Wall Street mixed, awaiting ‘hawkish’ Fed cut

* Stocks choppy as Dow Jones lagged Tech and the Nasdaq

* Silver crosses historic $60 mark, gold steady, USD edges higher

* FOMC to lower rates again but Powell may push back on more easing

* Bank of Canada to hold rates as economy shows signs of stabilisation

FX: USD was marginally better bid again as it settled just above the 50-day SMA at 99.19, and just above the mid-November lows. The JOLTS reading came in stronger than expected, supporting the greenback and US yields. The 10-year Treasury yields pushed higher for a fourth straight day to 4.19%. It had been sub-4% at the end of last month. All eyes are on the Fed – see below for a preview.

EUR drifted modestly lower for a fifth straight day. The 50-day SMA sits below at 1.1607. Rate expectations have recently steadied after their recent move higher, reflecting some renewed hawkishness from key ECB policymakers. The shift in rate expectations has lifted yield spreads to fresh highs ahead of the Fed meeting.

GBP moved lower after it looked like it could have been building a bullish consolidation pattern. The 200-day SMA is at 1.3331 with the 50-day below at 1.3259. UK data has been thin with eyes on central bank meetings. A 25bps BoE rate cut is baked in, but the 2026 outlook looks more uncertain.

JPY weakened for a fourth straight day as USD/JPY bulls look to the recent long-term high at 157.89. We heard from BoJ’s Governor Ueda, who reinforced the view that policymakers are closely watching exchange rates, noting how exchange rates will affect the bank’s inflation outlook and that is a “very important question for us.” There was only modest yen strength before the dollar asserted itself through the session.

AUD outperformed after the RBA held rates as expected but leant hawkish. Governor Bullock seemingly ruled out any further rate cuts and even contemplated rate hikes next year should core inflation prove persistent, and the labour market hold up.

US stocks: The S&P 500 lost 0.1%, closing at 6,840. The Nasdaq moved higher by 0.16% to finish at 25,669. The Dow settled lower by 0.37% at 47,561. Energy, Consumer Staples, Technology and Consumer Discretionary outperformed, while Health Care, Industrials and Real Estate underperformed. Dow weakness came after JPM’s Lake gave some disappointing Q4 guidance which hit JPM shares and also weighed on the Financial sector. There were mixed reports on Nvidia (-0.31%) as President Trump said the company can ship H200 AI chips in China if the US gets a 25% cut; however, the FT reported China is set to limit access to H200 chips. Microsoft said it planned to invest $23bn in new AI investment, with $17.5bn in India, its largest investment in Asia, as it deepens its bet on one of the world’s fasted growing digital markets. Oracle reports after the closing US bell today.

Asian stocks: Futures are mixed. APAC markets traded cautiously ahead of Wednesday’s FOMC decision and fresh Fed dot plot projections. Losses were limited, helped by improving US–China trade sentiment after President Trump said NVIDIA will be allowed to sell H200 chips to China. The ASX 200 dipped after the RBA held rates at 3.60%. Governor Bullock struck a hawkish tone, saying more rate cuts don’t look necessary and policy may stay on hold, or even tighten next. The Nikkei 225 traded flat, stuck in a tight range as traders wait for next week’s BoJ meeting and potential rate hike. The Hang Seng & Shanghai Comp slipped after a muted Politburo update, while Chinese chipmakers fell early despite the NVIDIA news.

Gold continued to trade sideways just above a minor Fib level at $4,173. Silver grabbed the headlines as it surged over 4%, crossing the $60 mark for the first time, in a textbook upside breakout from a bullish consolidation pattern.

Day Ahead – FOMC and BoC Meetings

Markets have nailed on a 25bps rate cut giving it a 90%+ chance. That would be the third consecutive move and take the target range to 3.5-3.75%. Soft job market data is trumping possible tariff-induced inflation in what might again be labelled as an ‘insurance cut’. New growth and inflation forecasts may see relatively limited changes, while the dot plots are expected to show one more cut in 2026 likely as the median. But the committee is heavily divided with at least two dissents favouring no action at this meeting, and one official likely wanting a bigger cut. Consensus appears to be for a ‘hawkish cut’. But markets could look through Powell’s comments as the next Chair is being decided on currently, and is likely to be dovish.

Policymakers at the Bank of Canada will very likely sit on their hands and keep the overnight rate at 2.25%, especially after the blowout November jobs data. Their rate decision comes a few hours before the Fed’s. With inflation easing and growth solid too, market expectations for more easing have faded. Indeed, the chances of a 2026 rate hike doubled to 40% after the recent labour market report. The bank is predicted to maintain that policy is appropriate while reiterating that it can respond if the outlook changes. There is no MPR but there will be a Macklem press conference.

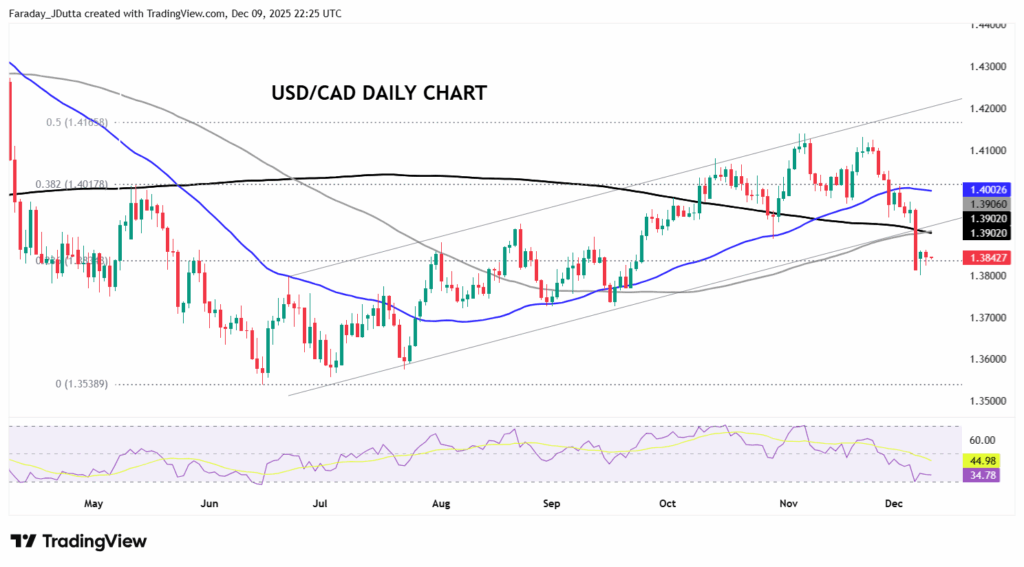

Chart of the Day – USD/CAD consolidating after bearish move

Prices plunged last Friday after market positioning was caught offside by the surprisingly strong Canadian jobs data. The major fell through the lower end of the upward channel developed since the June lows. The sharp drop also broke down through the 200-day SMA at 1.3902 and the 100-day SMA at 1.3906. Prices have settled on a minor Fib level (23.6%) of this year’s high to low at 1.3834. Another breakdown sees next support around the late August and mid-September lows around 1.3725.