Oil volatile, stocks and bullion bid on geopolitics and data

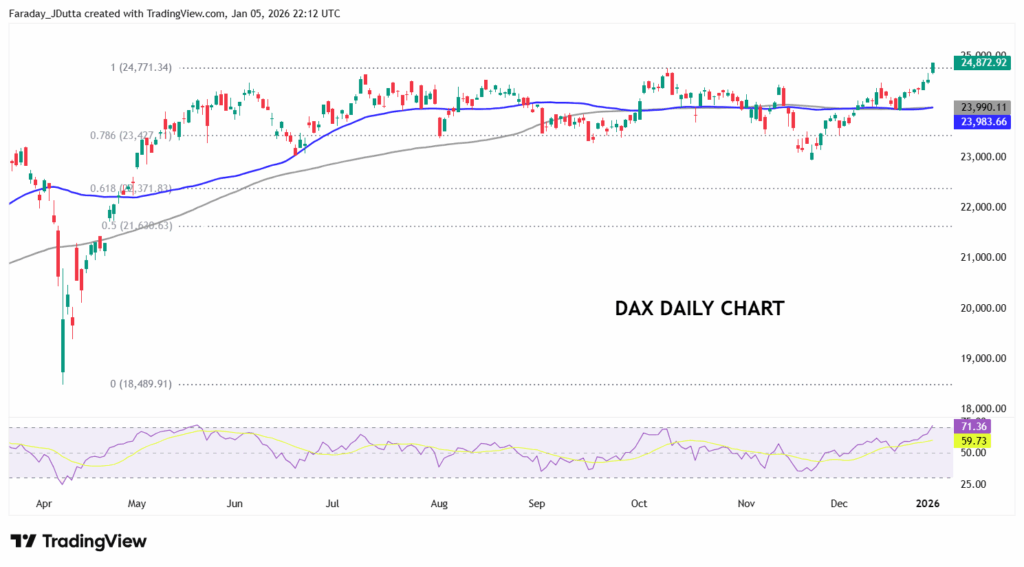

* Dow, Dax makes record high on massive blue-chip rotation

* Gold, silver jump as Venezuela tensions add to geopolitical risk

* US factory malaise continues as key gauge drops to one-year low

* Copper hits record $13k as US import rush fires up bulls

FX: USD was choppy amid geopolitics and disappointing US data. Investors initially preferred the liquidity of the dollar as havens were favoured. There is some uncertainty about where US foreign policy goes next and if investors will shun the greenback, along the lines of the de-dollarisation theme. All that said, stocks were bid in Asia and then through to the US session. Disappointing ISM manufacturing figures weighed on sentiment later, with the index back under the 100-day SMA. It’s a busy week of data with jobs and NFP numbers through the week.

EUR dipped to the 100-day SMA at 1.1659 before dollar selling saw the world’s most popular currency pair modestly rebound into the green. The broader tone dominated with the single currency midpack among its peers. Focus this week will be on inflation data, though it is expected to be in line with the ECB’s target and not market moving. Interest rate differentials are near fresh highs and should offer fundamental support to the euro.

GBP outperformed its peers with flows driven by geopolitics. Cable jumped to a fresh cycle top to levels last seen in mid-September. It’s been quite a textbook technical rally since the November lows with a bull channel, series of higher highs and lows with breaks to the upside and then consolidation.

JPY gained in the Asian session on safe haven demand on concerns related to Venezuela. Domestic yields have climbed on the first trading day of 2026, with the 10-year yield ending up at the highest level since 1999. The rise in JGB yields reflects ongoing concerns about Japan’s fiscal path and worries about the BoJ’s ability to rein in inflation. US-Japan yield spreads continue to narrow in a yen-supportive manner.

US stocks: The S&P 500 added 0.64%, closing at 6,902. The Nasdaq moved higher by 0.77% to finish at 25,401. The Dow settled higher by 1.23% to close at 48,977, a fresh all-time high. Energy, Financials and Consumer Discretionary were the leading sectors while Utilities, Consumer Staples, Health and Tech were the sectors in the red. Brent crude saw gains in a choppy session which helped US oil companies like Chevron, Exxon and Haliburton. The former is the only US firm still working in Venezuela. Tesla jumped over 3% as investors brushed aside soft delivery figures and focused instead on the company’s record energy storage deployments.

Asian stocks: Futures are mixed. APAC stocks were mostly higher as the region shrugged off the US strike on Venezuela. Last year’s semiconductor-led rally lifted the KOSPI to a record high, while TSMC shares also notched firm gains as its ADR’s jumped late last week to become the sixth-largest company in the world by market cap. The ASX 200 was flat as gains in mining and material stocks were offset by losses in tech and consumer sectors. The Nikkei 225 rallied with notable strength in the heavy industries and semiconductor stocks. The Hang Seng and Shanghai Comp traded mixed as the Hong Kong benchmark lagged and with the mainland reclaiming 4,000.

Gold surged along with silver with bullion pushing up above the prior record high at $4,380 on safe haven demand. The all-time top from late December sits at $4,550.

Chart of the Day – Dax hits fresh highs

The US equity premium has begun to shrink. Last year saw non-US stock markets outperform as various catalysts boosted Asian and European equities. Trump’s isolationism and policy chaos helped, while fiscal flexing by EU and Japan, an AI spending spree and asset bubble igniting Asia’s tech manufacturing hubs proved strong tailwinds. In addition, improving governance in key emerging economies was a boon. We’ve picked the German Dax index today, but notably the FTSE 100 hit 10,000 for the first time and the South Korean Kospi continues ever higher after a stellar 2025.