Weekly Outlook | Year End Flows Amid Dollar Weakness

Important events this week:

While the year 2025 is coming to a close still two fairly important data releases might move markets. Meanwhile the S&P 500 index had created a new all- time- high again potentially also supported by the weakness of the Dollar. The Nasdaq technology index, on the other hand, keeps lagging behind showing that a shift in markets away from the tech- sector is currently happening. The usual moves during times of low liquidity in markets might also be the reason why the price of Silver has been increasing again. This month alone prices climbed more than 23 Dollars to a high above the USD 79 handle. Silver has been rising about 275% so far this year.

The choppy ride in financial markets might also continue in 2026. With Trump on the helm of the United States unpredictable moves might continue to shape markets, while the potential of further rate cuts in the US also currently increase as we will examine below.

– US – FOMC meeting minutes–

The meeting minutes are always being released two weeks after the interest rate decision took place. This release might be in particular interesting as the focus of the Fed has changed. Previously, the Central Bank rather took a hawkish approach in order to keep inflation at bay. With CPI data as well as the PCE price index coming down the meeting minutes might now offer further insights, whether more rate cuts will follow in the near future.

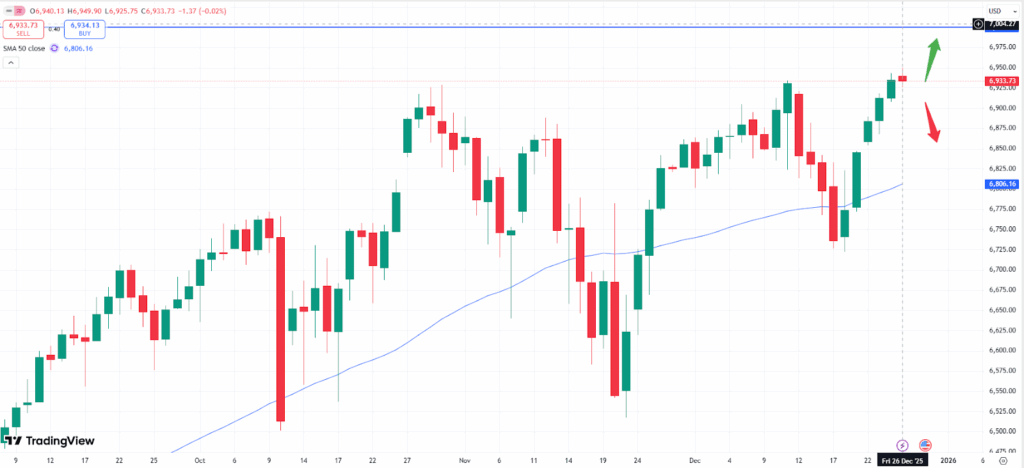

The S&P 500 index shows that the uptrend remains intact. Since the market created a new all- time- high last week more positive momentum might be on the cards. The positive trend might continue towards the psychological 7,000 mark, before a correction might be seen. The minutes will be released on Tuesday, December 30 at 20:00 CET.

– US – Unemployment claims–

As mentioned above, the unemployment claims usually don’t deviate much and are mostly released in a similar range. However, any weaker reading for the week might increase the odds for a potential further rate cut of the Fed. With lower rates, the economy will be stimulated causing a higher demand in the labor market.

The AUDUSD currency pair pushed higher again during last week’s trading. As the monthly chart above shows the market even broke above the 50- moving average line. This might suggest that the price will continue with the current uptrend. The next target could be seen at 0.6750, where some technical resistance level might cause a correction. Vice versa negative momentum might only follow below the zone of 0.6475. The data will be released on Wednesday, December 31 at 14:30 CET.