USD, yields fall on positive geopolitics and weak data

* Stocks advance as US yields decline and Nvidia tanks on competition

* Dollar slides on soft data and improved Fed rate cut chances

* RBNZ expected to cut rates to 2.25%, economists speculate if the last

* GBP jumps ahead of UK Budget and Chancellor Reeves big Budget day

FX: USD broke down as retail sales figures from September disappointed so continuing to paint a soft consumer spending picture. Other data was also mixed with consumer confidence poor and ADP negative once again on the new weekly print. The Dollar Index fell through the 200-day SMA at 99.81. December Fed rate bets increased further to around an 85% chance, up from the low 30%s last week. We note that WSJ Fedwatcher Timiraos said on X “allies have laid the groundwork for Fed Chair Powell to push through a cut if he wants one – then signal more cuts aren’t likely under current conditions”. A phone call between Presidents Trump and Xi was positive, amid ongoing potentially positive Ukraine/Russia peace plan talks.

EUR was the third best major as buyers look to take the world’s most popular currency pair up to 1.16. ECB messaging remains neutral though there will some attention on Friday’s countrywide inflation data. The 50-day SMA sits above at 1.1631.

GBP was the top performing major ahead of crucial Budget Day. EUR/GBP one-week implied volatility is trading at the highest relative gap since the 2022 Mini Budget. This signals that despite some recovery in gilts, the currency market remains concerned about the risk event. Cable has broken the downward trendline from the September high. See below for more detail on the Budget.

JPY outperformed all of its peers apart from sterling. The 10-month high in the major sits at 157.89. Expectations for a December BoJ rate hike have recently increased to around 35% as the head of Japan’s biggest union called on the government to step up its efforts to fight inflation. We also had more verbal intervention overnight warning that officials are concerned about yen weakness.

US stocks: The S&P 500 added 0.91%, closing at 6,766. The Nasdaq moved higher by 0.58% to finish at 25,018. The Dow settled higher by 1.43% at 47,112. The tech-laden Nasdaq underperformed though it did manage to pare losses initially seen, as Nvidia recovered but still ended the day in the red. Sectors overall were predominantly in the green, with Health and Consumer Discretionary leading, and Utilities and Energy in the red. The latter was hit by weakness in crude oil amid relatively positive Ukraine/Russia peace deal developments. Alphabet hit a fresh record high as it neared the $4 trillion market cap milestone. The latest move came on reports Meta would spend billions of dollars on Alphabet-owned chips for use in its data centres, starting in 2027. Alibaba reported revenue, net income, & cloud revenue beats, driven by China’s AI development boom, but the stock closed 2.3% lower.

Asian stocks: Futures are mixed. Stocks were mostly higher on the tech-led Wall Street rally. The ASX 200 moved north with mining gains offsetting financials and defensives. The Nikkei 225 initially rallied but gave back those gains on its holiday return. The Hang Seng and Shanghai Composite were supported by the positive Trump-Xi call. Many topics were said to be discussed including Ukraine/Russia, fentanyl, soybeans and Taiwan.

Gold printed a narrow range doji candle with prices making an 11-day high before paring gains and closing virtually unchanged on the day. Treasury yields dipped, with the 10-year touching 4%.

Day Ahead – Australia CPI, RBNZ Meeting

Australia October inflation is expected to remain unchanged at 3.5%. Economists say that October is traditionally a softer month while falling electricity and rents should limit the monthly increase. Offsetting this is likely to be still firm rents and dwelling inflation. This release is the first under the new CPI framework.

Money markets expect the RBNZ to cut the OCR by 25bps to 2.25%. Is this the terminal rate, is the key question. A data dependent stance is likely in 2026 with recent mixed. Inflation picked up with mean CPI closer to the 2% midpoint, but unemployment edged higher to a nine-year top with no job growth in Q3. An updated statement with projections will be published at this meeting. If no more cuts are signalled, NZD should find a bid with the 40bps of easing priced into 2026 potentially pared back.

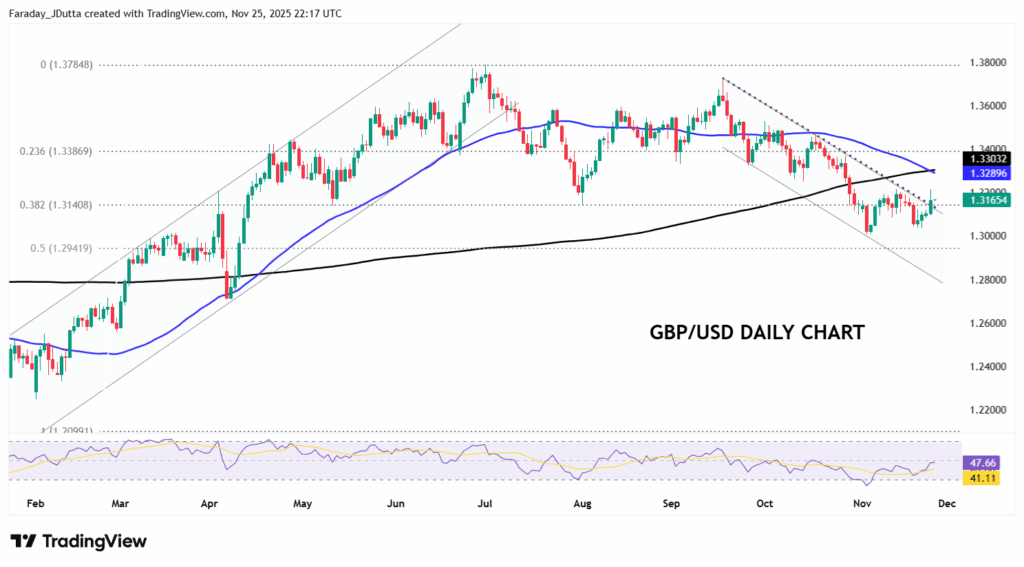

Chart of the Day – GBP/USD reversal pattern forming?

After the months of speculation and gossip, we finally get to hear what’s in the UK Autumn Budget. For the pound, sentiment remains weak but it does feel like a lot of bad news is in the price already. Is it a case of buy the rumour, sell the fact? Key will be how front loaded the ‘smorgasbord’ of tax hikes are and how realistic the filling of the fiscal gap is. Cable may have bottomed out just above 1.30 earlier this month and a possible minor double bottom pattern is now forming, which could imply a reversal. Yesterday’s sharp move higher also broke the downward trendline and potentially the bear channel from the September peak. A measured move with a break of the neckline in the pattern around 1.32 could mean upside towards 1.34. That said, the 50-day SMA is crossing down through the 200-day SMA which is bearish (‘death cross’), though this can be a lagging indicator.