Weekly Outlook | Sideways Price Action Dominate the First Trading Days.

The first trading days of the year 2026 did not reveal any news for now. Markets remained in their rather sideways pattern due to the absence of fresh liquidity. The US jobs data from December 31st came out slightly better than expected while the Dollar did not move much.

The Silver market remains extremely volatile, especially during the current time, where most traders remain absent from their trading desks.

Fesh volatility might be added this week with the upcoming market data. The ADP employment change data might offer insights into the US economy, while the usual Nonfarm payrolls report is expected to come in weaker. The US economy is currently facing tougher times as US equities remain mixed during the first trading days so far this year.

Important events this week:

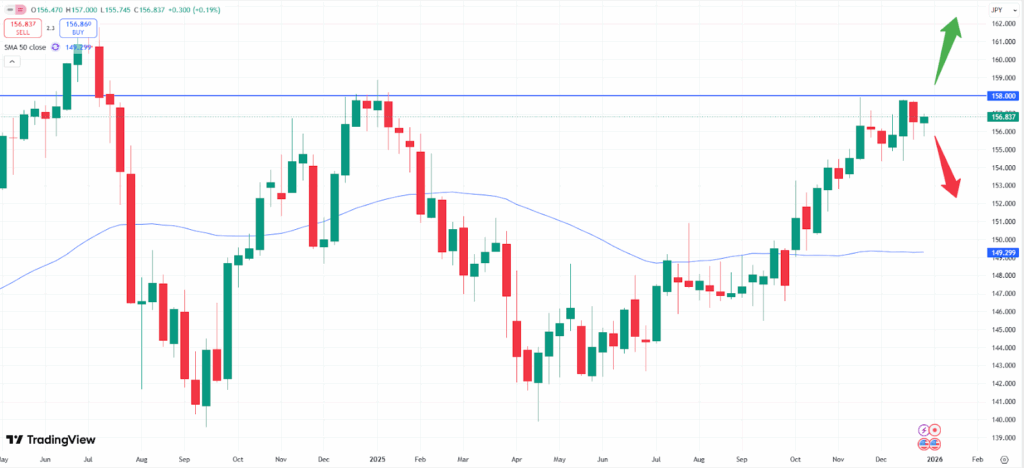

– US- ADP nonfarm employment change– it is expected that the US economy added 47.000 new jobs, which would be a better reading compared to last month’ data release. Yet the release is always taken with a pinch of salt, as compared to the Nonfarm payrolls report, which will be released on Friday. However, a bigger deviation from the expectation might also add some volatility and oftentimes, the USDJPY currency pair keeps moving a lot.

Based on the weekly chart above the currency pair keeps trading higher, and a positive reading might further strengthen the Dollar. A breakout above the technical resistance zone of 158.00 might offer fresh upside momentum, while a disappointment might lead to a recovery of the Yen. This could then pull the USDJPY currency pair to the downside again. Given the first important news release of the year, traders should focus on the release of the ADP report. The data will be released on Wednesday, the 07th of January at 14:15 CET.

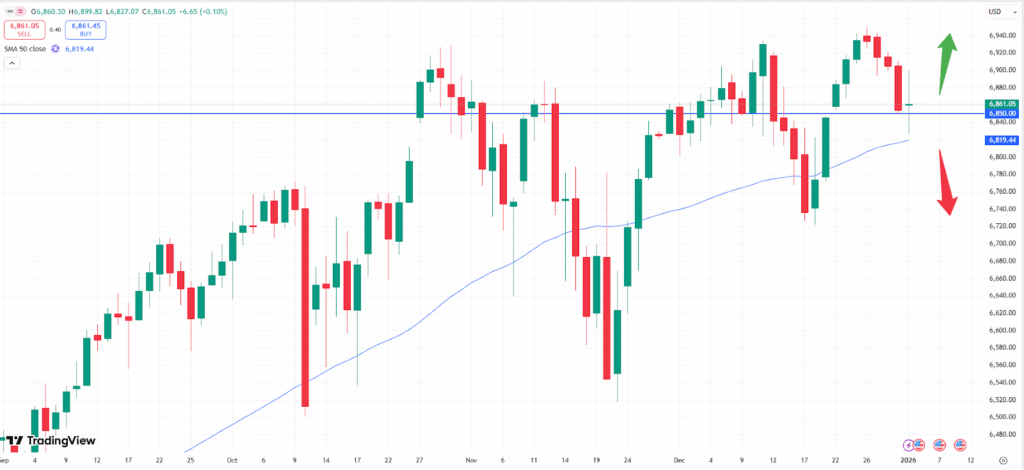

– US- Consumer sentiment– the release of the consumer sentiment report form the US is important for traders as it offers insights into the state of the American economy. As it is merely consumption- driven, the behavior of consumers is offering valuable insights. The survey, which is offering information about consumer spending can be used as guidance of overall economic activity. The prelim report, which is being conducted by the university of Michigan is expected to offer the most impact, especially during times, when stock markets remain strongly positive.

The S&P 500 stock index has started slightly shaky into the new year. However, the uptrend remains generally intact. If the market falls below the technical support zone of 6,850 more downside momentum might occur. Yet, the market remains well supported with the 50- moving average, which is coming as fresh support near that level. If both zones give way, traders should expect a correction, which is not uncommon during the early weeks of a new trading year. Furthermore, upside momentum might occur, if the market can break the recently created all- time- high, at around 6,945. The consumer sentiment index will be released on Friday, the 09th of January at 16:00 CET.