Fed fails to move the needle, gold soars as USD steadies

* FOMC leaves rates unchanged as expected, suggest easing pause will continue

* Dollar gains for the first time in 5 sessions on steady FOMC

* Gold futures extended record highs and enjoyed their biggest daily gain ever

* Microsoft, Meta and Tesla report mixed results, diverging price action

FX: USD climbed higher through the day with Treasury Secretary Bessent adding to strength by saying the US is not intervening in USD/JPY. But the greenback fell into the FOMC decision and closed in the middle of its daily range. The Fed left monetary policy unchanged in a range between 3.5% and 3.75%, but the accompanying statement and press conference suggested rate setters are more confident that the policy easing cycle is close to a conclusion. Money markets barely changed their pricing of policy action going forward, with 45bps of cuts expected by year-end and 17bps by June. Powell said the Fed does not comment on the currency and he strongly defended central bank independence, warning that any loss of credibility would be difficult to reverse.

EUR moved off its four and half year high at 1.2082 from Tuesday. ECB doves have been quick on the wires, noting that the central bank is closely watching euro gains for any impact on prices. That said, the risk of any near-term reaction is very low, though a stronger currency could see the ECB missing its inflation target to the downside. The September 2025 high sits at 1.1918.

GBP outperformed most of its peers, closing off its lows and above the 2025 top from June at 1.3784. It is all sentiment driven at present though we do get a BoE meeting next week when we get the rate decision, minutes, and Monetary Policy Report released simultaneously. The MPC is expected to sit on their hands but guidance will be key.

JPY gave back some of its huge gains in recent days, but prices closed below the 200-day SMA at 153.71. President Trump criticised China and Japan for devaluing their currencies, suggesting a particular focus on competitiveness with Asia. The major sees support at this week’s lows just above 152.

AUD outperformed among its peers on hotter than expected inflation – 3.8% vs an expected 3.6% and 3.4% previously. That pushed up the odds of an RBA rate hike next week to 70% from 60% before the data. Bulls have broken above the 200-month SMA at 0.6946 with long-term targets around 0.7150. Prices are very overbought on several indicators.

US stocks: S&P 500 lost 0.01% to close at 6,978, after it hit an intraday high at 7,002, the Nasdaq was up 0.32% at 26,023 and the Dow Jones was higher by 0.02% at 49,016. US indices were eventually mixed, as Real Estate, Consumer Staples and Health lagged, as the latter extended on Tuesday’s big losses. Energy and Tech sat atop of the pile, with the former buoyed by gains in the crude complex amid punchy Trump remarks on Iran, while Tech saw strength ahead of Mag-7 earnings after the close. Microsoft fell 5% after hours as the software and cloud giant reported high spending and only a small cloud revenue beat. Meta surged nearly 8% after its bumper earnings reported after the bell quelled demands from Wall Street to justify a near doubling of its AI spending plans. Tesla suffered its first annual drop in revenue in 2025, but its earnings beat estimates and Optimus robots are said to be on track for end-of-year production. After hours trading saw the EV maker rising 3.5% before giving back gains. ASML, the chip maker topped profit and revenues with a record order book and strong guidance. The stock spiked to record highs before closing lower on the day, but other chip stock like Micron jumped higher.

Asian stocks: Futures are mixed. APAC stocks were also mixed even though Us stocks were bid save the Dow Jones, which was impacted by UnitedHealth’s plunge. The ASX 200 was muted after hotter inflation and tech weakness. The Nikkei 225 underperformed on the stronger yen. The Hang Seng and Shanghai Comp settled in the green as telecoms and energy helped Hong Kong.

Gold carried on higher, with a strong push north after the Fed, and posting another record high at $5,419. Debt-fuelled, retail-heavy, FOMO driven flows are likely pushing this parabolic leg higher, which could be prone to a pullback soon. That is tough to call with such bullish momentum, and underlying drivers.

Day Ahead – Tokyo CPI

This inflation data is the forerunner to Japanese nationwide inflation. There are no estimates. Policymakers at the BoJ see growing evidence that wage gains are feeding into prices, raising confidence in eventually achieving their 2% target, though progress since December has been modest. Policy will remain accommodative for now, but the BoJ intends to raise rates further if its outlook materialises, with decisions guided by developments in underlying inflation, wages, FX-driven import costs and key data such as April prices. Nationwide CPI is projected to print at 2.7% in 2025, according to the latest BoJ forecasts. Officials view the recent weakness of the yen as increasing inflationary pressures. There is around a 53% chance of a rate hike in April.

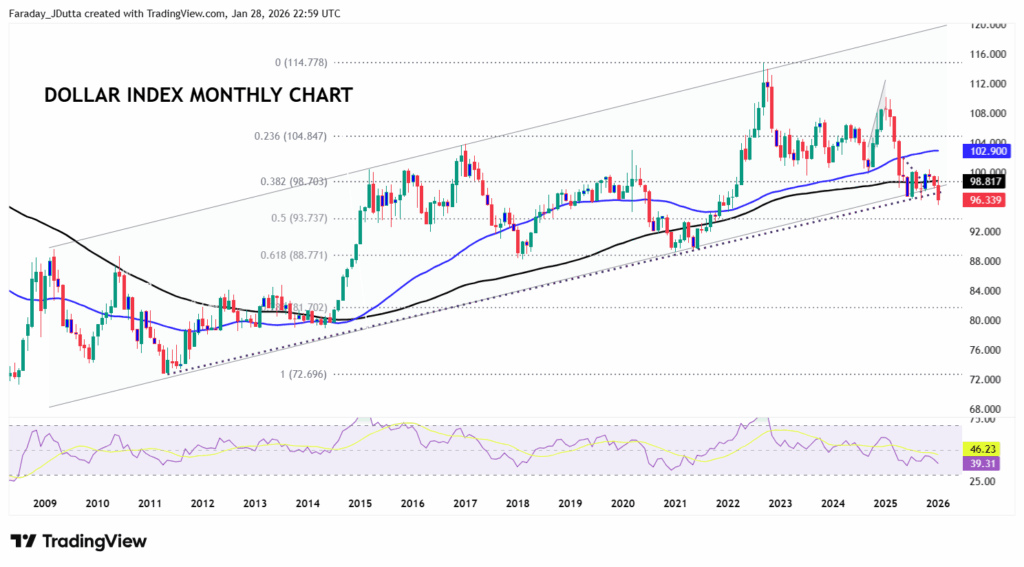

Chart of the Day – Dollar long-term breakdown?

We don’t often put out a monthly chart but in the dollar’s case this time it is worth doing. We often highlight that after prices track sideways for a prolonged period, we get a big range breakout and expansion, typically in line with the longer-term trend. So, after months of relative FX calm, where the greenback tracked in a range around the 200-month SMA, dollar pairs went wild as Fed subpoenas and the Greenland drama sparked fresh doubts about US assets and the buck itself. Talk of possible US–Japan coordination to support the yen has been touted though reined in by Treasury Secretary Bessent. We also got Trump comments about the dollar slide, which he waved it off, saying the dollar was “doing great”. Markets ultimately heard that loud and clear: no defence of the dollar is a green light for more downside. The midpoint of the 2011 low to 2022 high sits at 93.73. But if it is a false breakout then prices need to get back above Monday’s gap at 97.43 and then to 100 with resistance just above.