Nvidia boosts stocks ahead of Fed and Mag 7 earnings

* Wall Street posts more fresh all-time highs as Nvidia jumps

* Gold slides with Fed decision and US-China trade talks in focus

* Dollar trades slightly lower as Fed and earnings eyed

* Trump and Xi to discuss lowering China tariffs for fentanyl crackdown

FX: USD was relatively quiet again as the drift lower continued into today’s FOMC rate cut and meeting. Trade related headlines will also garner attention into the Trump-Xi meeting, though things look cordial currently. Attention turns on Mag7 Q3 earnings with 20% market cap of the S&P 500 reporting today and tomorrow after the US close. A weaker Conference Board’s Consumer Confidence survey printed at the same time as Amazon announced 14,000 job lay-offs. Two inside weeks on the Dollar Index potentially means we get a period of range expansion soon.

EUR tapped the 100-day SMA at 1.1663 as prices ticked modestly higher. The 50-day SMA is at 1.1686. There was little data to drive price action with Q3 GDP out tomorrow, plus of course the ECB unchanged decision. Markets are expecting a repeat of recent language with policy in a ‘good place’ and a data dependent, meeting-by-meeting stance.

GBP was the major underperformer as cable hit a 3-month low and threatened to break down below 1.3250. EUR/GBP did break to the upside, through the resistance zone around 0.8750. BoE rate cut bets increased on reports the OBR plans to downgrade the UK’s growth forecast by 0.3%. That would leave a £20bn gap in the public finances and adds more pressure on to Chancellor Reeves ahead of next month’s budget.

JPY was the outperformer with some mild verbal intervention from a MoF official about avoiding rapid, short-term fluctuations in FX moves. There were also positive US-Japan trade developments including deals on rare earths and nuclear power. PM Takaichi is said to have offered ‘anything you want’. Strong resistance now sits above 153 with initial support at 151.61.

AUD outperformed with prices jumping above the 50-day SMA at 0.6553. Positive risk sentiment and US-China vibes are helping high-beta FX. Today’s release of September monthly inflation is forecast to tick one-tenth higher to 3.1% and third quarter CPI at 1.1%. Housing is key to underlying, core inflation data with several domestic economists seeing upside risks. CAD was midpack as the major broke down through short-term support at 1.3976. A rate cut is expected from the BoC today – but risks are skewed to a possible neutral rate reduction and the possible end of the policy easing cycle.

US stocks: The S&P 500 added 0.23% to close at 6,891, a new record close and the 36th one of 2025. The Nasdaq moved higher by 0.74% to settle at 26,102, another record close. The Dow Jones finished at 47,706, up 0.34% on the day and also a record finish. Only three sectors were in the green, Technology was by far the biggest gainer (+1.64%) with Consumer discretionary and Materials also gaining. Real Estate, Utilities and Energy were all down over 1% to 2.2%. Nvidia surged 4.98% as the CEO unveiled new products and numerous new partnerships including with Nokia, MSFT and JNJ. Notably, the Chinese market is assumed to remain at zero. There were positive earnings everywhere with UPS and UnitedHealth jumping on top and bottom line beats. Lay-offs were announced at Amazon, Paramount and UPS. PayPal surged 11% after it announced a partnership with OpenAI to allow ChatGPT users to buy products using its platform. Apple crossed $4 trillion in market value for the first time as it hit a record high ahead of its results on Thursday.

Asian stocks: Futures are mixed. Stocks didn’t follow the bullish lead after a strong session Stateside. The ASX 200 pulled back dragged lower by tech and mining weakness. The Nikkei 225 retraced some of Monday’s gains but remained above 50,000. A firmer yen didn’t help but positive US-Japan trade talks underpinned support. The Hang Seng and Shanghai Comp were choppy ahead of the Xi-Trump meeting scheduled for today.

Gold sold off again but moved off its lows through the European and US sessions, having hit a 3-week trough at $3,886. A major Fib level (38.2) sits at $4,033. The midpoint of the September low to record high is $3,925.

Day Ahead – FOMC Meeting, 3 of Mag 7 earnings

The Fed takes the spotlight this week, with markets fully expecting a 25bps rate cut to bring the Fed Funds Rate down to 3.75–4.00%. Another cut is anticipated in December and it’s currently near 50:50 on a third straight 25bps move in January. Officials are weighing up a cooling labour market against still-sticky inflation around 3% so above the Fed’s 2% target. Policymakers remain divided between supporting jobs or keeping pressure on prices, while delayed government data clouds the broader economic picture. Tariff-induced price increases are also expected to feed into the economy in the months ahead. Any signals that Powell is more cautious than the market on more policy easing will see USD strength and risky assets like stocks lower.

Microsoft, Alphabet and Meta report their Q3 earnings after the US close. These tech giants represent roughly 20% of the market cap on the S&P 500 worth trillions of dollars. They are investing big time in AI and cloud infrastructure so markets will focus on how much revenue that’s already producing. They have also been spending huge on data centres, AI hardware and R&D so key will be if that spending is paying off.

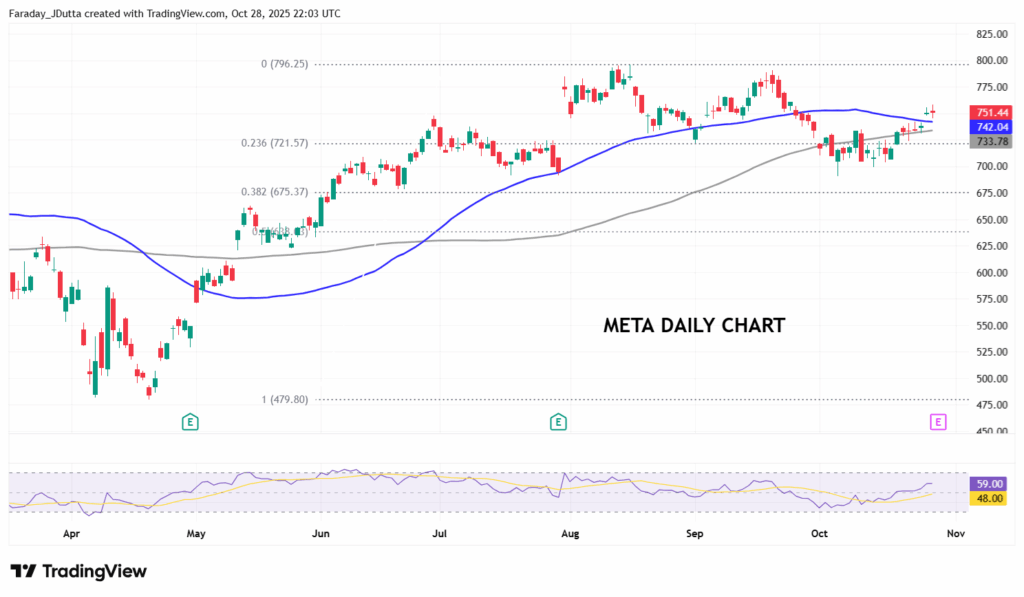

Chart of the Day – Meta win streak into earnings

Meta has enjoyed an 8-day win streak into its Q£ results. Investors will focus on ads and AI return on investment (ROI), with expectations of continued strong advertising revenue of around 21%+ y/y growth. Any positive commentary on the monetisation of AI features like the AI chatbot would also be welcome by bulls. Risks to watch out for include heavy and rising investment spending, which could raise concerns about the ROI. The stock is also constantly threatened by EU regulatory changes that could hurt ad targeting. The stock has outperformed the benchmark index and its Mag 7 peers, rising more than 22% this year. Options see a move up or down of 6.4% in the 24 hours after results. Resistance sits just below $800, with the record high from August at $796.25. The 50-day SMA is $742.04, with the 100-day SMA at $733.46 and the October swing low at $716.88.