’s models will be based on Google’s Gemini models. Meta closed 1.7% lower as it reportedly plans to cut around 10% of Reality Labs Business staff, according to the New York Times.

Asian stocks: Futures are mixed. APAC stocks were mostly in the green, following on from the positivity seen stateside during Friday’s session. Japanese traders enjoyed a domestic holiday. The ASX 200 saw gold miners outperform, followed by consumer discretionary and energy. The Hang Seng and Shanghai Comp conformed to the regional gains, although upside was capped amid a lack of major drivers for the bourses.

Gold surged higher to fresh highs to start the week, as we predicted in the weekly commentary, with another textbook breakout after bullish consolidation just below the recent prior all-time top. Geopolitical and Fed independence issues saw investors jump to havens. Silver also surged to new record highs with the metal up 20% in 2026 already. FOMO trading seems obvious though the recent pause eased severely overbought conditions.

Day Ahead – US CPI

December CPI is predicted to show the headline print rising at 0.3% m/m and 2.7% y/y, and the core at 0.3% m/m and 2.7% y/y. Data collection issues stemming from the longest-ever US government shutdown led to a surprisingly soft November CPI report. The collection disruptions during the government closure amplified seasonal discounting. This time, goods prices are expected to rebound more sharply than services, while tariff pass-through appears to be moderating. Services inflation should also firm, while shelter inflation is seen following its pre-shutdown trend, which means shutdown-related softness may linger into the second quarter.

Recent FOMC commentary from the latest minutes said inflation had fallen a long way from the peak but was still a bit too high and vulnerable to tariff and fiscal shocks, so policy should only be eased gradually. Fed Chair Powell said it remained somewhat elevated to the 2% goal and that recent data hadn’t changed that picture much. The Fed’s latest projections see headline PCE inflation at 2.4% and core at 2.5% by year-end, with a return to target only by 2028. Of course, there is a wide split of views on the committee with some thinking further rate cuts are warranted if inflation drifts lower while others are not convinced inflation is on a sustainable path to 2%.

Chart of the Day – S&P aims for 7,000 and beyond

Odds of a January Fed rate cut got reined in after the lower jobless rate seen in NFP on Friday and that may slow any upside in tech too. The one in five chance of a 25bps January move is now around 5% only. There is less than a 50% chance of a move up until May and Powell’s last FOMC meeting. A stronger CPI print could wipe out these odds, and we note many investment banks have now pushed back a lot of their rate cut forecasts. Softer data would be more of a surprise due to most economists judging a bounce back is due after November’s messy data.

Stocks shouldn’t be unduly troubled, with earnings season on tap and JP Morgan’s results due before the US market open along with other big banks later this week. These earnings stand as a barometer of broader economic performance and consumer spending. Credit provisions are likely to be watched particularly closely, with banks broadly strong due to healthy M&A activity in a robust economy, the regulatory environment remaining favourable, plus stable credit quality. The third record of the close is likely to be followed by more and soon, with bullish momentum picking up again.