Weekly Outlook | A Busy Central Bank Week Will Guide Markets

Important events this week:

After a rather quiet week in the Forex market, this week is expected to offer a lot of fresh volatility. With several Central Banks reporting their interest rates moving forward markets might offer some fresh momentum. Apart from the US also other important Banks like the BoC, BoJ as well as the ECB are giving their rate updates. It is expected that the Bank of Canada will cut their interest rate. The recent weakness of the CAD might gear up momentum with an expected rate cut of 25 basis points towards the final rate of 2.25%. Currency pairs like the EURCAD and the USDCAD might hence move higher. The other Banks apar from the FED might not adjust their rates according to their forecasts. In Japan the situation remains the same. With the debt burden being extremely high, the Bank of Japan might not adjust their interest rate as well. The Japanese Yen looks like it will continue to lose momentum against most other currencies.

US interest rate decision: The most important interest rate decision will come from the Federal Reserve Bank in the US. It is expected that Jerome Powell will cut interest rates towards 4.00%. A move is highly expected especially since last week on Friday the consumer price index revealed a weaker than expected number. Lower rates might boost inflation, which does not seem to be the case for now.

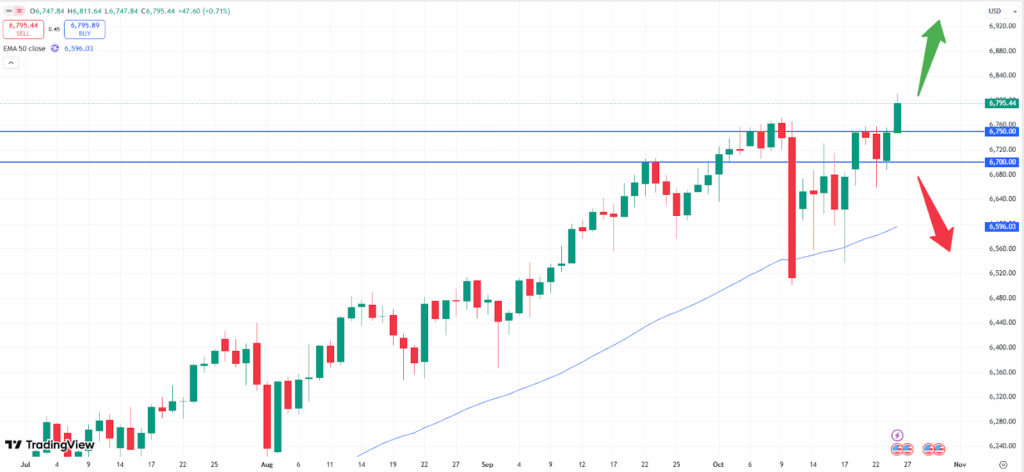

With the break of the technical resistance zone at 6.750 as the daily chart of the S&P 500 index above shows, more upside might now be seen. Despite the rate cut being expected the market might still move higher when the news kick in. The rate decision will be held on Wednesday the 29th of October, 2025 at 19:00 CET.

ECB interest rate decision: It is not expected that the ECB will adjust their interest rate during this meeting. The last rate cut had been done in June this year. However, the market might also face some fresh volatility. The focus is on their outlook and the upcoming meetings. Christine Lagarde might offer further insights on the future development of the rate. Another potential rate cut, either as a surprise during this or the next meetings, might also send the EUR lower.

As the weekly chart above shows, the strength of the Euro seems to be fading. Some positive momentum of the Dollar keeps pulling this market lower, while also the technical resistance zone at 1.1800 has not been broken. Hence, some weaker momentum might occur. In particular since the rate decision will follow this week after the FED, the market might get more clarity offering a bigger move into either direction. Currently, the odds seem to be in favor for the Greenback. The rate decision will occur on the 30th of October, 2025 at 14:15 CET.